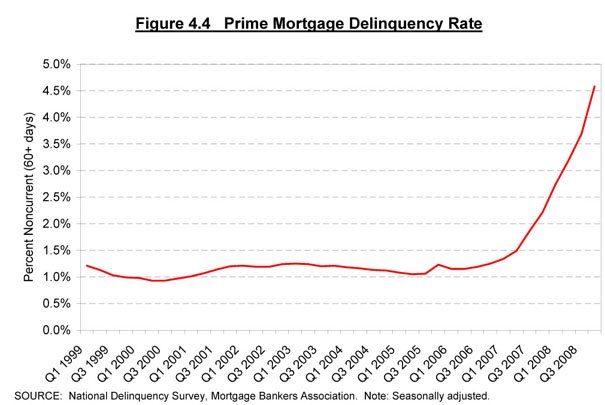

Maryland Fights The Laffer Curve and Loses

As state tax revenues plunge, politicians are attempting to increase spending and cover budget deficits by imposing “sin and millionaire taxes”.

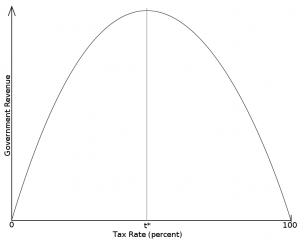

Failed attempts by the State of Maryland to cover their budget deficit with “sin and millionaire taxes” should be a text book lesson to other States that this policy is counter productive. Large tax increases have resulted in lower than expected tax revenues. Maryland has challenged supply side economics as represented by the Laffer Curve and lost.

Laffer curve

Courtesy: Wikipedia.com

Consider the following examples of diminishing returns as tax rates increase.

Maryland’s Doubled Cigarette Tax Brings in Just 50% More Revenue

Maryland doubled its cigarette tax from $1 to $2..

In FY 2007, Maryland’s $1 cigarette tax brought in $269.1 million in revenue. In proposing the increase, Governor Martin O’Malley estimated that the increase would bring in $255 million a year. In other words, he estimated that the 100% tax increase would result in a 95% revenue increase.

Maryland’s 100% tax increase is now resulting in just a 51% revenue increase. Put another way, Maryland is getting just half the revenue it expected.

Maryland couldn’t balance its budget last year, so the state tried to close the shortfall by fleecing the wealthy. And because cities such as Baltimore and Bethesda also impose income taxes, the state-local tax rate can go as high as 9.45%. Governor Martin O’Malley, a dedicated class warrior, declared that these richest 0.3% of filers were “willing and able to pay their fair share.” The Baltimore Sun predicted the rich would “grin and bear it.”

One year later, nobody’s grinning. One-third of the millionaires have disappeared from Maryland tax rolls. In 2008 roughly 3,000 million-dollar income tax returns were filed by the end of April. This year there were 2,000, which the state comptroller’s office concedes is a “substantial decline.” On those missing returns, the government collects 6.25% of nothing. Instead of the state coffers gaining the extra $106 million the politicians predicted, millionaires paid $100 million less in taxes than they did last year — even at higher rates.

Taxing the rich may be a great vote getting slogan for politicians but it will not balance the deficits facing State governments. IRS figures show that the top 5% of wage earners pay 60% of total income taxes. The bottom 50% of income earners pay virtually zero. Increasing taxes on the “rich” is not the solution to curing budget deficits.

Maryland is not alone in pursuing high income taxpayers, despite the documented futility of such action. The highest tax states are consistently losing population as taxpayers vote with their feet, leaving high tax states with less jobs, business and income. Arthur Laffer documents the self defeating results of high taxes on investment capital and people in a recent Wall Street Journal article.

With states facing nearly $100 billion in combined budget deficits this year, we’re seeing more governors than ever proposing the Barack Obama solution to balancing the budget: Soak the rich.

Updating some research from Richard Vedder of Ohio University, we found that from 1998 to 2007, more than 1,100 people every day including Sundays and holidays moved from the nine highest income-tax states such as California, New Jersey, New York and Ohio and relocated mostly to the nine tax-haven states with no income tax, including Florida, Nevada, New Hampshire and Texas. We also found that over these same years the no-income tax states created 89% more jobs and had 32% faster personal income growth than their high-tax counterparts.

Did the greater prosperity in low-tax states happen by chance? Is it coincidence that the two highest tax-rate states in the nation, California and New York, have the biggest fiscal holes to repair? No. Dozens of academic studies — old and new — have found clear and irrefutable statistical evidence that high state and local taxes repel jobs and businesses.

Finally, there is the issue of whether high-income people move away from states that have high income-tax rates. Examining IRS tax return data by state, E.J. McMahon, a fiscal expert at the Manhattan Institute, measured the impact of large income-tax rate increases on the rich ($200,000 income or more) in Connecticut, which raised its tax rate in 2003 to 5% from 4.5%; in New Jersey, which raised its rate in 2004 to 8.97% from 6.35%; and in New York, which raised its tax rate in 2003 to 7.7% from 6.85%. Over the period 2002-2005, in each of these states the “soak the rich” tax hike was followed by a significant reduction in the number of rich people paying taxes in these states relative to the national average. Amazingly, these three states ranked 46th, 49th and 50th among all states in the percentage increase in wealthy tax filers in the years after they tried to soak the rich.

Or consider the fiasco of New Jersey. In the early 1960s, the state had no state income tax and no state sales tax. It was a rapidly growing state attracting people from everywhere and running budget surpluses. Today its income and sales taxes are among the highest in the nation yet it suffers from perpetual deficits and its schools rank among the worst in the nation — much worse than those in New Hampshire. Most of the massive infusion of tax dollars over the past 40 years has simply enriched the public-employee unions in the Garden State. People are fleeing the state in droves.

The “solution” of higher taxes and borrowing to cover state budget deficits is no longer an option, with California as the prime example. Taxing the higher income groups yields lower tax revenue. Raise taxes on everyone and get voted out of office. When will the States consider the obvious alternatives of reduced spending and balanced budgets?