Economics 101 tells us there is an inevitable correlation between supply and demand in a free market. Overproduction of goods relative to demand invariably leads to lower prices. This seemingly iron clad theory is currently being tested as retail gasoline prices approach all time highs even as U.S. Oil Production Rise Is Fastest Ever.

U.S. oil production grew more in 2012 than in any year in the history of the domestic industry, which began in 1859, and is set to surge even more in 2013.

Daily crude output averaged 6.4 million barrels a day last year, up a record 779,000 barrels a day from 2011 and hitting a 15-year high, according to the American Petroleum Institute, a trade group.

It is the biggest annual jump in production since Edwin Drake drilled the first commercial oil well in Titusville, Pa., two years before the Civil War began.

The U.S. Energy Information Administration predicts 2013 will be an even bigger year, with average daily production expected to jump by 900,000 barrels a day.

The surge comes thanks to a relatively recent combination of technologies—horizontal drilling and hydraulic fracturing, or fracking, which involves pumping water, chemicals and sand at high pressures to break apart underground rock formations.

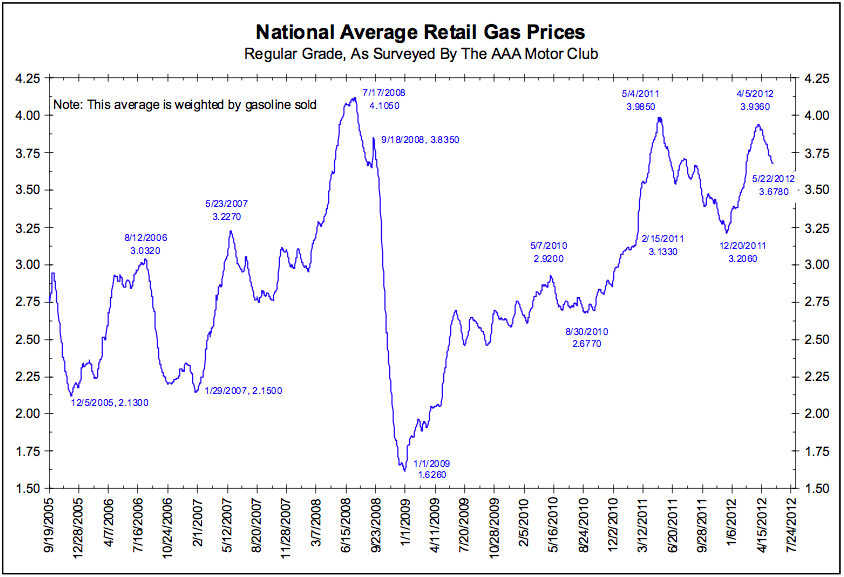

Despite the huge increase in oil and gas production, the retail price of gasoline is near all time highs.

- Courtesy: ritholtz.com

If demand for oil and gasoline was also rapidly increasing, current high prices would make sense from a demand and supply standpoint, yet this is not the case.

According to the American Petroleum Institute, the demand for oil fell to an astonishing 16 year low in the U.S. during 2012, yet gasoline prices are closing in on all time highs. The drop off in demand for gasoline in the U.S. has been of historic proportions. Gas consumption fell off a cliff when the economy crashed in 2008 and continued economic weakness has driven gas demand to all time lows. Unemployed and underemployed people don’t drive much and the shock of a 100% increase in gas prices since 2009 has far outpaced the growth in paychecks, forced many consumers to take fewer trips by car.

- courtesy: www.theburningplatform.com

Surging oil and gas production in the U.S. combined with much lower demand has resulted in energy companies exporting surplus oil and gas. Exxon Mobil (XOM), the second largest market cap stock in the world, predicts that the U.S. could actually become a net oil exporter by 2025.

The reason why increased oil and gas production has failed to bring down prices, despite an historic decline in demand, is twofold.

- Oil prices are determined by the global market and world demand for oil continues to grow.

- Virtually all of the increased oil production in the U.S. is based on horizontal drilling and fracking technology which significantly increases the cost of production to around $80 per barrel.

Although it is better to have oil and gas at a high price instead of no oil at any price, it is disconcerting to contemplate how much oil and gas prices could spike from higher demand if the world economy ever comes out of its long slump.

Disclosure: Long position in XOM

Speak Your Mind