Newt Gingrich started a food fight at the last Republican debate by calling Barrack Obama “The Food Stamp President” and suggesting that food stamps were creating dependence on the government. Mr. Gingrich went on to say that he wanted to “help poor people learn how to get a job” so that they could get off the food stamp dole.

Although Mr. Gingrich’s pitch for individual self reliance and hard work resulted in a standing ovation from the Republican audience, the message may not play out as well across the broad spectrum of American society.

For decades, politicians have told the American public that they are entitled to all sorts of benefits and the public has grown to love them. Promises of benefit cuts or austerity measures do not win elections. In this regard, Mr. Gingrich may lose more votes than he gains by trying to reduce the number of food stamp recipients. (The food stamp program is now known as the Supplemental Nutrition Assistance Program or SNAP).

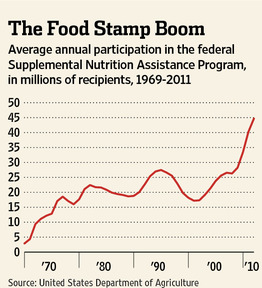

All well intentioned government entitlement programs expand exponentially over time. The number of food stamp recipients has exploded to a record 44.7 million people and this is a voting bloc to be reckoned with. Newt’s somewhat hostile message to food stamp constituents has probably lost him a considerable number of votes.

Mr. Gingrich, who has an incredible depth of knowledge on most topics, seems to be unaware that food stamps have become an entitlement not just for the poor, but also for many who are financially independent and chose not to work or have retired early.

Here’s an example I looked at for a married couple in Connecticut who both chose to retire at the age of 50 since they are financially independent with $5 million in liquid assets. Since they will live off their savings until they start receiving pensions at age 60, the couple has no “earned income” and can therefore qualify for a decade’s worth of food stamp benefits.

Exactly how can multimillionaires qualify for food stamps? The reasons lies in the lack of asset testing for SNAP eligibility. Connecticut, like 34 other states, does not limit eligibility based on assets. Most SNAP applicants, except for limited exceptions, do not have to report money in the bank, retirement assets, stocks or other assets.

According to the handy benefit calculator from the Connecticut Department of Social Services, the multimillionaire couple cited above are eligible for food stamps to the tune of $367.00 per month.

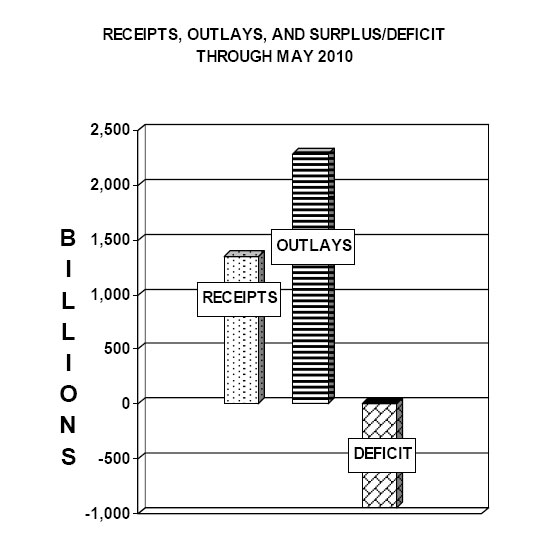

The food stamp program has grown not only due to tough economic times but to vastly widened eligibility guidelines. The SNAP program costs the taxpayers over $75 billion per year. Here’s a partial listing of who can qualify for food stamps.

- Non-citizens

- Unemployed

- Retired social security recipients

- Working people with low wages

- Homeless

- Legal immigrants

- College students

- Millionaires showing little or no earned income

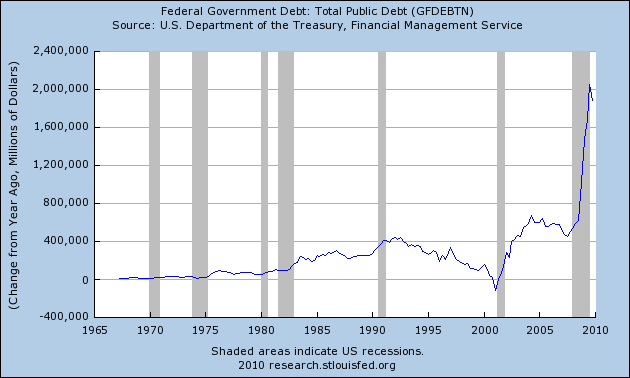

The graph below from The Wall Street Journal shows the explosive growth in the SNAP program since 1970.

Mr. Gingrich drew some well deserved applause for trying to reassert the basic values of American free enterprise and self reliance. However, based on the vast voting constituency that is now on the food dole, reducing or eliminating the food stamp program is a political impossibility.

The Entitlement Society – Million Dollar Lottery Winner Feels Entitled To Food Stamps – “I have bills to pay.”