Payday Lenders Serve The Financially Inept

One of the fastest growing lending businesses in the country has been “payday lending”. Without the hassle of a credit check or application, a payday lender will give an employee a cash advance to carry him over to his next paycheck. There has been huge consumer demand for payday loans as reflected by the growth of payday storefronts to 25,000 today from zero in 1990. Convenient locations and quick easy cash entice consumers to take a one week loan on a $300 paycheck for a $50 fee.

Payday lenders argue that the credit losses, overhead costs and the complexity of administering millions of small loans require them to charge high fees to stay in business. When Pennsylvania capped interest based fees on payday loans, the payday lenders disappeared from the State.

Responsible Lending.org has characterized payday lending as predatory and forcing borrowers into a vicious cycle where each loan is paid off with another loan resulting in huge fees to the borrower. Effective annual interest rates can exceed 800%.

A full three quarters of loan volume of the payday lending industry is generated by borrowers who, after meeting the short-term due date of the loan, must re-borrow before their next pay period

Repeat borrowing of what is marketed as a short-term loan of a few hundred dollars has long been documented, but this report verifies for the first time how quickly most payday lending customers must turn around and re-borrow after paying off their previous loan.

Payday lenders generate loan volume by making a payday loan due in full on payday and charging a sizeable fee—now nearly $60 for an average $350 loan. This virtually guarantees that low-income customers will experience a shortfall before their next paycheck and need to come right back in the store to take a new loan. This churning accounts for 76 percent of total loan volume, and for $20 billion of the industry’s $27 billion in annual loan originations.

Payday lenders argue that they are lenders of last resort and provide vital credit that cannot be obtained elsewhere. If payday lenders cease operating, how would those who had relied on the payday loan get by?

North Carolina provides an example of how consumers fared after payday lending was closed in 2006. Here are the results of a study done by the Center for Community Capital:

Researchers concluded that the absence of storefront payday lending had no significant impact on the availability of credit for households in North Carolina. The vast majority of households surveyed reported being unaffected by the end of payday lending. Households reported using an array of options to manage financial shortfalls, and few are impacted by the absence of a single option – in this case, payday lending.

More than twice as many former payday borrowers reported that the absence of payday lending has had a positive rather than negative effect on their household.

Payday borrowers gave first-hand accounts of how payday loans are easy to get into but a struggle to get out of.

Nearly nine out of ten households surveyed think that payday lending is a bad thing.

As was the case with aggressive no income and sub prime mortgage lending, many people will borrow money despite onerous fees and high rates. Financially desperate consumers giving up 15% of their next paycheck to have money a week early are clearly not helping their financial situation. The government cannot prevent people from making foolish financial decisions, but in the case of payday lending, tougher regulation seems necessary to protect the financially inept.

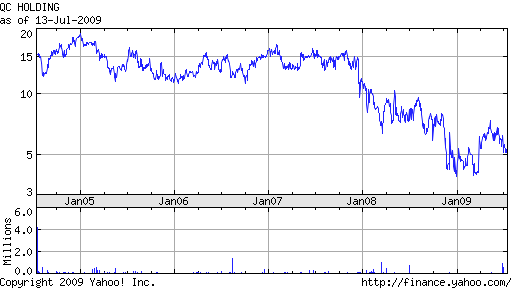

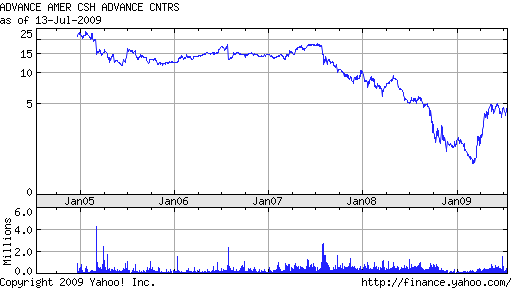

Ironically, despite the high fees charged by payday lenders, it turns out that investors fared no better than the payday borrowers. Earnings have generally been trending downwards and stock prices have declined significantly. New State or Federal fee restrictions on the payday lending industry would crush loan growth and profits. Investors in QCCO and AEA are likely to face continued disappointing returns.

Disclosures: No positions.

This is Obama’s new plan, called “pay as you go”, just packaged in an alternate way.

With the Fed bleeding losses on its balance sheet, how different is our experience to that of those forced to take on these monster 425% loans? Or whatever it is. Why does our government have strict restrictions on military “employee” use of these types of loans but not others?

Bah.

Interesting. Deals that are so stupid that BOTH the borrower and lender get burned. But the beat goes on.

As for CIT (another story here), it looks like they’ve gotten themselves the corporate equivalent of a payday loan.

CIT Hit With Interest Rate More Than 25 Times Libor

http://www.bloomberg.com/apps/news?pid=20601087&sid=aiJwhWb4QleU

‘Don Corleone Financing’

“This is called Don Corleone financing,” Egan said, referring to the patriarch in the organized-crime family depicted in the 1972 film, “The Godfather.” “You can’t lose money on this deal.”

Outside of the “urban underworld,” Egan, 52, said he couldn’t recall seeing a loan backed by as much collateral that paid interest rates so high. “These terms would make a pawn-shop operator blush.”