A few short months ago at the end of 2021, 30-year mortgage rates hit their lowest level in history in the low 3.25% range. Since that time rates have skyrocketed by 50% to a shade below 5%. Increased rates have occurred as the Federal Reserve was forced to raise rates due to a rapidly increasing rate of inflation resulting in double digit price increases for many products and services.

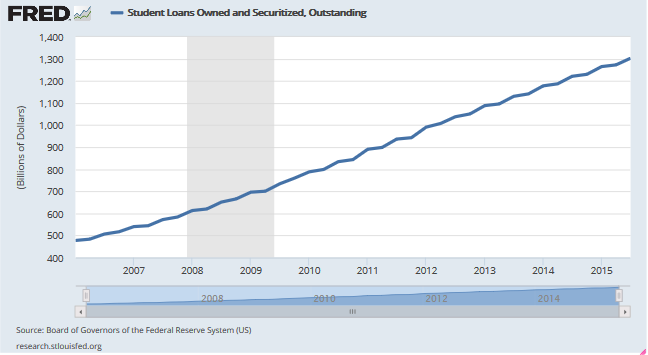

Any one expecting rates to decline from here is likely to be disappointed. Both wage and price inflation have become embedded in the economy as shortages of workers and products relentlessly drive prices higher. Trying to tame inflation while at the same time keeping the economy running at full speed is the biggest challenge the Fed has faced in the past thirty years when short term rates approached 20%.

None of this has been on the boom/bust mortgage industry as thousands of workers have been laid off as mortgage refinances plunge and purchases slow down.

According to the Mortgage Bankers Association, refinance volume has plunged 60% below levels one year ago.

… The Refinance Index decreased 15 percent from the previous week and was 60 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 1 percent from one week earlier. The unadjusted Purchase Index increased 1 percent compared with the previous week and was 10 percent lower than the same week one year ago.

“Mortgage rates jumped to their highest level in more than three years last week, as investors continue to price in the impact of a more restrictive monetary policy from the Federal Reserve. Not surprisingly, refinance application volume declined further, as fewer borrowers have an incentive to apply at rates that are significantly higher than a year ago. Refinance application volume is now 60 percent below last year’s levels, in line with MBA’s forecast for 2022,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist…

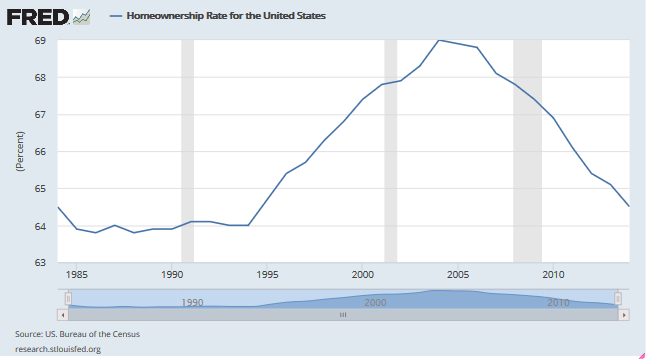

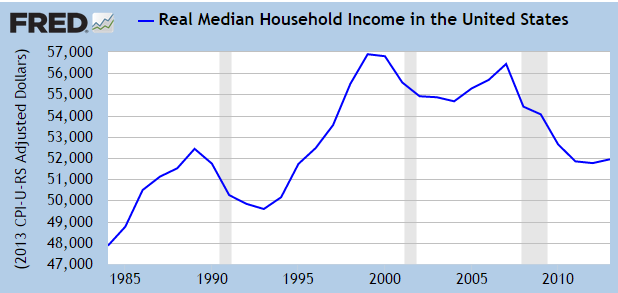

The average interest rate for a conforming 30-year fixed rate conforming loan with a 20% down payment in now at about 4.8%. Although the mania in the purchase market continues, it’s only a matter of time until activity declines due to higher rates and dramatically increased home prices. Potential purchasers are being squeezed as wages lag far behind the increases in the cost of living and housing.

If the Fed engages in multiple half point rate hikes as they are suggesting, expect mortgage rates to steadily increase.