SBUX On The Right Road

There is an old saying that if you don’t know where you are going, any road will get you there. Starbucks seems to know where it wants to be and is also taking the right steps to get there. When the bottom starting falling out of the economy in 2008, Starbucks developed a plan for the continued success of its valuable franchise.

In February of this year Howard Schultz, chief executive of Starbucks, explained his long term plan for future growth and profitability. The essence of the Starbucks turnaround was to cut costs and convince customers that Starbucks coffee was value priced. Mr. Schultz shrewdly based his plans on a forecast that the economy would be weak for a protracted period of time.

“I strongly believe we are going to be in this environment for years… it is a reset of both economic and social behavior.” – Howard Schultz

Strategy Starting To Pay Off

The latest quarterly results announced by Starbucks (77% profit decline) would seem disastrous at first glance. Looking beyond the quarterly results, it matters more where Starbucks is going rather than where they have been. The company’s focus remains on cost cutting, selective price cutting and portraying Starbucks coffee as a high quality value priced product. The quarterly profit decline was due largely to the costs associated with store closings. The important metric of customer sales shows improvement from the previous quarter.

The key positive for Starbucks is that the decline in sales had minimal correlation to product quality. Besides introducing some new coffee products such as the Pike’s Place blend, the basic Starbucks menu was not changed. Starbucks continues to deliver a high quality product and is adjusting their business strategy to reflect the reality of weak consumer spending. The company is strong financially with a modest amount of net long term debt.

Profit From Short Term Weakness

Starbucks is one of the great American success stories. None of Starbucks’ basic success ingredients have changed – superior management and a great product sold in a pleasant environment by friendly and well trained employees. The company is taking the right steps to reposition itself for future growth. The bad news has probably been discounted, making the stock a great long term buy. The flight to safety play is becoming yesterday’s strategy. What would you rather own today – a five year treasury paying sub 2% or an ownership interest in a great American franchise?

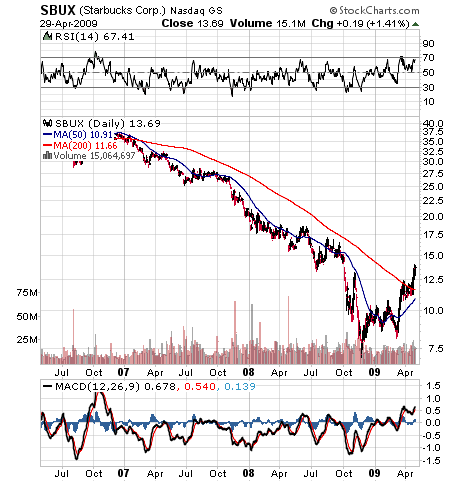

Courtesy: stockcharts.com

Courtesy: stockcharts.com

Disclosures: Long SBUX