The Delusion of Lenders

The old banking rule of lending only to those who had the capacity to repay was gradually relaxed and then completely abandoned over the past two decades.

New techniques such as loan securitization spread the risk far and wide, theoretically reducing the risk by spreading the risk. No income verification for mortgage loans became routine since home price appreciation seemed to further diminish the risk – a defaulted mortgage loan could be fully recovered by seizing and selling the collateral. Risky unsecured credit card lending seemed to have limited risk, as well, since a troubled borrower could simply borrow more to make loan payments that were beyond his income ability.

It all worked fine until it didn’t and economic historians will be debating for decades what went wrong. The short answer is, of course, that loans extended to those without the ability to repay will eventually default.

The government’s answer to cure defaults by over indebted consumers is to encourage banks to extend more credit to postpone the day of reckoning. Unfortunately, the government’s “solution” won’t work this time since it is the day of reckoning.

Businesses and the average American consumer have the good sense to realize that borrowing more when they can’t afford the debt payments they have now is total lunacy. The result is stricter lending by the banks and reduced demand for loans. Consider the reduction in bank lending taking place:

Lending continues to slow as bankers and borrowers refrain from taking risks, in a bearish sign for the economy.

The total amount of loans held by 15 large U.S. banks shrank by 2.8% in the second quarter, and more than half of the loan volume in April and May came from refinancing mortgages and renewing credit to businesses, not new loans, an analysis by The Wall Street Journal shows.

The numbers underscore two related trends weighing on the economy. Financial institutions are clamping down on lending to conserve capital as a cushion against mounting loan losses. And loan demand is falling as companies shelve expansion plans and consumers trim spending to ride out the recession.

The slow pace of lending has created political heat for the Obama administration. On Friday, Rep. Spencer Bachus (R., Ala.) pressed Treasury Secretary Timothy Geithner to “tell me why we didn’t really see that multiplier effect” from banks funneling their TARP money into lots of loans.

The disturbing part of the above article is that politicians view tougher lending standards as an economic negative when, in fact, it is extremely positive.

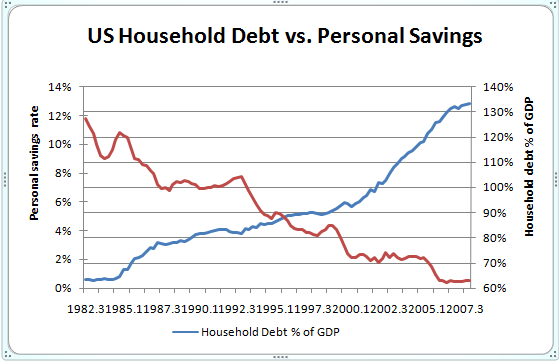

Bankers, businesses and consumers see the new economic reality and are cutting debt and rebuilding balance sheets – essential actions for a sound economic recovery. Those encouraging more lending and borrowing should consider the following chart.

Debt VS Savings

Courtesy: Credit Writedowns

Debt Burdens Double

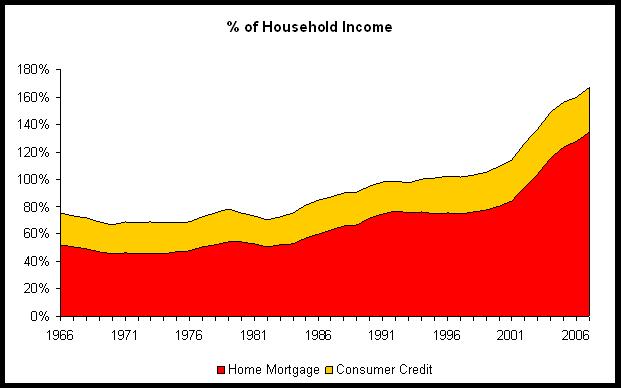

With income growth declining and debt burdens already intolerable for many, what rational lender would seek to lend and what rational borrower would seek to borrow? The debt burden for many has reached levels where default is the only option – more credit would only lead to a larger future loss to a lender.

Growth in debt that is commensurate with growth in income promotes sound economic growth. Unfortunately the debt burden has expanded far in excess of income growth, with debt to income ratios doubling since the 1980’s.

