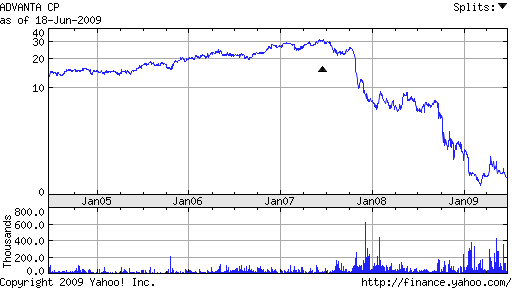

Advanta & CIT – Same Customers Equal Same Results

In early May, when Advanta Corp (ADVNA) announced that it was suspending all new credit card lending, it was speculated that many borrowers would simply stop paying. The fact that borrowers might default on their debts when Advanta refused to extend new credit says a lot about the crowd that Advanta was lending money to. Like many overleveraged borrowers, Advanta customers were probably using new loans to make their monthly payments.

May 12 (Bloomberg) –– Advanta Corp., the credit-card issuer for small businesses, may leave 1 million customers scrounging to find new lenders and debt holders facing losses of 35 percent after the company shut down accounts to preserve capital.

“Early amortization has been viewed as a catastrophic event for issuers,” Scott Valentin, an analyst at Friedman Billings Ramsey & Co., said today in a research note. Advanta’s filing said that the charge-off rate for uncollectible loans may increase after accounts are closed. Valentin said that’s likely because “the cards have substantially less utility to cardholders,” cutting the incentive to keep up with payments.

Advanta was the 11th-biggest U.S. credit-card issuer at the end of 2008 with about $5 billion in outstanding balances, and the only major lender focused on small business borrowers, Robertson said.

Advanta Defaults Soar To 57%

Two months later, the nature of Advanta’s high risk lending became obvious when they disclosed that the default rate on their loans had soared to a staggering 57%. A solid risk customer with sufficient income does not stop paying on his debts merely because he is denied further credit. Much of Advanta’s lending was made to the highest risk customers and the huge default rate proves it.

July 20 (Bloomberg) — Advanta Corp., the credit-card company that cut off almost 1 million small-business accounts after posting three quarterly losses, said the default rate more than doubled in June from May to 56.95 percent.

Advanta’s charge-off rate dwarfs the national average, which set a record in June when it topped 10.4 percent, according to Fitch Ratings. Bank of America Corp. on July 15 posted the highest June write-offs among the nation’s biggest lenders at 13.86 percent, a rate that includes consumer credit cards.

The ugly picture at Advanta may be on the minds of CIT bondholders since both companies lend to the same customer base of struggling small business owners. If CIT goes the bankruptcy route and ceases all new lending, will CIT default rates skyrocket as they did at Advanta? Bondholders are calculating that allowing CIT time to restructure will result in lower losses.

July 20 (Bloomberg) — CIT Group Inc. said bondholders agreed to provide $3 billion in emergency financing, giving the 101-year-old commercial finance company time to devise a recovery plan that averts bankruptcy.

CIT, led by Chief Executive Officer Jeffrey Peek, is receiving a $3 billion secured term loan with a 2 ½-year maturity, the New York-based firm said today. Loan proceeds of $2 billion are available immediately and the rest is expected within 10 days, the company said.

CIT has said bankruptcy would put 760 manufacturing clients at risk of failure and “precipitate a crisis” for as many as 300,000 retailers, according to internal documents.

The Dark Side Of Credit

The question that should be addressed here is how many small business owners where put at the “risk of failure” due to Advanta and CIT extending more credit than their customers could reasonably expect to pay back? Should public companies be allowed to lend capital to whomever they chose to in a free enterprise system?

Lending without regard to a borrower’s ability to repay may seem initially profitable to the lender and beneficial to the borrower. The past several years have shown that, in the long run, excessive over extension of credit leads to financial disaster for the lender, borrower and society in general. Hopefully, proposed regulatory changes for the financial industry will address this matter.

Disclosures: No positions