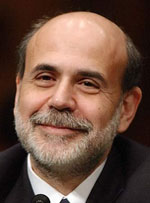

The Wall Street Journal reports on the lessons that Chairman Bernanke, a student of the last depression, learned from his textbooks and studies in school. According to the Chairman, “The experience of the Depression helped forge a consensus that the government bears the important responsibility of trying to stabilize the economy and the financial system, as well as of assisting people affected by economic downturns”.

The Wall Street Journal reports on the lessons that Chairman Bernanke, a student of the last depression, learned from his textbooks and studies in school. According to the Chairman, “The experience of the Depression helped forge a consensus that the government bears the important responsibility of trying to stabilize the economy and the financial system, as well as of assisting people affected by economic downturns”.

This theory no doubt has been the impetus behind the efforts to provide massive amounts of liquidity and loans not only to the banking industry but also to scores of non banking related entities as well. These operations have been criticized for their apparent ineffectiveness so far but I have no doubt that eventually, the Federal Reserve will succeed in “stabilizing” the banks and the economy by providing oceans of credit in such great quantity that only the most ridiculously inept companies won’t survive. If you have an inquisitive mind, however, and analyze why we are in a financial crisis, one might conclude that it was brought forth by excessive credit creation and leverage on a scale never seen before by the same government entity now attempting to save us. The great credit bubble did not start overnight- it began in the 1980’s and has grown exponentially ever since, propelled in large part by the Federal Reserve, which reacted to every mini crisis of the past two decades by simply providing more credit at lower rates. Every event that might have caused a ripple in the economy was papered over with more credit instead of letting the creative destruction forces of a capitalist system purge itself of poorly run, financially reckless companies. A recession, which is the mechanism by which excesses are cured and capital allocated more wisely next time, was viewed with horror and an end of the world event.

So here we are today, again, apparently left with no options to save the system, except by increasing the leverage again. Will it work one last time or will our lust to borrow in excess once again this time be tempered by the reluctance of our foreign creditors? My vote is that since we cannot apply fiscal discipline on ourselves, let us hope that China, Japan and the rest of the future bag-men for our treasury paper will limit our attempts at financial self destruction.