When reverse mortgages were last reviewed, it was predicted that many unqualified borrowers would wind up defaulting, despite the fact that a reverse mortgage has no payment due.

As originally conceived, reverse mortgages were designed to fulfill a legitimate borrowing need. Reverse mortgages were developed for elderly Americans who had a mortgage free home with substantial equity and wanted to cash out their home equity to supplement their retirement income without having to sell the house or face large mortgage payments.

In theory, the HECM made sense by allowing homeowners to remain in their homes and monetize their equity. The lifetime HECM payment, along with other retirement income and savings would allow for a more comfortable lifestyle. The only theoretical loser on the HECM program would be the FHA if property values dropped.

The HECM is available to all those 62 or older who have sufficient equity in their homes. HECM program lends without regard to credit or income and is strictly asset based lending. Do these lending criteria remind anyone of past disastrous mortgage programs, such as sub prime, ALT A or Pay Option ARMs??

A HECM does not require that the homeowner escrow for taxes or homeowners insurance. A known risk factor for default is a non escrowed loan. The homeowner can face foreclosure for not properly maintaining the property or for non payment of taxes or insurance.

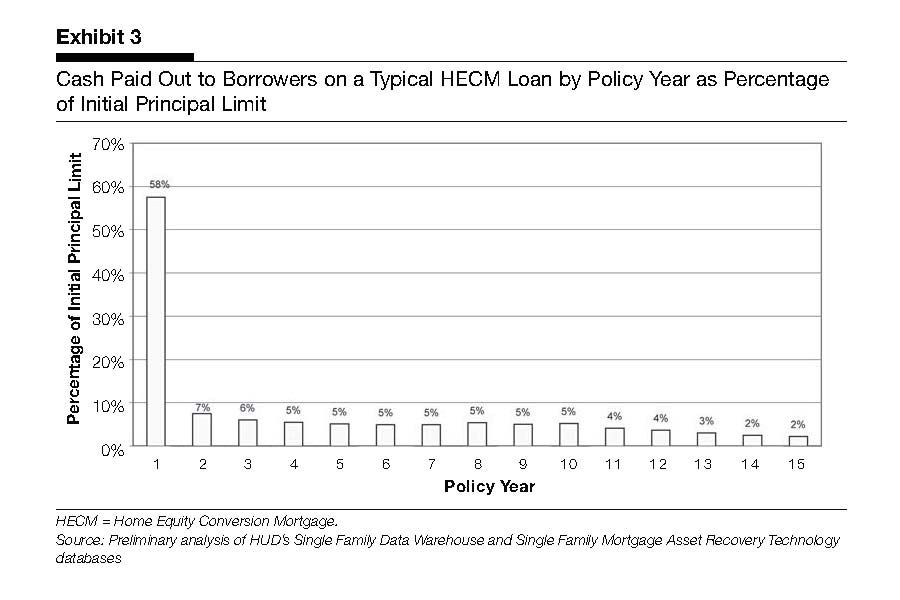

Many homeowners taking out reverse mortgages were taking the maximum loan allowed upfront (instead of taking a monthly draw) and using the proceeds to payoff existing debt. This choice left the elderly homeowner with little equity and no monthly cash payment to supplement retirement, a recipe for financial disaster.

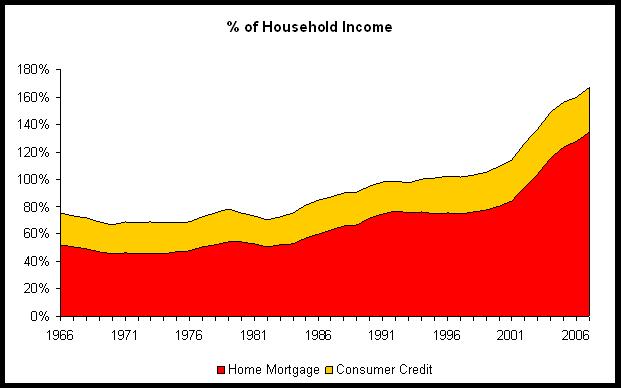

The reason why borrowers are taking most of their available cash out upfront is because they are using the proceeds to pay off mortgages, consumer debt, medical bills, credit cards, etc. Borrowers run up large amounts of debt when spending exceeds income, a situation likely to continue after the borrower taps the last dime of equity from his home. Since the HECM was the last option available, what happens in a couple of years when the borrower is again overwhelmed by debt?

Based on the credit profile and debt levels incurred prior to his approval of a HECM, what are the odds that the borrower’s finances turn around after his refinance? My guess is that within a few short years, the borrower is in heavy debt again, unable to pay the property taxes or maintenance on the property and thus facing a potential foreclosure. Since HUD will not be throwing senior citizens out of their homes, expect a mortgage modification program for reverse mortgages and further losses to the taxpayer on another mortgage program gone bad.

It now appears that, as predicted, many elderly reverse mortgage borrowers cannot afford to pay the property taxes due on their homes or are strategically chosing default since the decline in property values wiped out whatever equity they had left. The end result is the predicted and ridiculous situation of borrowers defaulting on mortgages that do not have payments.

This situation was confirmed in an audit report by the Office of the Inspector General.

HUD Was Not Tracking Almost 13,000 Defaulted HECM Loans With Maximum Claim Amounts of Potentially More Than $2.5 Billion

We performed an internal audit of the U. S. Department of Housing and Urban Development’s (HUD) Home Equity Conversion Mortgage (HECM) program because we found that an increasing number of borrowers had not paid taxes or homeowners insurance premiums as required, thus placing the loan in default. Also, we noted that HUD had granted foreclosure deferrals routinely on defaulted loans, but it had no formal procedures.

We found that HUD’s informal foreclosure deferral policy and its reversal had a negative effect on the universe of HECM loans and loan servicers (servicers). As a result, four servicers contacted were holding almost 13,000 defaulted loans with a maximum claim amount of more than $2.5 billion, and two of the four servicers said they were awaiting HUD guidance on how to handle them. Further, the servicers had paid taxes and insurance premiums totaling more than $35 million for these 12,958 borrowers…

Since unreported defaulted loans were only obtained from 4 of a total of 16 HECM servicers nationwide, more defaulted loans may exist. Further, as HUD could not track these loans, it did not know the potential claim amount. In the event of foreclosure of the 7,673 loans for which HUD was aware and 12,958 loans of which it was not aware, HUD could lose an estimated $1.4 billion upon sale of the properties.