The latest FDIC Quarterly Banking Profile reveals that banks increased loan loss reserves by 11.5% and the ratio of reserves to total loans increased to 2.5%, an all time high. Despite the large loan loss reserves, the ratio of reserves to noncurrent loans fell for the 12th consecutive quarter to 66.5%, the lowest level in 17 years. This low reserve ratio, despite large increases in loan loss provisions indicates that the banking industry’s estimates of future delinquencies has consistently been too low.

Reserve Coverage Ratio

Even if the amount of noncurrent loans level off, the implications for future banking profits is a dismal picture. In order to establish an adequate coverage ratio for noncurrent loans, loan loss provisions will have to rise dramatically.

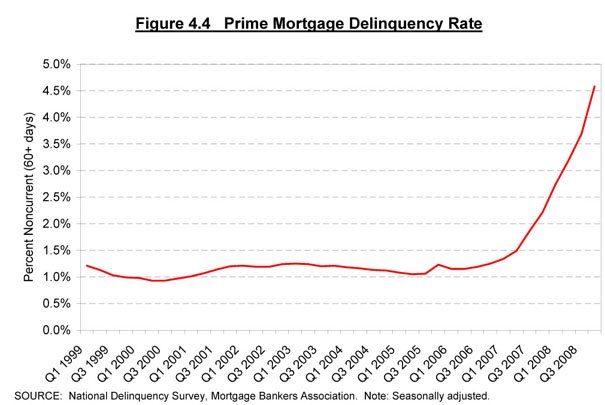

Prime Mortgage Defaults – Another Black Swan

The banking industry’s low estimate for loan delinquencies may be due in large part to the unexpectedly large increase in default rates seen on prime mortgages. Prime mortgages were never expected to have a default rate above the historical ratio of around 1% since these were mortgage loans made to the best customers. In the past, the only defaults typically seen on prime mortgages were due to unexpected job loss, a divorce, illness or other factors beyond the control of the borrower.

The rapid increase of delinquencies on prime mortgages has caught the banks off guard. The default rates on prime mortgages is now almost 5% (5 times normal), a true Black Swan event for the banking industry. In addition, the default rate could rise even higher since 25% of prime mortgage holders now have negative equity, a situation which enhances the odds of delinquency and defaults.

Based on the rapidly deteriorating numbers for prime mortgages, loan loss reserves need to be increased significantly. The myth that most of the smaller community banks are not exposed to the risks that afflicted the bigger banks is only partially true. Banks of all sizes have significant exposure to the mortgage market and the growing number of defaults by prime mortgage borrowers will cause significantly higher than expected losses at all banks.

Courtesy of: moremortgagemeltdown.com

Problem Banks, Failed Banks Increasing Rapidly

The 36 failed banks we have seen this year has expanded dramatically from 25 for all of 2008, but has remained very low considering the extent of the losses in the banking sector. Many very weak banks have apparently been allowed to stay open under the misguided hope that mortgage defaults would decrease as the economy improved. The number of banks classified by the FDIC as “Problem Banks” has risen to 305 from 90 last year. The latest surge in mortgage defaults due to job losses, declines in real estate prices and negative income trends will have a devastating effect on an already weakened banking industry.

The FDIC’s line of credit with the Treasury was recently increased to $100 billion from $30 billion. The FDIC can borrow up to $500 billion with Federal Reserve and Treasury Department approval. Expect to see the FDIC draw down significantly on their expanded line of credit with the Treasury as the FDIC is forced to close increasing numbers of insolvent banking institutions.

Speak Your Mind