The Trust Dilemma

It is widely known that the credit card industry has serious problems. Defaults are reaching all time highs as unemployment and high consumer debt levels impede borrowers’ ability to repay their debts. Defaults based on job losses or over leveraged customers are nothing new to credit card lenders, who have traditionally lent to less than sterling credits at rates commensurate with risk.

In the past, card issuers extended generous credit to all borrowers, seemingly indifferent to credit or income levels. The lower credit score borrowers’ losses would be covered by higher rates. Card loans to homeowners could always be paid off when the borrower refinanced his home. The higher credit score borrowers got lower rates but would never default in large numbers. This scenario worked well and produced huge profits for the card companies until the housing market crashed and the securitization market for credit card debt disappeared.

Recently, in addition to expected losses, the credit card industry is now experiencing a troubling new phenomenon not accounted for in their risk models.

Customers with high credit scores and no previous history of default are suddenly defaulting on their card payments. Since the credit card companies never expected large default rates by their “high credit high income” borrowers, they now seem forced to suspect that every customer is a high risk and should be dealt with accordingly.

Have the dynamics of the credit card industry fundamentally changed or should the credit card companies have done a better job of qualifying their borrowers before extending generous lines of credit?

Capital One Can’t Identify Their Low Risk Customers

Here’s a real life verified example of a borrower approved for a credit card based only on stated income and a credit score.

The applicant’s on line credit card application to Capital One was approved instantly for $30,000 after providing name, address, social security number, name of employer, job title and income. Income was never verified according to the borrower’s employer. Credit score was 800 plus when the credit card was approved several years ago. The borrower has used her card frequently, always paid on time and incurred interest charges at 7.9% when the monthly balance was not paid in full. The borrower has maintained a plus 800 credit score and her credit line has not been reduced. Capital One knows the borrower’s current credit score since they monitor customer scores on a monthly basis.

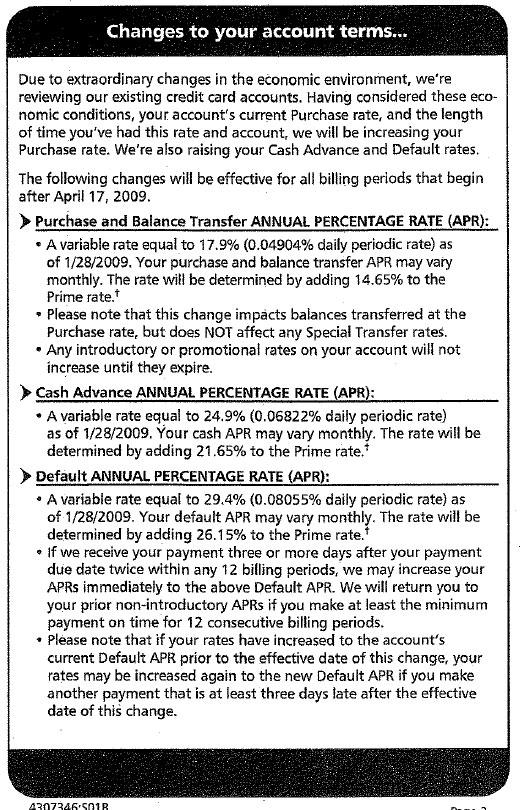

This 800 plus FICO score borrower who has never been late with any payments recently received a notice from Capital One that effective April 17, 2009, the interest rate on unpaid purchase balances will be 17.8% and on cash advances the rate will be 24.9%. Is this just another example of rates being adjusted to reflect lending risks, or an indication of how little Capital One knows about its customers? Here’s what Capital One does not know about this customer since they never bothered to ask.

Customer has a secure job, little debt and her income comfortably exceeds all living costs. In addition, customer has verified liquid assets in excess of $1 million plus home equity and other assets that put her net worth in the $2 million range. Net result for Capital One is that this customer will be paying off all monthly balances in full to avoid paying interest at 18%. Should the need arise to borrow money, the customer has access to a home equity line of credit at 4%.

Establish Lending Parameters Based on Sound Underwriting

In order for Capital One to rebuild their business going forward, they should consider re-qualifying their customer base with a detailed loan application and then verify the information. For those determined to be low risk customers, charge a lower interest rate.

Capital One now seems to have a strategy of charging high rates to all of its customers which seems counterproductive. The customers who are financially strong will not pay 18% rates – they will either pay off their balances monthly or borrow cheaper elsewhere. Customers willing to pay 18% to 25% interest on a loan are probably stressed financially and the most likely to borrow and default. This bizarro business strategy of targeting the weakest borrowers in a weak economy seems destined for failure.

Perhaps one day Capital One may come up with the unique concept of restricting lending to borrowers with a verified ability to repay.

Late Update

US consumers in February reduced outstanding revolving debt (which is primarily credit card loans) by $7.8 billion. Some of the decrease is due to decreased credit card lines and consumer reluctance to take on more debt. My guess is that a good portion of the decrease in credit card balances is also due to the sky high rates being charged by the credit card lenders. The higher quality card customers are accessing lower rate money elsewhere or simply saying no to 25% lending rates.

Consumer Credit In US Falls $7.48 Billion As Recession Cripples Spending

Thanks for your post . It is useful for me.

This is the industries loosing strategy not just one lender. Since all CC lenders were not qualifying applicants as you would a car loan or home loan, the first lender to implement this strategy would push away applicants to all the other lenders who had simpler applications. And thus put themselves out of business.

Very good point. Most of the large players went for the high risk/high return play that blew up on them. There were and are many smaller card issuers that did not follow this path and offer great deals on their cards. See “Low Rate Credit Cards That Make Sense” posted May 1, 2009.