Mortgage Rates Explode to 12 Year High

This year has seen one of the most explosive mortgage rates increases in history. In a matter of a few short months the 30-year fixed rate mortgage has almost doubled from the high 2’s to over 5%. There have been previous periods of time during which rates rose substantially but 2022 has been a vertical move up that is rarely seen.

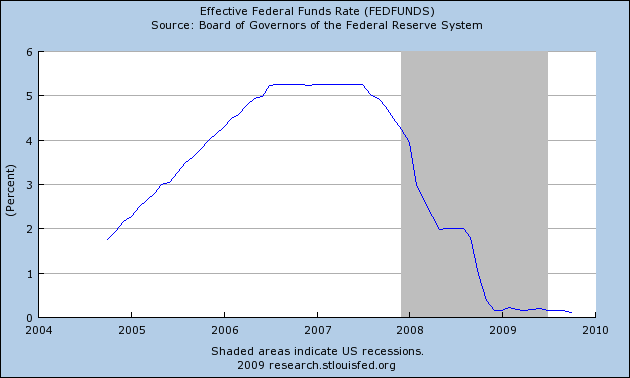

Why rates have risen so quickly is no mystery. After months of Federal Reserve talk of “transitory inflation” it has become clear that inflation is here to stay and likely to get worse before it gets better. The Fed must increase rates significantly to have any chance of reducing the inflation rate since current rates are far below the rate of inflation.

This from the WSJ:

During the 1980s, when Paul Volcker’s Fed was desperate to avoid a repeat of the inflation of the 1970s, interest rates were on average more than 4 percentage points higher than inflation. Leave aside the fact that at the moment the Fed Funds target rate is an extraordinary 7 percentage points below inflation; markets aren’t bracing for the Fed to be truly hawkish in the long run. Investors still think there’s no need, since in the long run inflation pressures will abate.

This is probably a mistake. The inflationary pressures from Covid and war will surely go away eventually. But self-fulfilling consumer and business expectations of inflation are rising, and a bunch of longer-term inflationary pressures are on the way. These include the retreat of globalization, massive spending to shift away from fossil fuels, more military spending, governments willing to run loose fiscal policy, and a starting point of an overheated economy and supercheap money.

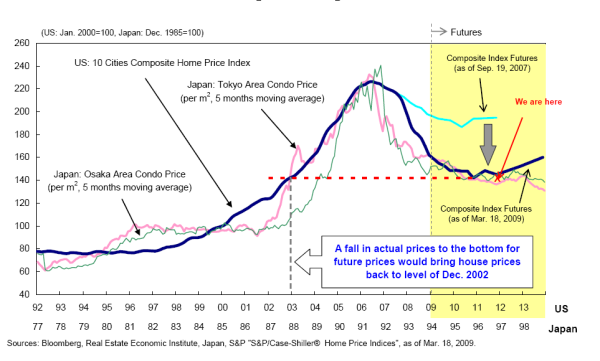

If interest rates continue to rise, we may be looking at another housing bust similar to what we saw in 2018.