K-Ratio Predicts Higher Gold Stock Prices

Based on the recent large rally in the gold stocks, it is time to sell and take profits? The K-Ratio, a time tested method for timing the purchase and sale of gold stocks is telling us to stay long gold.

The K-Ratio is computed by dividing the value of Barron’s Gold Mining Index (GMI) by the Handy and Harmon price of gold. The index reflects the relative value of the price of gold stocks to the price of the underlying metal. When the ratio of the price of gold stocks to the price of gold is low, it is a bullish signal. Conversely, if the price ratio of the gold stocks relative to the metal is excessive, it is usually a good signal to sell the gold stocks.

The K-Ratio works best at extremes. The rule of thumb based on past history tells us that a K-Ratio at 1.20 or lower indicates that gold is cheap compared to the price of bullion. A K-Ratio reading of 1.90 or higher is extremely bearish and indicates extreme overvaluation of the gold stocks.

Bullish On Gold Stocks

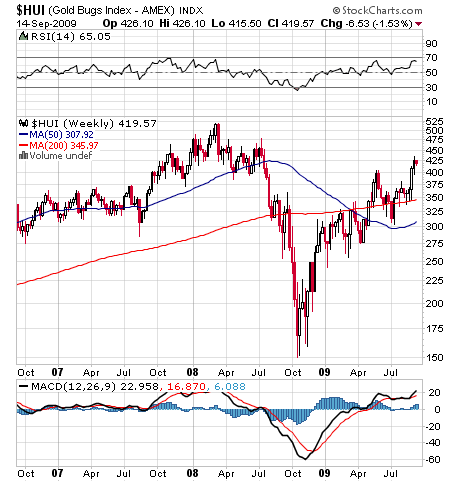

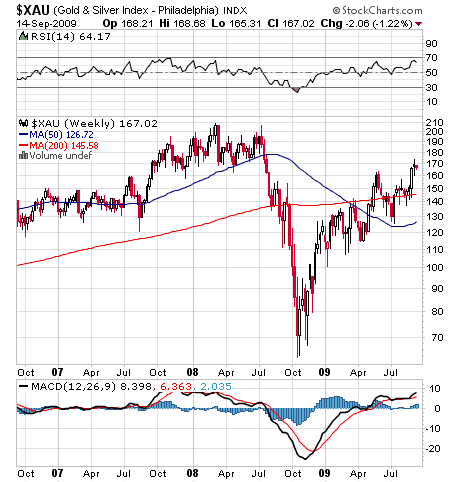

When last reviewed on April 24, 2009, the K-Ratio was at .90 and flashing a major buy signal. Since that time, the Gold Bugs Index (^HUI) has advanced by 39%. What should be of extreme interest to gold stock investors at this point is that, despite the large gains in the gold stocks, the K-Ratio has increased only modestly and presently stands at 1.15, still in solidly bullish territory. (K-Ratio = Barron’s Gold Mining Index of 1159.20 divided by the Handy & Harmon Gold Price of $1008.25).

Since 1975, readings at or below 1.15 on the K-Ratio have resulted in gold stock gains 90% of the time over the next 12 months with the average gain a very profitable 40%.

There are no absolutes in investing and gold stocks are likely to fluctuate, but based on the time tested K-Ratio, it is way too early to be taking profits in the gold stocks.

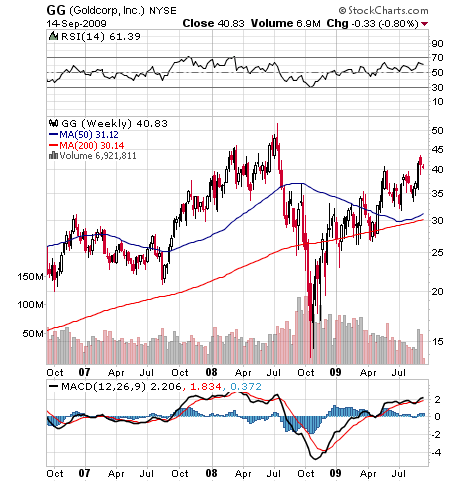

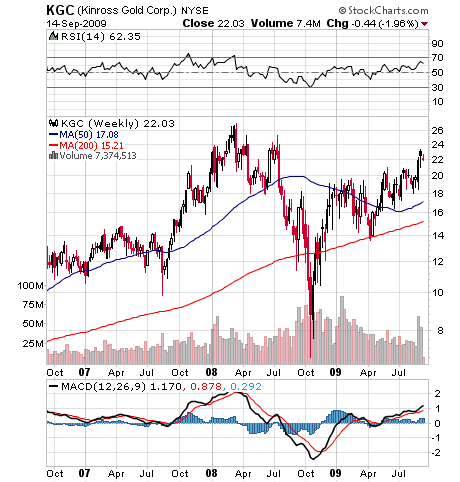

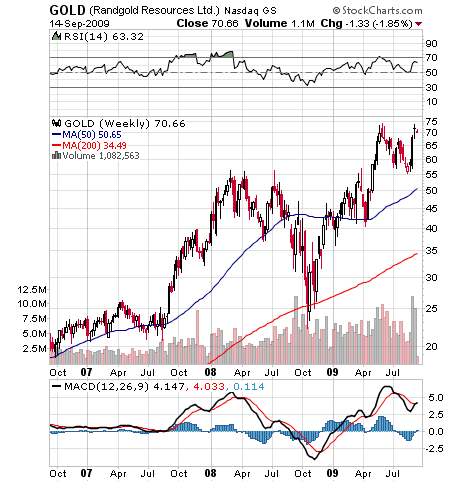

Disclosures: Long GOLD, KGC, GG

UPDATE: FEBRUARY 14, 2010

The K-Ratio is still flashing bullish at 1.03. As is typical when the bullion price retreats, the gold stocks react in a more volatile manner, resulting in greater price declines in the gold stocks than in the price of the bullion. From the recent high in late 2009, the price of gold bullion has retreated by 11%, while the price of major gold stocks such as Goldcorp (GG) and Randgold (GOLD) are down by 20%. Accumulation of gold shares still seems warranted based on technical and fundamental factors.