Has Japan Been Pulled Into A Black Hole?

According to Einstein’s theory of general relativity, a black hole is a region of space in which the gravitational field is so powerful that nothing, including electromagnetic radiation can escape its pull after having fallen past its event horizon. Recent accounts of Japan’s economic woes are beginning to sound like a black hole event.

Japan’s Economy Goes From Best To Worst On Export Slump

Feb. 17 (Bloomberg) Gross domestic product shrank an annualized 12.7 percent last quarter, the Cabinet Office said yesterday. The contraction was the most severe since the 1974 oil crisis and twice as bad as those in Europe or the U.S.

The credit crisis that crippled the U.S. financial system may have also knocked out the props that supported Japanese growth between 2002 and 2007: a U.S. consumer-spending bubble and a cheap yen. The speed of the deterioration has taken companies by surprise.

Since then, industrial production plunged at the steepest pace in 55 years in the fourth quarter, and unemployment rose at the fastest rate in 41 years in December. Panasonic Corp., Pioneer Corp., Nissan Motor Co. and NEC Corp. announced a combined 65,000 job cuts in the past month.

‘Devastating Effects’

The end of easy credit in the U.S. will lead to a “quantum downward shift” in consumer spending in the world’s largest economy that may have long-term and devastating effects on economies that have relied on it, according to Allen Sinai, chief global economist at Decision Economics Inc. in New York.

TOKYO — Japan’s economy contracted at its fastest pace in nearly 35 years during the final quarter of 2008 — and is likely to underperform other major nations early this year as demand for its goods collapses.

Japan’s gross domestic product shrank by 3.3%, or an annualized pace of 12.7% during the quarter, the government said Monday, a steeper decline than contractions of 3.8% reported for the U.S. and 5.9% in the euro zone for the same period. The world’s second-largest economy was slowed by a staggering 14% decline in exports and diminished capital spending by companies.

Japan’s economy is facing “without a doubt, the worst crisis since World War II,” said Economy Minister Kaoru Yosano.

Economic data already signal more deterioration. Industrial output is expected to drop by around 20% during the first quarter, a government survey says. After tumbling by a record 35% in December, exports sank 46% from a year earlier during the first 20 days of January.

Japan doesn’t have much room for further fiscal stimulus. It has the most debt in the world, coming to 157.5% of annual GDP in the fiscal year starting in April.

Japan Heads For Worst Postwar Slump

Jan. 30 (Bloomberg) — Japan headed for its worst postwar recession as factory output slumped an unprecedented 9.6 percent in December, unemployment surged and households cut spending.

“Japan’s economy is falling off a cliff,” said Junko Nishioka, an economist at RBS Securities Japan Ltd. in Tokyo. “There’s really nothing out there to drive growth.”

The International Monetary Fund said this week that Japan’s gross domestic product will shrink 2.6 percent this year, the bleakest projection for any Group of Seven economy except the U.K. That contraction would be Japan’s worst since World War II.

“We’re in a very grave situation,” Economic and Fiscal Policy Minister Kaoru Yosano said in Tokyo today. “Japan is being hit by this wave of weakening global demand.”

Japan’s Economy – No End in Sight?

Turning to the immediate news in off the wire the situation in Japan apparently went from bad to worse and then onto horrendous in Q4 2008. The latest data points from December are thus quite staggering as will also be detailed below.

Add to this that the debt to GDP ratio is already running at alarmingly high levels, Japan finds itself in a situation where, despite policy makers’ best intentions, the room to manoeuvre is very small. Or as Edward succinctly puts it;

This is the real core of the problem that Japan faces in 2009, that previous fiscal policy did not attack the growing fiscal deficit in the good times, so there is little room to manoeuvre in the bad ones. Which is why the Japan economic outlook in 2009 is grim, grim and nothing but grim.

On the fiscal front the steps are also fundamentally sound I think, but once again Japan is constrained on the debt side and especially of the fact that before a single penny can be spent on the crisis at hand the fiscal authorities need to issue a handsome portion of paper just to cover the primary budget deficit. In terms of the immediate outlook for Japan it is consequently dire.

Do The Japanese Read The News Reports?

Reports on the recent economic news from Japan cited above have included the following words or phrases: “most severe, plunged at the steepest pace, quantum downward shift, devastating effects, collapses, staggering, worst crisis, deterioration, worst postwar recession, unprecedented, falling off a cliff, bleakest, very grave situation, horrendous, staggering, alarmingly, grim, grim and nothing but grim, dire.”

The Japanese readers of these news reports might consider a rendezvous with a black hole as a better option than facing the future. Is this really a time of desperation or is it the point at which the news can’t get worse, so it has to get better? Acquaintances of mine who have recently been to Japan report that trains still work, planes still fly, people still go about their business, the streets are crowded and Japan Inc is open for business. To evaluate the situation further, let’s examine how the horrific economic news has impacted the Nikkei 225.

NIKKEI 225 Ignores Horrific Economic Stats

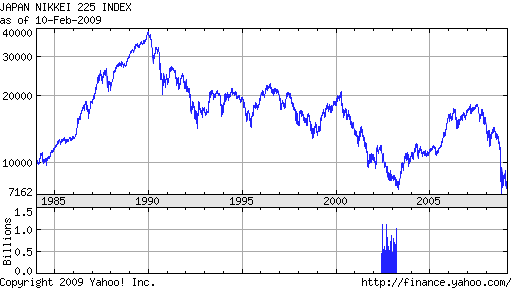

If we look at the price action of the Nikkei 225 there appears to be a glaring disconnect from the current litany of bad news. The Nikkei appears to have already discounted today’s bad news last year when the average fell 47% from its June 2008 high of 14490 to the October low of around 6868. To date, the Nikkei refuses to pierce the October lows and now stands at 7670, almost 12% higher than the October 2008 low. I am not a chart technician, but this type of price/news divergence is usually a positive sign. If the Nikkei can stay above last year’s lows, perhaps investors have already discounted the worst. Conversely, should the Nikkei start posting new sub 7,000 lows, it might be “lights out”. Time will tell.

Long Term Factors To Consider:

-the Nikkei is already off 80% from its December 1989 high and has perhaps discounted the worst that can happen.

-a multi year double bottom may be forming at current price levels.

-the most fundamentally bullish factor may be that the Japanese government has reached the limits on its borrowing capacity, thus precluding the continuation of costly and ineffective stimulus plans (see Japan’s failed strategy). With the government no longer able to subsidize failed enterprises, free market forces can now accomplish the restructuring necessary to rebuild Japan’s economy.

-logical minds have made a persuasive case that the United States is now following the same failed policies that did not work in Japan for the past 20 years. If this is the case, the United States needs two decades, deficit spending of $30 trillion and a Dow Jones at 2800 to achieve the same economic status that Japan has today.