For all of those worried about tax increases, slow economic growth and rapidly expanding deficits, I have one word – relax. Consider the following comments made by the President today.

Obama Says Robust Growth Will Prevent Tax Increases

June 16 (Bloomberg) — “One of the biggest variables in this whole thing is economic growth,” the president said in an interview with Bloomberg News at the White House. “If we are growing at a robust rate, then we can pay for the government that we need without having to raise taxes.”

Obama has repeatedly said he would keep his campaign pledge to cut taxes for 95 percent of working Americans while rolling back tax breaks for households making more than $250,000 a year.

The U.S. economy shrank at a 5.7 percent annual pace in the first quarter… The median forecast for growth next year is 1.8 percent, according to the survey.

Obama warned that if economic growth remains “anemic” and Congress fails to adopt his plans to hold down the cost of health care, work on alternative energy sources and improve the U.S. education system, “then we’re going to continue to have problems.”

He also repeated his promise to cut the budget deficit, forecast to hit $1.8 trillion this year, in half by the end of his first term.

“If my proposals are adopted, then not only are we cutting the deficit in half compared to where it would be if we didn’t do anything, but we’re also going to be able to raise revenue on people making over $250,000 a year in a modest way,” he said. “That helps close the deficit.”

Fiscal discipline that leads to lower budget deficits is important, Obama said, to ensure investors around the world keep buying U.S. government debt.

From warning of a “financial catastrophe” some short months ago, we are now being told that:

- Robust economic growth will cover government spending increases

- 5% of working Americans will cover the tab for the other 95%

- New spending on health care, education and the environment will spur economic growth

- Deficits will be cut in half to only $1 trillion a year

- Fiscal discipline will cause investors to lust after U.S. debt securities

News like this is almost enough to make one believe that the recent 40% gain in stock prices is just the beginning of new wealth creation for investors.

Before rushing into a 100% long position with your portfolio, consider some of the potential headwinds that the President’s magic scenario will face.

Past decades in the U.S. have been distinguished by slow economic growth (despite huge credit stimulus), stagnate or declining real incomes and a massive increase in the debt burden on every sector of the economy. In addition, American’s have seen their major asset categories – stocks and real estate – vaporized by multi trillion dollar losses.

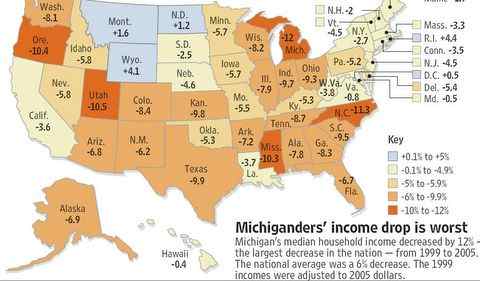

Median Household Incomes Fell in 94% of the States – 1999-2005.

1999-2006 Income Declines

Courtesy: mwhodges.home

Household Debt Ratio

Debt to National Income

Debt to National Income Ratio

Workers in Manufacturing

Personal savings rate

Decline In Purchasing Power US $

Conclusion:

The national economic trends of past decades are:

- Lower incomes

- Staggering increases in debt

- Dramatic decreases in savings

- The destruction of our manufacturing base

- A 90% decline in the purchasing value of our currency

If the President can reverse these trends, I say change the Constitution and give him 40 more years in office!