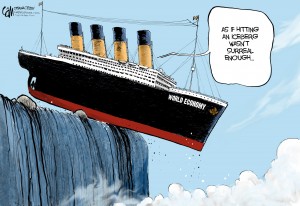

The Federal Reserve failed miserably in preventing the meltdown of the American financial system. Worse yet, the Fed’s loose credit and monetary policies and failure to properly regulate the financial system was arguably one of the biggest causes of the financial meltdown. Now, based on the Fed’s sterling record of failure, Washington’s answer is to give absolute power to the Fed – what are these nitwits in Washington thinking?

Back in the U.S.S.A. – Peter Schiff

Harry Browne, the former Libertarian Party candidate for president, used to say: “the government is great at breaking your leg, handing you a crutch, and saying ‘You see, without me you couldn’t walk.’” That maxim is clearly illustrated by the financial industry regulatory reforms proposed this week by the Obama Administration.

In seeking to undo the damage inflicted over the past decade by misguided government policies, the new regulatory regime would ensure that the problems underlying our financial system will only get worse.

The underlying problem is that the excessive risk taking which brought about the crisis was not market-driven, but a direct consequence of government interference with risk-inhibiting market forces. Rather than learning from its mistakes and allowing market forces to once again control risks and efficiently allocate resources, the government is merely repeating its mistakes on a grander scale – thereby sowing the seeds for an even greater crisis in the future.

Obama proposes to entrust the critical job of “systemic risk regulator” to the Federal Reserve, the very organization that has proven most adept at creating systemic risk. This is like making Keith Richards the head of the DEA.

Given the Federal Reserve’s disastrous monetary policy over the past decade, any attempt to expand the Fed’s role should be vigorously opposed. Through decades of short-sighted interest rate decisions, the Fed has proven time and again that it is only able to close the barn door after the entire herd has escaped. If setting interest rates had been left to the free market, none of the excesses we have seen in the credit market would have been remotely possible.

The perverse result will be that our government and the Fed gain more power as a direct result of their own incompetence.

With the transition now fully under way, I propose we end the pretense and rename our country: “The United Socialist States of America.” In fact, given all the czars already in Washington, we might as well go with the Russian theme completely: appoint a Politburo, move into dilapidated housing blocks, and parade our missiles in the streets. On the bright side, there’s always the borscht.

Courtesy: The Liberty Voice

Courtesy: The Liberty Voice

Washington constantly employs the same failed tactics to a problem and expects different results and only those outside of Washington understand the implications of such thinking. Instead of expanding Federal Reserve powers, serious thought should be given to severely restricting the Fed’s ability to destroy what’s left of the American free enterprise system.

What The Fed Chairman Said At The Onset Of The Credit Bubble

Speak Your Mind