K-Ratio Flashing Major Buy Signal

The increase in gold prices over the last five years has outperformed virtually every other asset class. From the low $400 range in 2005, gold has soared almost 300% to over $1200 per ounce.

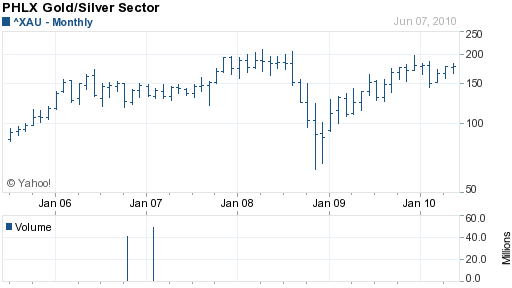

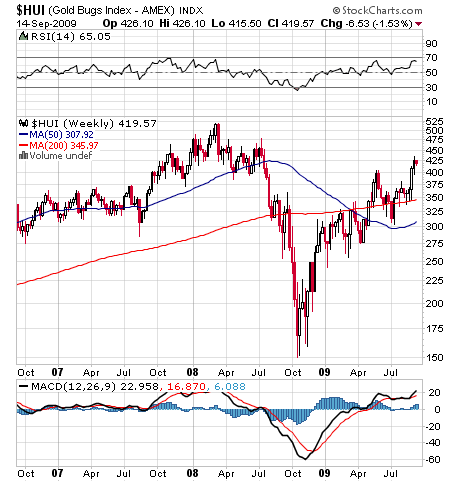

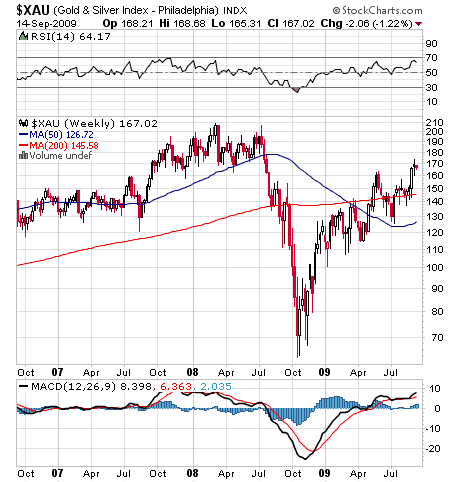

Although many gold stocks have seen substantial gains since 2005, the overall price gains of gold stocks has underperformed the price appreciation of the metal as can be seen by viewing the PHLX Gold&Silver Index, comprised of 16 major gold and silver producers. While the price of gold has appreciated almost 200%, the XAU has lagged considerably with a gain of 96%.

While the reasons for the price disconnect between gold and individual gold stocks are in many cases company specific, the question on most investors minds is where do we go from here? Will the large increase in gold prices eventually translate into major gains for the gold producing stocks? The emphatic prediction, according to the K-Ratio, a time tested method for timing the purchase of gold stocks, is telling us to stay long and accumulate gold stocks.

The K-Ratio is computed by dividing the value of Barron’s Gold Mining Index (GMI) by the Handy and Harmon price of gold. The index reflects the relative value of the price of gold stocks to the price of the underlying metal. When the ratio of the price of gold stocks to the price of gold is low, it is a bullish signal. Conversely, if the price ratio of the gold stocks relative to the metal is excessive, it is usually a good signal to sell the gold stocks.

The K-Ratio works best at extremes. The rule of thumb based on past history tells us that a K-Ratio at 1.20 or lower indicates that gold is cheap compared to the price of bullion. A K-Ratio reading of 1.90 or higher is extremely bearish and indicates extreme overvaluation of the gold stocks.

The latest weekly reading on the K-Ratio shows a very bullish reading of .96 (Barron’s Gold Mining Index of 1158.99 divided by the Handy and Harmon Gold Price of $1203.50). Since 1975, readings at or below 1.15 on the K-Ratio have resulted in gold stock gains 90% of the time over the next 12 months with an average gain of 40%. Lending anecdotal support to a large rally in the gold stocks is the overwhelming number of bearish articles on gold by the mainstream press. From a fundamental perspective, of course, it does not hurt that logical minds are beginning to question the value of paper currencies of numerous sovereign nations.

