Google has done it again with the release of the Google Chromecast streaming media player.

Google has done it again with the release of the Google Chromecast streaming media player.

It wasn’t enough that Google (GOOG) developed and offered for free the Android operating system. As an open source OS, Android quickly became the world’s most widely used smartphone platform. Due to its low cost and flexibility, Android is also becoming the software of choice for a wide range of other electronic devices including televisions, video games and digital cameras.

Google has quietly been coming out with a string of ingenious devices which will bring fundamental changes to the economy and revolutionize the way we live. Who would have thought that Google would make a self-driving car a reality so quickly or allow us to merge our lives with the internet with Google Glass?

Although the Chromecast HDMI streaming media player does not seem like that big of a deal compared to other ingenious Google products, it threatens to fundamentally change the multi-billion dollar cable industry, perhaps in the same dramatic fashion that Apple’s IPod changed the music industry. As media inexorably moves to the internet, who needs the expensive and clunky cable companies with their hideous black cords running all over the house when you can wirelessly connect your TV to the internet with Chromecast? High monthly cable bills could become a thing of the past.

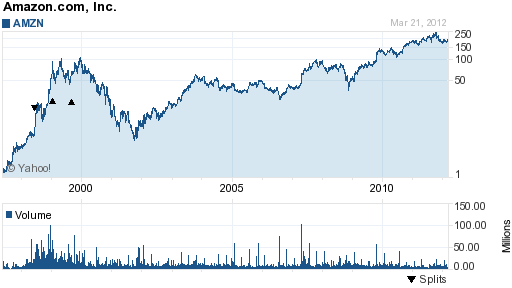

For only $35 dollars and two minutes of installation time, Chromecast uses your smartphone, laptop or tablet to stream pretty much anything you want from the internet to your TV. As word of Chromecast spreads, it has quickly sold out at major retailers such as Best Buy and Amazon.

If you use Netflix (NFLX) or want to sign up for Netflix the Chromecast is essentially a free giveaway to consumers since existing or new Netflix customers will receive three months of free service which is worth about $35.

Google is quietly establishing itself as one of the most innovative companies in the world. It’s hammer lock on internet searches provides billions of dollars in profits that are being used to develop new products and technologies which in turn provide Google with massive amounts of information on consumer preferences and buying habits. The massive data bases gathered on consumers using Google products in turn allows Google to charge advertisers higher ad prices through focused marketing and the profitable circle is completed. If anyone is looking for the first trillion dollar market cap stock, Google is a prime candidate.