FDIC May Request Treasury Loan As Losses Grow

The FDIC always takes pride in noting that it is self funding and covers failed bank losses by assessments on FDIC insured member financial institutions.

Congress created the Federal Deposit Insurance Corporation in 1933 to restore public confidence in the nation’s banking system. The FDIC insures deposits at the nation’s 8,195 banks and savings associations and it promotes the safety and soundness of these institutions by identifying, monitoring and addressing risks to which they are exposed. The FDIC receives no federal tax dollars – insured financial institutions fund its operations.

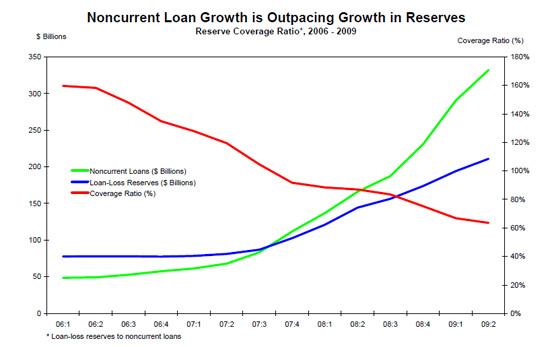

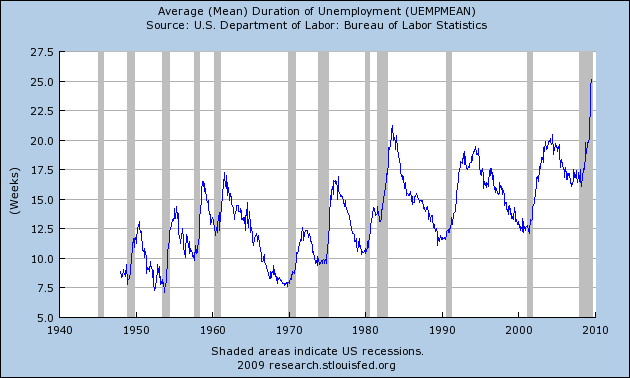

How much longer the FDIC can continue to fund itself based on fee assessments is questionable. For the second quarter of 2009, the banking industry as a whole lost $3.7 billion dollars and second quarter FDIC assessments totaled $9.1 billion.

FDIC Insurance Fund Nearly Depleted

The FDIC did borrow money from the Treasury during the last banking crisis in the early 1990’s and later paid the money back. The escalating number of costly bank failures over the last two years has reduced the FDIC Deposit Insurance Fund (DIF) to only $10.4 billion which covers potential losses on almost $5 trillion dollars in FDIC insured deposits. In addition, the number of banks on the FDIC Problem Bank List continues to expand.

The Problem Bank List grew to to 416 institutions from 305 last quarter. The total assets at Problem Banks increased to $299.8 billion from $220 billion last quarter. This is the largest number of problem banks since June 30, 1994. The number of FDIC insured institutions declined to 8,195 from 8,247 last quarter.

Earlier this year the FDIC’s line of credit at the Treasury was increased to $100 billion and up to $500 billion with the consent of both the Federal Reserve and the Treasury. With a nearly depleted DIF fund and the prospect of hundreds of additional banking failures, the FDIC may have no choice but to borrow from the Treasury as noted in the Wall Street Journal.

WASHINGTON –– Federal Deposit Insurance Corp. Chairman Sheila Bair said Friday her agency may tap its $500 billion credit line with the U.S. Treasury to replenish its deposit insurance fund, though she appeared cautious about doing so.

“We are carefully considering all options” including borrowing from the Treasury, Ms. Bair said Friday after a speech in Washington.

Ms. Bair has already warned banks that they may face an assessment increase to bolster the fund. Friday, she said there are also other little-known options available to the agency, including requiring banks to prepay assessments. The FDIC board of directors will meet at the end of this month to consider how to replenish the fund, she said.

Ms. Bair appeared cautious about resorting to the Treasury credit line, saying there are different views on when it should be used. She said some believe it should be reserved for emergencies only, rather than for covering losses that are already known.

Surging loan defaults show no sign of leveling off which in turn puts more banks at risk of failing. The FDIC will need a Treasury bailout – the only question is will $500 billion be enough?