US Companies Build Massive Cash Reserves Based on Economic Worries

Wall Street Journal – U.S. companies are holding more cash in the bank than at any point on record, underscoring persistent worries about financial markets and about the sustainability of the economic recovery.

The Federal Reserve reported Thursday that nonfinancial companies had socked away $1.84 trillion in cash and other liquid assets as of the end of March, up 26% from a year earlier and the largest-ever increase in records going back to 1952.

Idle cash of almost $2 trillion is a massive amount, but let’s put that into perspective by comparing that to the spending habits of the U.S. Government. If the U.S. Government expropriated every dollar of cash held by U.S. companies, it would barely cover 16 months of U.S. deficits. The entire $1.84 trillion of cash held by U.S. companies would pay for a mere 6 months of U.S government spending.

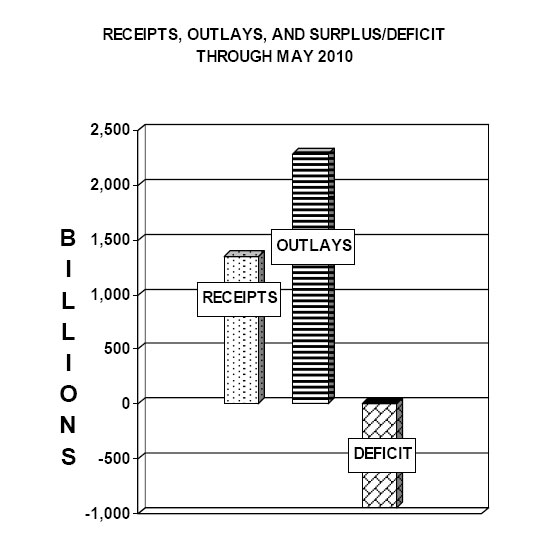

In the government’s last fiscal year, receipts were $2.1 trillion and spending totaled $3.5 trillion for a deficit on $1.415 trillion. Latest figures from the U.S. Treasury indicate that the current fiscal year’s deficit will exceed last year’s deficit – here are the numbers month by month.

FISCAL 2010 RECEIPTS OUTLAYS DEFICIT

$MILLIONS

OCTOBER……………..135,294 311,657 176,363

NOVEMBER…………..133,564 253,851 120,287

DECEMBER…………….218,918 310,628 91,410

JANUARY………………205,240 247,874 42,634

FEBRUARY…………….107,520 328,429 220,909

MARCH……………………153,358 218,745 65,387

APRIL………………………245,260 327,950 82,689

MAY…………………………146,795 282,722 135,927

YEAR TO DATE 1,345,950 2,281,566 935,606

Graphical Representation of Looming Disaster

Government spending is now almost twice total receipts. How long can any entity continue at this pace before hitting an economic brick wall?

Source: Department of the Treasury

Fed Chairman Bernanke recently warned that unless deficits are reduced, the U.S. could become the next Greece, but the economy is currently too fragile to initiate deficit reductions. Translation – we are facing social and economic disaster from out of control deficit spending, but we can’t do anything about it right now. Conclusion – the government will need trillions every year for the foreseeable future to cover the gap between receipts and spending.

Let’s hope the President doesn’t connect the dots here – $trillions needed by the government while companies are sitting on $trillions that they are not investing, spending or paying to shareholders – not very patriotic! After having already proposed a plethora of tax increases on everything possible, “idle corporate cash” could easily become a very tempting target. Let’s hope Mr. Obama does not read this post.