Concerns about the current economic mess turning into another Great Depression seem to have faded. The consensus view of government officials and private economists seems to be that the economy, although still fragile, is well on its way to a robust recovery. According to Bloomberg,

Companies in the U.S. expanded in December at the fastest pace in almost four years, signaling the economic recovery is gaining speed heading into 2010.

The Institute for Supply Management-Chicago Inc. said today its barometer rose to 60, exceeding the most optimistic estimate of economists surveyed byBloomberg News and the highest level since January 2006. The gauge, in which readings greater than 50 signal expansion, showed companies boosted production and employment as orders climbed.

Stimulus programs and discounting have propelled a rebound in global sales that is reducing stockpiles, which may spur manufacturers to further increase production in coming months.

The world’s largest economy expanded at a 2.2 percent pace from July through September after a yearlong contraction that was the worst since the 1930s, figures from the Commerce Department showed last week. Economists surveyed byBloomberg forecast growth to pick up to a 3 percent pace in the fourth quarter and average 2.6 percent for all of 2010.

Predictions for a strong economic recovery seem to grow by the hour. Recent articles in the press lead one to believe that – unemployment has bottomed, the growth of foreign economies will result in greater demand for U.S. goods and services, inflation will remain subdued, the dollar has stabilized, a recovery in the housing market has started, mortgage rates will remain low, the bailed out banks are in full recovery mode, the Fed will gradually remove excess liquidity from the system, the politicians will get the deficit under control and the stock market will continue to post impressive gains.

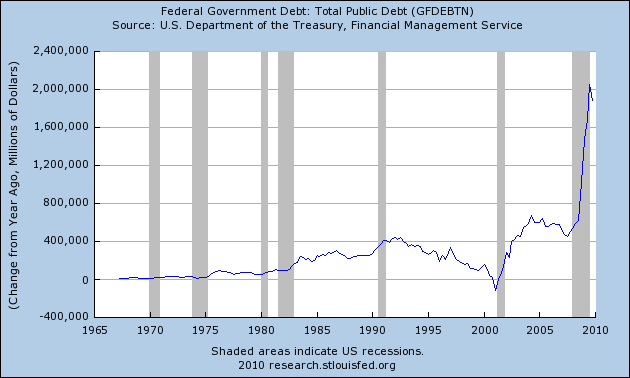

Is the bullish consensus getting out of hand or will there be a few surprises on the path to a booming economy? One scenario that could shatter the dreams of the bulls is if private individuals and businesses are crowded out of the debt markets by a U.S. government that needs to borrow seemingly endless trillions of dollars. The latest data on private and governmental borrowing from the St Louis Federal Reserve show that crowding out could slam the brakes on an economic recovery. Businesses and individuals may be unable to borrow in strained capital markets or face much higher borrowing costs as they compete with the government for capital.

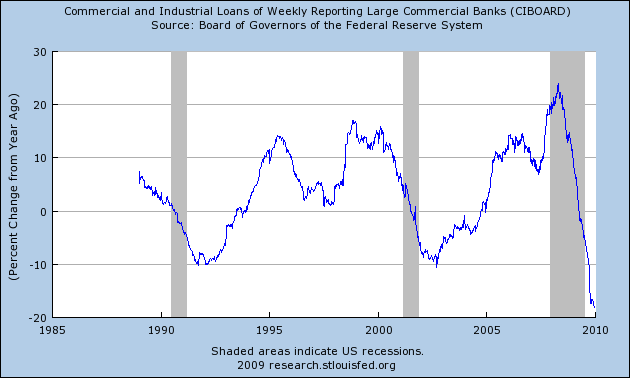

Lending by large commercial banks has plunged, a combination of tougher lending standards and reduced loan demand. Any economic recovery would result in increased loan demand by the private sector which strained capital markets may not be able to supply. Competition for funds could lead to a spike in interest rates.

As lending to the private sector has collapsed, government borrowing has exploded.

With no end in sight to new trillion dollar programs being passed by Congress, the financing needs of the U.S. Government are not likely to be reduced any time soon. The recovery of the U.S. economy that many foresee may come to a grinding halt if private sector borrowers are crowded out of the capital markets.

I am largely in agreement with what you have said here, but feel that you have left out a huge barrier and significant risk to a recovery that will last long enough to send America on the right path.

Not only does a rapid recovery risk causing a rise in interest rates from the stand point of excessive demand for capital, I also believe that even if the capital markets are able to meet all demand for loans a robust rapid recovery is still the biggest threat to a sustained recovery.

This belif stems from the idea that if businesses rapidly start demanding commodities to replenish inventory and meet consumer demand, it is very likely that we could see a spike in inflation with the way all the world governments have been on a mad dash to devalue their currencies. I believe that even with the large level of unemployment and lag in full use of business capital we could still very well see a spike in inflation. In fact this last December had substantially larger than expected increase in CPI and PPI. This suggests that inflation is a serious threat.

If we see inflation take hold the fed will have no choice but to raise interest rates making loans more expensive even if the supply of loans is able to meet demand. This will throw us into a second recession with an already battered and nervous consumer. Therefore, a rapid recovery is a major risk to a sustained recovery from more than one angle. Even though I do not like to see the pain many Americans are going through I believe that the country is best served by a slow recovery and a slow reduction in the countries unemployment level.

The government has been doing a lot of programs to help the economy and that makes the deficit worse. However I think if they would not have done it, we would have continued to spiral until we went into a deep, long lasting depression.