With little press coverage and no debate by Congress, the U.S. debt level is set to automatically increase by another $1.2 trillion in January.

The most remarkable aspect to the latest huge increase in U.S. debt is the manner in which the debt limit was implemented. As part of last year’s budget agreement, even if Congress decided to vote against the debt increase, the President has the power to issue a veto. In other words, the debt increase is a done deal – no debate, no discussion.

Massive deficit spending by the U.S. government was supposed to stimulate growth and bring us out of recession as it has in previous economic downturns. This time, it’s simply not working and the debt levels have reached a tipping point at which economic growth slows as debt increases.

An impressive body of research covering eight centuries of government debt defaults (“This Time Is Different” by Carmen Reinhart and Kenneth Rogoff) resulted in ominously accurate predictions since its publication in 2009. The collapse of the real estate bubble lead to a collapse of the banking industry which lead to massive government borrowings to bail failed banks and other institutions.

According to Reinhart and Rogoff, a slowdown in the economy leads to further government deficit spending which ultimately puts the solvency of sovereign governments into doubt, which is exactly what’s currently happening across Europe.

Meanwhile, as the U.S. approaches its own tipping point towards insolvency, Americans remain remarkably obliviously to the dangers of mortgaging our future.

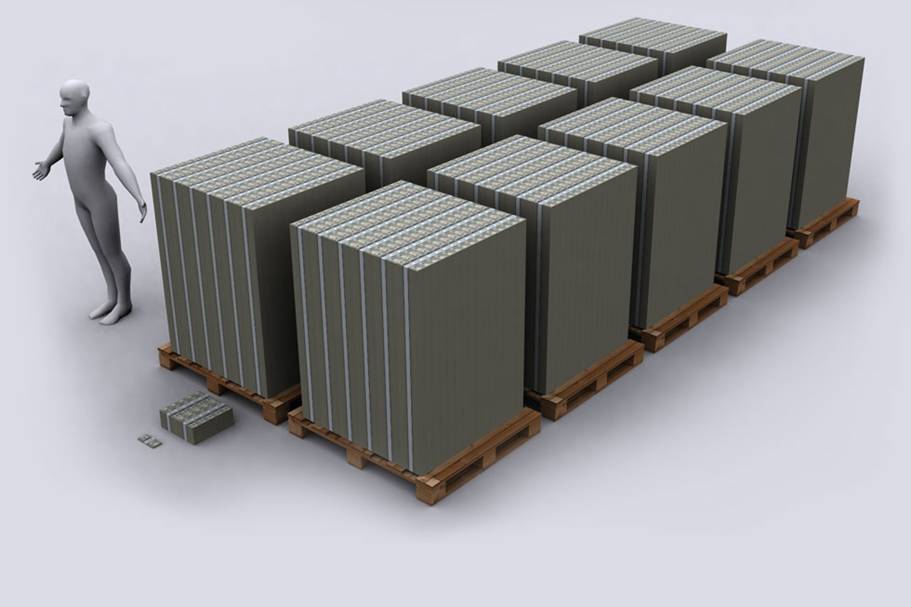

How much is a trillion dollars of debt? The number is so large that it is inconceivable for the average American to understand. Deep down, the country has a foreboding of impending disaster from our crushing debt burden, but remains oblivious as to the real extent of the problem.

Here’s a visual to put things into perspective.

One Hundred Dollars $100 – Most counterfeited money denomination in the world.

Keeps the world moving.

One Billion Dollars $1,000,000,000 – You will need some help when robbing the bank.

Now we are getting serious!

One Trillion Dollars $1,000,000,000,000

When the U.S government speaks about a 1.7 trillion deficit – this is the volumes of cash the U.S. Government borrowed in 2010 to run itself.

Keep in mind it is double stacked pallets of $100 million dollars each, full of $100 dollar bills. You are going to need a lot of trucks to freight this around.If you spent $1 million a day since Jesus was born, you would have not spent $1 trillion by now…but ~$700 billion- same amount the banks got during bailout.

15 Trillion Dollars – US GDP 2011 & Debt $15,064,816,000,000- The U.S. GDP in 2011. The debt as of Jan 1st, 2012 is 15,170,600,000,000. United States now owes more money than its yearly production (GDP).

Statue of Liberty seems rather worried as United States national debt soon to pass 20% of the entire world’s combined GDP (Gross Domestic Product).

114.5 Trillion Dollars $114,500,000,000,000. – US unfunded liabilities

To the right you can see the pillar of cold hard $100 bills that dwarfs the

WTC & Empire State Building – both at one point world’s tallest buildings.

If you look carefully you can see the Statue of Liberty.The 114.5 Trillion dollar super-skyscraper is the amount of money the U.S. Government

knows it does not have to fully fund the Medicare, Medicare Prescription Drug Program,

Social Security, Military and civil servant pensions. It is the money USA knows it will not

have to pay all its bills.

If you live in USA this is also your personal credit card bill; you are responsible along with

everyone else to pay this back. The citizens of USA created the U.S. Government to serve

them, this is what the U.S. Government has done while serving The People.The unfunded liability is calculated on current tax and funding inputs, and future demographic

shifts in US Population.Note: On the above 114.5T image the size of the base of the money pile is half a trillion, not 1T as on 15T image.

The height is double. This was done to reflect the base of Empire State and WTC more closely.