Household Debt To Income

Courtesy: continuations.com

Debt Repudiation And Unintended Consequences

Ironically, the biggest impediment to future bank lending is the growing trend of debt repudiation directly sponsored and encouraged by a government concurrently seeking to encourage more lending.

Consumers having trouble paying their debts can now chose from a long list of government programs for debt forgiveness, loan modifications, rate reductions, 125% loan to value mortgages and more programs on the way. Their is no longer any shame or embarrassment associated with defaults and bankruptcy. Defaulting on debt has become a rational choice for many with little repercussions.

How does a banker factor into his risk adjusted lending rate “defaults of convenience”? The problem of debt repudiation is large and will get larger as described by the New York Times.

When Debtors Decide to Default

Those on the front lines of the debt industry say there is a small but increasingly noticeable group of strapped consumers who, like Ms. Birks, are deciding they will simply stop paying. After loading up on debt eagerly provided by the card companies during the boom times, these people now find themselves trapped in an endless cycle where they are charged interest on interest and fees upon fees while the lenders get government bailouts.

The lending industry term for these people is “ruthless defaulters.” In a miserable economy where paychecks, savings and expectations are all diminished, their numbers will surely grow.

Collectors are noticing a shift not only in ability but in willingness to pay. “With all the bailouts the government is giving everyone, no one has any personal accountability about their own debts,” said Roger Knauf, who runs a trade group of debt-buying firms.

Much of the blame for the excessive debt that consumers took on can be placed on fee crazed bankers who did not properly evaluate risk. As loan losses continue, expect bankers to act like bankers again and to continue tightening their lending standards to avoid future defaults.

Lending will remained constrained and intelligent consumers will continue to borrow less and save more – the exact strategy necessary to work off the insane debt binge this country has been on for decades.

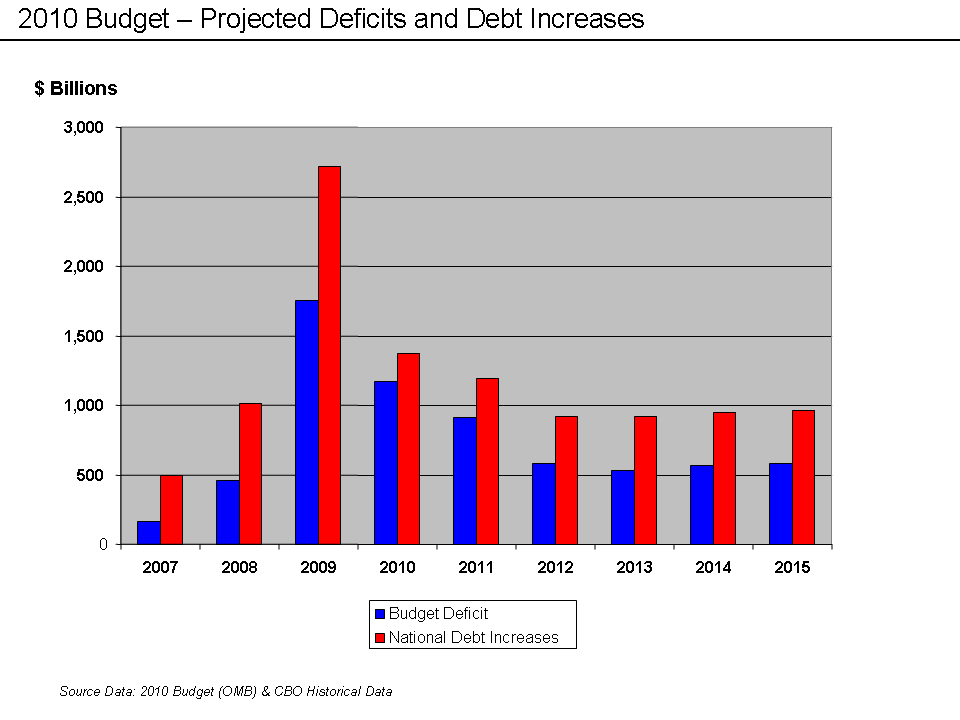

Biggest Fool Still Borrowing

Unfortunately, there is still one drunken fool at the party, relentlessly expanding the borrowing insanity that has put the world on the brink of economic ruin. Uncle Sam needs to sober up and rethink the flawed theory that unlimited credit equals unlimited wealth.

US Deficits and Debt Increases

Courtesy: Wikepedia