US Bancorp (USB) is still profitably while other banks can’t find enough zeros to put after their losses. In the latest quarter ending September 30, 2008, USB’s net earnings declined by 48% to $576 million due mainly to an increase in provision for credit losses of $549 million in the quarter. The increase in the provision for credit losses for the 9 months ending 9/30/2008 increased dramatically also, by $1.3 billion. Nonetheless, even after these large increases for bad debts USB was still able to show a very respectable 9 month net income of $2.6 billion (down 23%). A large reduction in their interest expense of $1.1 billion due to lower funding costs helped results considerably.

USB is a highly regarded well run institution still profitable and well capitalized despite horrendous losses by the banking industry in general. Warren Buffet through Berkshire Hathaway owns over 4% of the company and other institutional investors own approximately 60% of the shares outstanding. Of 22 analysts covering USB, there are 4 strong buys, 1 sell and the rest mainly hold.

USB pays a generous dividend of $1.70 yielding almost 8% at the current price although this is unlikely to be maintained since the payout is 100% of earnings. If earnings continue to drop the dividend would probably be cut. USB is borrowing $6.6 billion under the TARP program via a preferred stock sale. USB is a non agency lender, retaining many of its mortgages.

USB’s portfolio is not heavily weighted to any particular lending sector, being spread geographically and across a broad spectrum of borrowers. The short position on the stock is only 2% of the float. In the last 12 months, of 71 insider trades there were 51 sells and 20 buys.

Level 2 assets as of 9/30/2008 totaled $41 billion and Level 3 assets totaled $3.7 billion, for a combined 214% of total equity, a potential source of earnings trouble depending on what mark to market rules ultimately apply and whether the credit quality of these assets deteriorate. (Level 2 assets are not actively traded but priced on what similar securities are valued at; Level 3 assets are “model derived” using best guess estimates to determine value.) As of 9/30/2008, USB had a derivatives position of total notional amount of $52 billion; the company states that it does not use derivatives for speculative purposes.

USB apparently is in a very strong position to lend and gain market share while its competitor banks struggle to stay alive. With other banks reportedly reluctant to lend, it would seem that USB could cherry pick its customers, lending only to the best credits at a properly risk adjusted rate. With this in mind, I spoke recently to some mortgage companies that broker loans to USB and reviewed some wholesale rate sheets that USB distributes to its broker network. The following items are noted:

USB has a wholesale operation that aggressively recruits mortgage companies. Many other banks have terminated their wholesale side of the business due to volume declines industry wide and also due to the questionable quality of brokered loans. This gives USB the opportunity to pick up a lot of new business if they can effectively monitor the various brokers that they deal with. The word on the street as I hear it is that USB is the most aggressive lender out there and if you have a deal you can’t get done, you try USB.

USB allows debt ratios of up to 50% on a first position fixed rate loan and 45% on a first/second purchase with a FICO score over 680, subject to disposable income limits. For a score of 650-679 a more reasonable debt ratio cap of 35% is imposed. A debt ratio over 35% is neither “affordable nor sustainable” as I have detailed in past discussions. The FDIC has recently proposed that mortgage borrowers in default have their loans modified so that the debt ratios of the mortgage payments do not exceed 31% of income. There is a big difference between front end and back end debt ratios, but USB’s allowed debt ratios are aggressive lending standards under any circumstances.

No reserves are required for many of the USB loans. This means you can have a borrower purchase or refinance a home with zero in savings to fall back on should unexpected expenses occur. With a high debt ratio on top of no savings, this is a recipe for disaster for many homeowners.

USB has a very aggressive jumbo (over agency loan limits) loan program. Some features as highlighted in their wholesale rate sheets are quoted, as follows:

-interest only to 80% loan to value; competition offers only 65% loan to value limit

-full 80% for cash out -competition allows only 70%

-no hits for cash out refinance – competition does not allow this or charges a rate adder or fee

-revolving debt (credit cards, etc) can be paid with cash out proceeds to qualify-competition does not allow. (Credit card debt paid off with a refinance can be easily run up again causing payments to become unmanageable.)

-only 36 months out of bankruptcy allowed – competition requires 5 – 7 years.

The Wall Street Journal reports that USB had the greatest increase in loan volume, a whopping 35%, among midsized lenders, beating out BB&T and Flagstar Bank. The reasons given by the Journal for the very large loan increase are different from mine as noted above. Typically, the most aggressive lenders fund the most loans.

USB recently acquired failed $13 billion asset Downey Savings Bank in an FDIC arranged takeover. Downey had a significant presence in California and Arizona. USB agreed to accept the first $1.5 billion in losses on Downey’s portfolio; losses in excess of this amount are subject to a loss sharing agreement.

Downey was one of the biggest pay option arm lenders, which allowed borrowers to pay only a small portion of the interest actually accruing on a mortgage, thus resulting in negative amortization. With the severe property declines in CA and AZ, many of these loans now greatly exceed the value of the mortgaged property. In addition, many of the pay option arms allowed “stated income”. 80% of pay option arm holders pay the minimum payment each monthly and took out this type of loan because it was the only way they could afford the loan payments. USB may find that the lossses on the Downey pay option arm portfolio vastly exceed any estimates they might have made, once they establish the borrowers’ true income and property value.

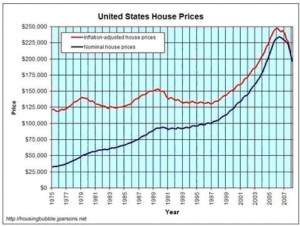

USB’s aggressive lending and acquisition of Downey may put them in an exceptionally profitable position if the economy turns around quickly, companies start hiring again and the residential property markets quickly recover. If you believe in regression to the means, however, and that bubbles that burst wind up either at the level where they first started or lower, consider the chart on US home prices below. Home values may still have much further to fall which would cause great distress to USB’s mortgage portfolio and ultimately their income statement.