Loan Modification Enters Mainstream Vocabulary

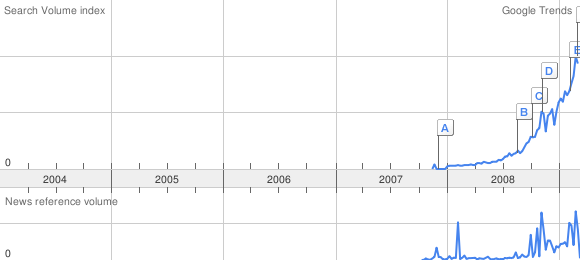

If you had used the term “loan modification” six months ago, most people would have given you a blank stare. With the passage of the Homeowner Affordability and Stability Plan, the term loan modification has now entered the mainstream vocabulary. News coverage of the government plan to help homeowners with their mortgage problems via loan modification has generated huge interest in this topic as can be seen by the increased Google searches on “loan modification”.

Loan Modification Assistance Programs

HUD’s website provides details on the modification program and also warns homeowners to beware of foreclosure rescue scams.

- There is never a fee to get assistance or information about Making Home Affordable from your lender or a HUD-approved housing counselor.

- Beware of any person or organization that asks you to pay a fee in exchange for housing counseling services or modification of a delinquent loan. Do not pay – walk away!

- Beware of anyone who says they can “save” your home if you sign or transfer over the deed to your house. Do not sign over the deed to your property to any organization or individual unless you are working directly with your mortgage company to forgive your debt.

- Never make your mortgage payments to anyone other than your mortgage company without their approval.

Need urgent help? Contact the Homeowner’s HOPE™ Hotline: (888) 995-HOPE

Making Home Affordable Refinance – General Features & Eligibility

Some of the features of the new loan modification program include reducing the interest rate to as low as 2%, increasing the mortgage term to 40 years and possibly reducing the principal balance of the mortgage loan. Note that after 5 years, the interest rate could start to increase each year.

Some of the basic guideline qualifications are:

1. applies only to a first mortgage on a principal residence, 2. income verification is required, 3. there must be a financial hardship, 4. the mortgage must be owned by Fannie Mae or Freddie Mac, and 5. the current mortgage payment must exceed a specified percentage of monthly income.

HUD has an easy to use program on their website that allows a homeowner to determine program eligibility – see Do I qualify for a Making Home Affordable refinance? Answer these questions:

Home Mods Get Complicated

In theory, a loan modification is a simple concept. The reality of loan modification is that it has become ever more complicated, involving multiple parties and numerous financial, tax and legal issues. The government has become deeply involved with loan mods and government programs tend to become complicated, confusing and bureaucratic.

At a minimum the following questions should be asked and the answers understood by every homeowner before deciding on a particular course of action.

1. Exactly what would be the terms of my proposed loan modification?

2. Are there tax issues involved?

3. Is the benefit of owning my home outweighed by the costs? In other words, would I be better off renting after considering my income and all the numerous costs of home ownership?

4. What is the impact on my credit score? It will be difficult to obtain any type of future loan with a low credit score.

5. If I decide home ownership is not the best option – do I let the home be foreclosed or attempt to negotiate a short sale with the bank? What are the pros and cons of each option?

6. If I accept a loan modification but receive no principal forgiveness, does it make sense to stay in the home if the loan balance still exceeds the value of the home? Any sale of the home under this condition would mean bringing money to closing that may not be available.

7. Is it cheaper to rent than to remain in the home after the loan is “modified”?

8. Will housing prices increase going forward? Keep in mind that real estate prices in Japan are still far below the peak prices reached in 1990. There is no divine rule which mandates an increase in housing values.

9. Are there legal issues involved with the loan modification that should be reviewed by my attorney?

Not much in life is simple. Do your homework before you finalize any decision involving your home.

Well written, detailed article that gets to the point!

I’m so not surprised. Lol. Even without the Google stats, I’d believe you. Foreclosure has been such a big problem lately, and the number of people next in line in losing their homes is just plain SCARY.