Bad News Discounted?

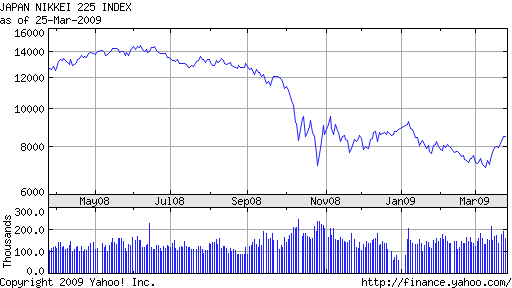

One of the hardest concepts for investors to grasp is the ability of markets to discount bad news. As the news mounts daily about the Japanese economic collapse, the Nikkei 225 continues to rise. As pointed out previously (see Can The Economic News From Japan Possibly Get Worse?) the Nikkei has refused to penetrate the lows reached in 2003 and at this point is up almost 22% from the March lows.

The ability of a market to rally in the face of horrific economic news is usually a sign that the worst has been discounted. The argument could be made that informed stockholders have already done their selling since mid 2008 and at this point are looking down the road a year or so for a recovery in business conditions. Consider also that the Nikkei is back to the levels it was at in the mid 1980’s before the world started its grand experiment with unlimited credit creation.

Time will tell whether or not the Japanese economy is due for some type of recovery. Bear market rallies of 20% or more are not uncommon after huge declines. As long as the Nikkei can stay above the 7,000 level, perhaps the worst has been seen.

Long Term Factors To Consider

As previously discussed (See Nikkei – Black Hole or Buying Opportunity?), some long term factors to consider are as follows:

-the Nikkei is already off 80% from its December 1989 high and has perhaps discounted the worst that can happen.

-a multi year double bottom may be forming at current price levels.

-the most fundamentally bullish factor may be that the Japanese government has reached the limits on its borrowing capacity, thus precluding the continuation of costly and ineffective stimulus plans (see Japan’s failed strategy). With the government no longer able to subsidize failed enterprises, free market forces can now accomplish the restructuring necessary to rebuild Japan’s economy.