Some Clear Thinking On Credit And Government Policies

Confidence More Important Than Gold

by Axel Merk | February 11, 2009

In a rare interview with Western media, Wen Jiabao, the Chinese premier, told the Financial Times (see http://www.ft.com/wen),

‘Confidence is the most important thing, more important than gold or currency’

Why is it that such wisdom comes from the leader of China, but is absent from the leaders of other countries? Do other presidents and prime ministers intentionally play a backstage role, letting their Treasury secretaries or finance ministers communicate with the public to avert blame when policies fail? That suggests that the leadership may not have all that much confidence in the programs they are promoting; or more likely, the leadership does not understand the issues.

Investors and entrepreneurs take risks in search of profit opportunities. In contrast, in times of crisis, many avoid risks and hoard cash in an effort not to lose money. Except, of course, if your bank or the currency you hold the cash in goes down the drain. When confidence even in cash erodes, gold thrives. The slogan for crisis investing so dreaded by governments is:

‘Gold is the most important thing, more important than confidence or currency’

Governments dread investors flocking to gold because it shows a lack of confidence in riskier alternatives available. Gold’s attraction is that its value cannot go to zero; that it has no counter-party risk; gold over the millennia has shown to be a store of value. But economies do not grow when gold is hoarded: capitalism requires risk seekers.

But what about all those folks who need to have a bailout? Something obviously went wrong as individuals and businesses took on too much credit. The solution, however, is not to prop up a broken system by stuffing even more credit down the throat of those who couldn’t handle the credit in the first place. The solution is to allow an orderly write off of investments and loans that have gone wrong. Most mortgages are non-recourse loans, meaning homeowners could simply hand over the keys to their homes and walk away from their debt. As a result, financial institutions would think twice before making a loan to such borrowers in the future.

What it comes down to is that just about all policies proposed deal with propping up a broken system rather than initiating the reforms necessary. Credit plays an important role in modern economies, but throwing more credit at those who are over-extended is not the solution. Quite

Present government policies are aimed at coercing the public into taking risky investments so that they don’t lose the purchasing power of their hard earned cash. The reason that’s done is so that all the debt can be served. We can do better than that. If we had less debt, we would be more concerned about preservation of purchasing power. But because the government also has tremendous debt, the interests of governments and savers are not aligned.

The U.S. economy has attracted investment for so long because it has been a fair place to conduct business in. Gaining the confidence of investors takes decades to build, but is easily destroyed. The U.S. must focus on reform to avoid some of the excesses from happening again; not simply prop up a broken system. So far, all we see is governments throwing money at the problem. We may be able to sum up our current policies as

‘We don’t know what we are doing, but we are doing a lot of it…’

This article is well worth a full reading.

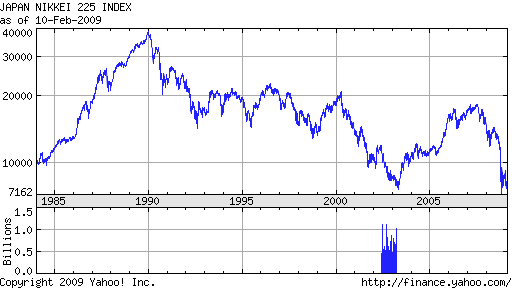

Politicians do what they do to stay elected whether it makes sense or not. We tell ourselves that we are not making the same mistakes as Japan did with its economy but we are deluding ourselves. We are employing the same failed policies that the Japanese politicians tried. Instead of letting free market forces work, the government is attempting to keep an over leveraged system functional by providing more credit to those who have shown no particular ability to repay what they owe already. This strategy does nothing to build a strong economic system going forward. The president is predicting a “lost decade”. We will be fortunate indeed if a real turnaround comes that soon. Japan is now close to starting its third “lost decade”.

More Thoughts On Gold

Is the gold market telling us that an economic catastrophe is imminent?

It certainly might seem as though it is. By late morning Eastern time Wednesday, an ounce of the yellow metal was ahead by more than $30 from where it closed Tuesday.But it doesn’t take much of a historical memory to appreciate that gold’s message is far more inscrutable.Consider, for example, that gold traded for nearly $1,000 per ounce last July, compared with the $945 level at which bullion was trading Wednesday morning. That’s a very telling contrast: Though things weren’t all brightness and light last summer,Even so, gold was higher then than now. Why?This question becomes even more pertinent upon realizing the federal government’s actions since last July have been a textbook illustration of the inflationary behavior for which Ben Bernanke earned his nickname of “Helicopter Ben.” Yet, curiously, gold — the ultimate inflation hedge — is lower today than then.

A good point is made as to why gold is not higher than it was a year ago. Every market price implies an equilibrium of buyers and sellers. Despite the obvious bad news reasons why gold should be higher, in theory, it is not. Perhaps investors are still in the denial stage from an economic perspective, preferring to believe that this is another routine recession. There will be a tipping point where denial turns to loss of confidence and gold will be avidly sought as a refuge for capital. At this juncture, the buyers will vastly outnumber the sellers.

Welcome To Washington Mr.Geithner – More Evidence of “We don’t know what we are doing, but we are doing a lot of it”

Feb. 11 (Bloomberg) — That’s it? That’s all Geithner had to offer?

It is amazing that this far into the financial crisis, we are still stumbling along, still so reluctant to tackle the problems facing the financial system and the economy.

Rather than offer the kind of comprehensive solution he had promised, Treasury Secretary Timothy Geithner yesterday served up a plan for banks and the financial system that was long on platitudes and short on specifics.

And that’s being kind. There were no specifics. There were only vague promises of programs and details to come.

And the specifics? “We are not going to put out details until we have the right structure,” Geithner said.

If that’s the case, it’s not clear why Geithner bothered to speak yesterday. If his goal was to calm markets, it didn’t work, especially since investors were hoping that he would simply agree to take all the bad assets from banks and reflate the financial system in one fell swoop.

And what of the herd of ailing banks that pose systemic risks to the global financial system? Rather than euthanize those that can’t survive, Geithner plans to continue coddling them.

This is the sort of float-all-boats thinking that led to Congress’s misguided stimulus package. It represents a false hope that there is still a way for the country to muddle through this crisis without having to accept a new norm in terms of asset prices, lifestyles and expectations.

That’s not likely to happen. And it’s why the Obama administration’s first, grand effort to fix the nation’s economic ills probably won’t be its last.

Any future economic recovery will be despite the government’s actions.

nice post