CIT Solution Is Bankruptcy – Not Bailout

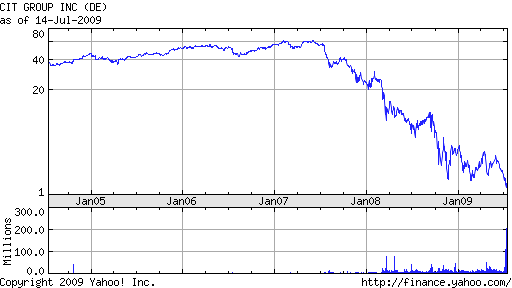

A CIT spokesman said late today that “There is no appreciable likelihood of additional government support being provided over the near term”. Taxpayers had previously supplied a massive $2.3 billion dollars in loans under the TARP program late last year. The large TARP infusion did little to turn around CIT which has reported losses for the past two years of over $3.4 billion.

CIT has $60 billion in finance loans and leases outstanding, an amount that is a mere rounding error in a $14 trillion US economy. CIT does not represent a systemic risk to the US financial system. The large amount of losses reported by CIT over the past two years suggest that loan approvals were given to risky enterprises. CIT would not be losing money and on the verge of bankruptcy if their lending policies had properly accounted for risk.

The weak economy certainly contributed to CIT’s losses, but they could have been mitigated by better risk management. As a private lender, CIT has the right to lend based on whatever standards they chose. As a private lender, they also bear the responsibility of loss.

The American taxpayer should not be stuck with the cost of bailing out every failed business enterprise. There already is a solution for poorly run companies – the solution is known as bankruptcy. The US Treasury can join other creditors in bankruptcy court – cutting your losses is often the best option.

CIT aggressively expanded its loan portfolio over the past fives years by almost 100% to $60 billion. CIT attempted to rein in its lending as the recession deepened, but the losses continued. Increased losses resulted in a dramatic reduction of new lending activity over the past year. CIT has effectively shut down new lending to small businesses for over a year now. Customers that qualify for financing have gone elsewhere.

For small businesses, CIT is already failing.

“In order to service its debt and meet obligations, [CIT] has been cutting back on new originations,” explains David Chiaverini, research analyst at BMO Capital Markets.

CIT CEO Jeffrey Peek said in November that his company was “the bridge between Wall Street and Main Street,” and “one of the few significant sources of liquidity for small and mid-sized businesses who are struggling to survive.” But by then, CIT was already burning down its bridge, turning away many of the small businesses that had come to rely on the company.

BMO Capital Markets’ Chiaverini sees bankruptcy as CIT’s most likely next step.

“The best case for CIT is to get its liquidity issues resolved — bankruptcy could actually get things back to normal on the lending front,” he says. “If it does go into bankruptcy, I think what will happen is unsecured debt holders will convert their debt into equity and it will emerge stronger without the overhang of debt coming due. Then, it can start lending again.”

CIT’s role in small business financing will be hard to fill, but for many companies, the damage is already happening. Saving CIT would only help Main Street businesses if the company became healthy enough to resume making loans.

FDIC Rejects CIT Loan Guarantee Request

Sheila Bair, FDIC Chairman, had previously expressed deep reservations about allowing CIT to access the Temporary Loan Guarantee Program (TLGP) due to CIT’s weak financial condition. Due to the financial crisis, the FDIC was called upon to provide guarantees to bank issued debt under the TLGP. This type of massive “mission creep” imperils the primary purpose of the FDIC which is to protect depositor funds. The FDIC Deposit Insurance Fund (DIF) is nearly depleted. Sheila Bair made the right call and so did the Federal Government. Let the owners and creditors of CIT assume the risk of loss – not the US taxpayer.

“Cutting Your Losses”

Disclosures: No positions

More on this topic: Treasury Bets U.S. Financial System Can Weather CIT Collapse

Speak Your Mind