Home buyers can once again purchase a home using FHA financing with a zero down payment.

Previous zero down payment FHA loan programs were funded by seller contributions funneled through a nonprofit group which then donated the down payment to the purchaser. These seller financed down payment programs were terminated in 2008 after the FHA experienced default rates three times higher than when buyers made a cash down payment.

The innovative zero down payment FHA home purchase program was recently introduced by The Lending Company of Phoenix, Arizona. In order to meet the FHA required 3.5% down payment the borrower receives a 2.5% gift from a non-profit organization and the remaining 1% can be gifted from a family member.

The Lending Company notes that the program is not a seller-paid down-payment assistance program. To further reduce the amount of cash required by the purchaser, the seller is encouraged to provide seller concessions to cover closing costs. A borrower receiving both gift funds and seller concessions can potentially purchase a home without putting any cash into the transaction.

The Lending Company – The One Percent Down Solution Gift Program is designed to provide eligible homebuyers a gift of up to 2.5% of the sales price to be applied towards the FHA down payment and/or allowable closing costs for the purchase of a home.

Targeted towards quality affordable housing, approved homebuyers can purchase a home for as little as 1% down payment. The program also allows for the remaining 1% down payment to be gifted from any FHA allowable source.

Program Benefits:

- The program provides up to a 2.5% gift to FHA qualified home buyers (subject to market conditions, greater gift amounts up to 5.5% may be allowed)

- Seller can and is encouraged to contribute towards the closing costs to further assist the homebuyer

- Minimum credit score of 620

- Successful credit restoration allowed

It will be interesting to see how future default rates on this zero down payment program compare to earlier “seller funded” down payment assistance programs (DAP). The Federal Housing Finance Agency is well aware that zero down payment mortgages default at a much higher rate, as detailed in a 2007 study by the Office of Federal Housing Enterprise Oversight.

This paper extends the analysis of mortgage default to include mortgages that require no down payment from the purchaser. The results indicate that borrowers who provide down payments from their own resources have significantly lower default propensities than do borrowers whose down payments come from relatives, government agencies, or non-profits. Borrowers with down payments from seller-funded non-profits, who make no down payment at all, have the highest default rates.

Source of down payment has not previously been considered in default modeling, but the relationship between default and the source of the borrower’s down payment may be related to trigger events. Borrowers who are capable of increasing their saving, or increasing their labor earnings, in response to unforeseen events may be less susceptible to trigger events. The need to save for a down payment may serve to separate those who can more readily increase saving and earnings from those who find it more difficult.

