Fed Sees Solution In Zero Rates

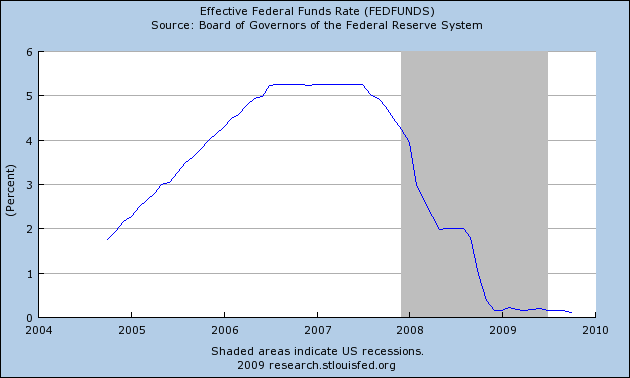

The Federal Reserve recently vowed to keep interest rates “exceptionally low” for the foreseeable future in an attempt to revive the economy. Since mid 2006 the Fed has brought the Fed Funds Rate down from 5% to virtually zero in an attempt to reduce the debt service burden on over leveraged borrowers.

A world of ultra low interest rates may continue for much longer than many expect.

Fed To Keep Rates Low (WSJ) – Fed officials voted unanimously to maintain their target for the key federal-funds interest rate — at which banks lend to each other overnight — near zero and said they expect to keep it there for an “extended period,” which suggested increases are at least several months off.

While consumers are spending, the Fed noted they were “constrained by ongoing job losses, sluggish income growth, lower housing wealth and tight credit.” Meanwhile, “businesses are still cutting back on fixed investment and staffing, though at a slower pace.”

A low interest rate policy has worked in the past to stimulate the economy and the Fed is applying the same prescription to the current economic downturn. At this point, it is too early to tell if the same policies of super low rates and easy money will work as it has in the past. Japan stands out as the premier example of a post bubble economy still failing to recover despite twenty years of super easy fiscal and monetary policies. The Fed prescription of attempting to revive an overly indebted economy with more lending may very well produce the same results as in Japan – slow economic growth, lower incomes and crushing public debt burdens.

Individuals who were prudent enough to save and avoid debt are now left to wonder if they will ever see a return on their savings. Short term CD’s are below 1%, money market funds pay a ridiculously low rate barely above zero and short term treasuries have a negative yield. Those who are retired and depend on interest income for living expenses must now deplete their savings or take on more risk by investing in higher yielding bond funds subject to substantial market fluctuations.

The Fed’s low interest rate policy effectively represents a massive wealth transfer from savers to debtors. FDIC insured deposits of bank savings and CDs currently total $4.8 trillion and there is approximately $5 trillion in money market funds for a total of $10 trillion that is earning at best 1% compared to 5% in 2006. The drop in interest rates from 5% to 1% represents an annual income loss to savers of $400 billion dollars per year.

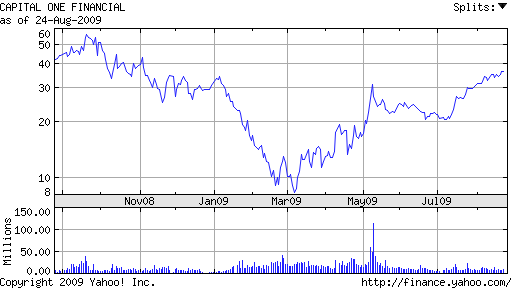

Congress and the Fed have attempted to bailout out every imprudent debtor with super low interest rates – homeowners who borrowed too much, bankers who lent foolishly, and hundreds of poorly run, over indebted companies from GM to AIG. Someone always pays in the end and in this case, the victims are the savers.

Hard Times Bring Back Thrift

Hard Times Bring Back Thrift