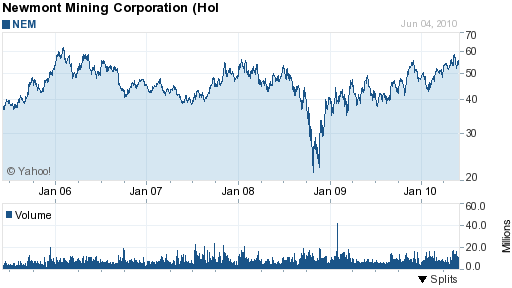

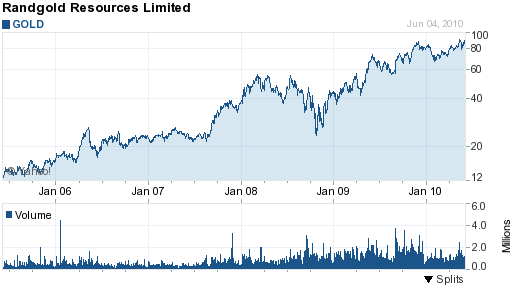

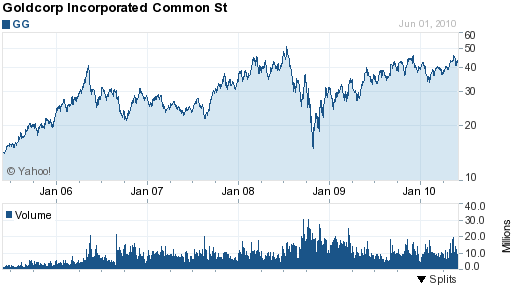

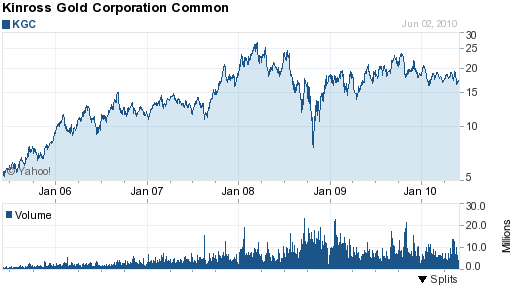

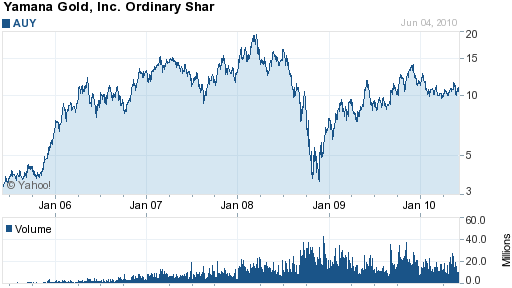

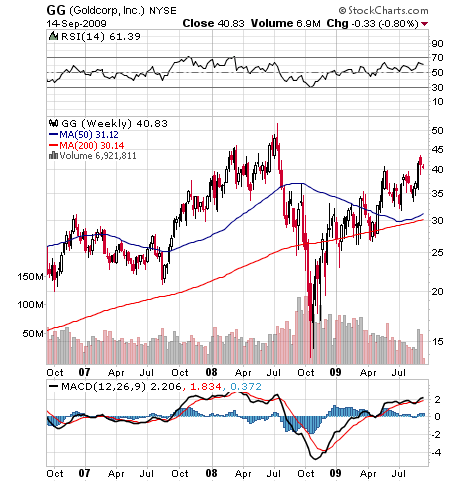

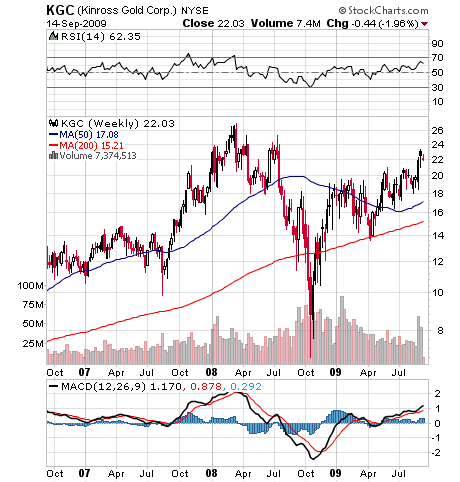

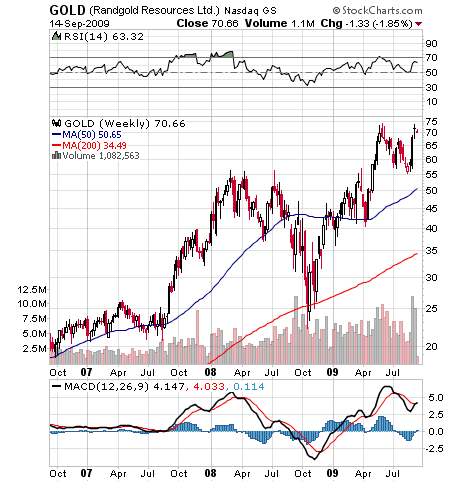

Accumulation of high quality gold stocks such as NEM, GOLD, GG, KGC and AUY seems warranted, especially on price pullbacks. Based on the technical and fundamental factors, the bull market in gold stocks has a long way to run.

Disclosures: Long NEM, GOLD, GG, KGC, AUY