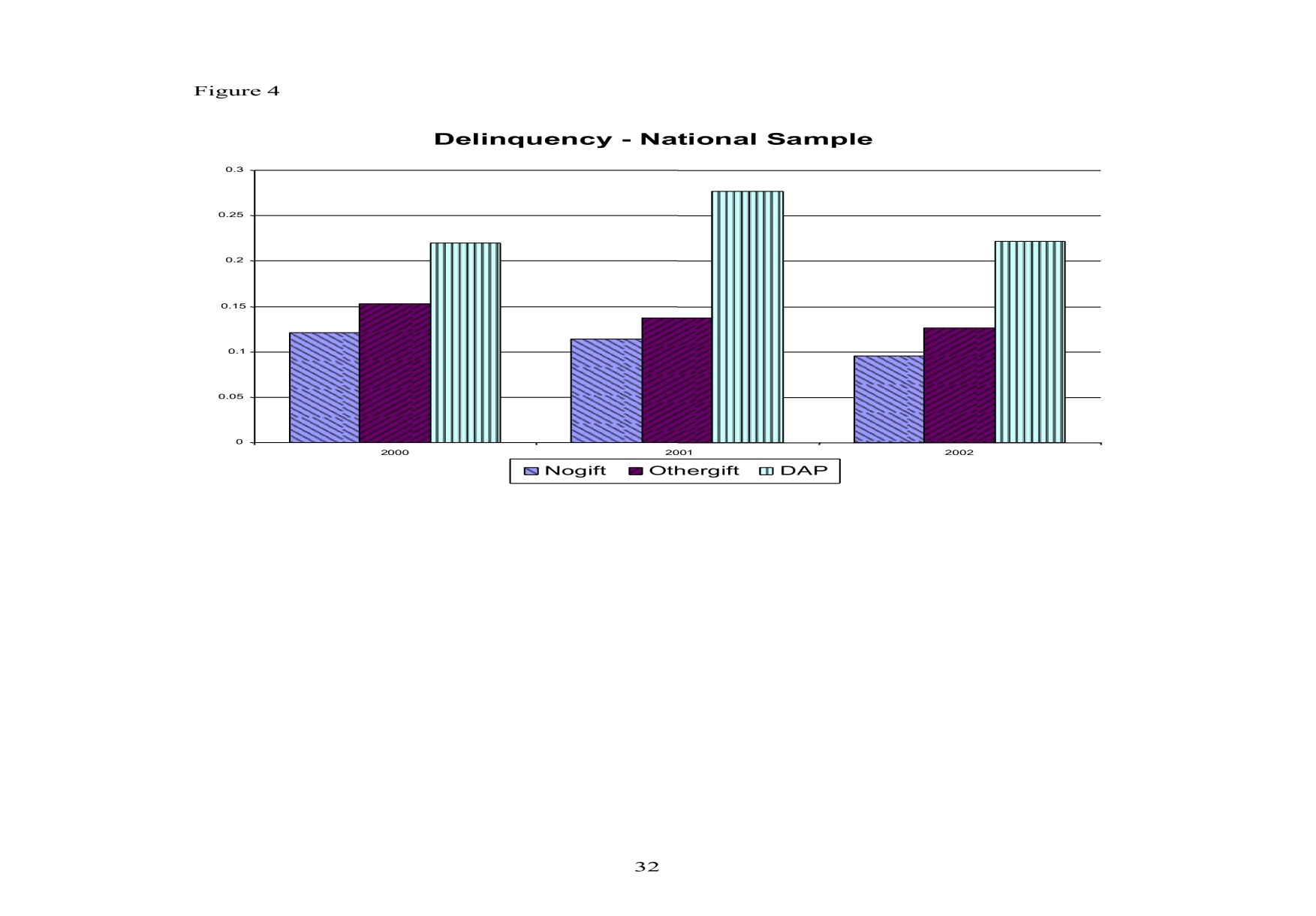

Loans with involvement from Down payment Assistance Program’s (DAPs), which effectively had no down payment, consistently showed the highest delinquency and claim percentages. Loans with a down payment from a source other than the borrower, such as a relative or government program, had lower claim and delinquency propensities, while loans with down payments from the borrower’s resources consistently showed the lowest rates of claim and delinquency.

This paper examines the case of literally “no money from the buyer” mortgages, and finds delinquencies and claim rates much higher than those for comparable loans with cash from the borrower.

In January of this year, a bill was introduced in Congress that would have reinstated seller funded FHA down payments to purchasers through non profit groups. The bill was never approved but FHA Commissioner David Stevens stated his opposition, as reported by Bloomberg:

“We’ll always listen to proposals, but Secretary Donovan has been absolutely crystal clear that he’s against the idea, as am I,” said David Stevens, commissioner of the FHA, which is under the purview of Housing and Urban Development Secretary Shaun Donovan.

Stevens said that homeowners are more willing to default if they haven’t put any cash into their purchases.

“If a buyer puts down even a few thousand dollars, it’s a lot of money for them,” he said. “There’s a financial and an emotional commitment to the home that you don’t have otherwise.”

About 13 percent of down-payment-assisted mortgages originated in 2004 have defaulted compared with about 4 percent of other FHA mortgages, according to agency data.

None of the lenders, including San Francisco-based Wells Fargo & Co. and Countrywide Bank, acquired by Bank of America Corp. in Charlotte, North Carolina, incurred any losses, since mortgages they issued were insured by the FHA, the agency said.

Programs that provide down payments to purchasers may help home sales, but past experience suggests higher default rates and increased losses for the FHA.

Thanks – appreciate your comments.

Bill Zielinski

I believe this will increase mortgage default rate in the US once again. Its clearly a discouraging step for bankers to finance a buyer/investor for real estate.

As a real estate agent, I would love to see my less fortunate buyers be able to purchase a home through an assisted down payment program, but as a citizen, I am tired of seeing all the defaulted loans and have to agree with David Stevens.

Which labor standards are being applied?

To what degree as productivity improved?

Disgraceful the govt has opened the spiggot again with the easy fraud loans earmarked for houses FHA and GMAC cars.

The collapse of the dollar is not far off n ow as the phony federal parabolic debts finance the juice to move the economy.

In my neighborhood a few months back a house sold at $7 k down $485k house FHA backed. Fraud loans. tried contacting that POS Stephens at FHA to file a complaint but could not reach the pile of horse dung crook.

Also Queens NY selling bunch of FHA condos at 500-700k. Seeling fast.

CROOKED GOVT FRAUDSTERS THINK NOONE IS PAYING ATTENTION TO THEIR BACK DOOR MONEY SCHEMES AS THEY MONETIZE $600 BIL IN DEBT..

Buy gold & silver protect wealth as well as foreign secure currencies.

I am suprised to see lenders going for a 0% down payment so soon after 2007. I think that a reasoable deposit shows at least some commitment from the purchaser, not to mention a reduced payment. You can expect to see a high rate of defaulting if this continues.

Here we go again.

The only thing I can think of is

IF YOU CAN’T BEAT ‘EM JOIN ‘EM.

Get a zero down,

stop making payments

Live for free

Yipppeee for America

Hi Bill,

Thanks for sharing this, This will provide buyers opportunity to buy their dream home with low down payments.