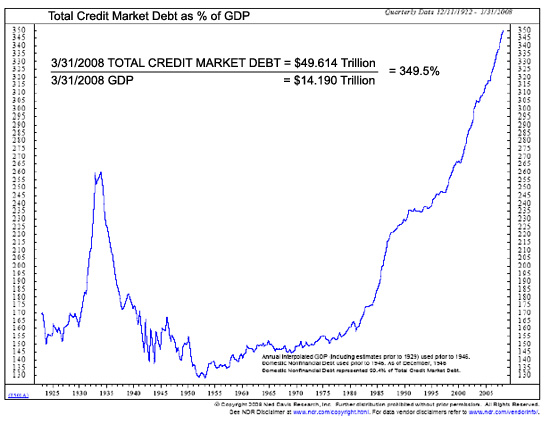

A chart is worth a thousand written words.

As we behold this chart of debt growth in the US, we need to ask ourselves:

- Has any trend similar to this in history ever been able to continue indefinitely?

- This debt is backed to a large degree by asset collateral – will the ongoing destruction of virtually every asset class be the tipping point?

- To prevent a totally horrific destruction of asset values, does this growth trend in debt need to continue? The actions of the Fed would imply that a slowdown or reversal of credit growth would be catastrophic to the world economies.

- Paper money is based on confidence which is becoming thinner by the hour.

- This chart is probably in the back of the minds of those choosing to receive negative interest rates from the Government on short term paper to avoid credit losses.

- When debts are so large that they cannot be paid back by the borrowers, then by definition they will not be paid back.

Speak Your Mind