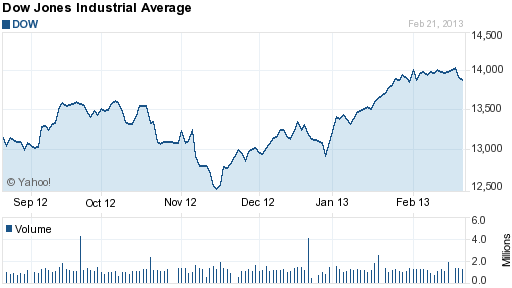

From mid November 2012 to February 19th, 2013, the Dow Jones Industrial average gained 1,400 points for a gain of almost 12%. On February 20 and 21, the Dow Jones swooned a quick 200 points, a loss of less that 2%. Such a minor pullback after a robust multi month rally is not what I would consider to be a shocking or unexpected event.

Nonetheless, innumerable articles predicting financial Armageddon have appeared in the mainstream financial press following the market’s minor correction. Has the world really changed all that much after a 200 point Dow loss or is there something fundamentally flawed with the manner in which the financial press presents information to its readers?

News organizations have the right to publish whatever they chose to. The question that needs to be asked by the investing public is whose interests are best being served. Do sensationalistic headlines really translate into useful information for readers or is the mainstream press primarily serving its own financial interests by publishing hyped up “news” to boost advertising revenue? Caveat emptor – financial readers need to identify and ignore trash journalism.

Here’s the example of the week on the type of “trash reporting” that investors need to ignore. So called “market guru” Dennis Gartman tells his subscribers that he is selling and “rushing to the sidelines.” CNBC regularly interviews Gartman who always comes up with wonderful soundbites that help CNBC (whose ratings have plunged). Gartman also benefits by plugging his market newsletter. No problem so far, but does the declining audience of CNBC benefit, most of whom presumably tune in for intelligent investment advice?

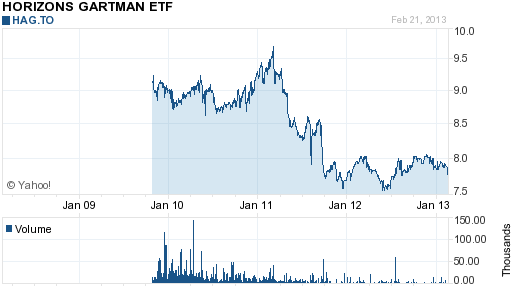

In Gartman’s case, it’s easy to determine the value of his investment prowess since Mr. Gartman runs his own little alternative investment fund known as Horizons Gartman ETF Comm (HAG.TO). According to Yahoo, “The fund’s objective is to provide investors with the opportunity for capital appreciation through exposure to the investment strategies of The Gartman Letter, L.C., founded by Dennis Gartman.” So how has that worked out?

The horrendous return on this fund becomes even more disconcerting when considering that the overall market is up around 100% since Mr. Gartman started the fund in late 2009, shortly after the bottom of the last bear market. When CNBC features Mr. Gartman as an investment expert without noting his abysmal investment track record, they are engaging in the worst form of deception. If CNBC ever wants to be taken seriously and increase its viewership level, they should start by removing idiots like Gartman from their interview list.