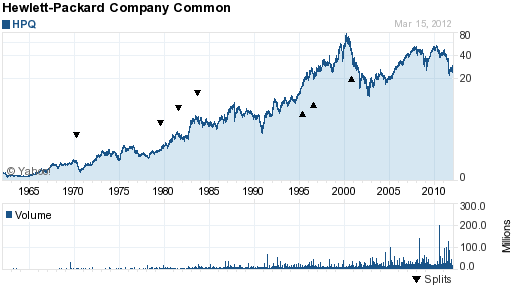

Hewlett-Packard Company (HPQ), one of the greatest success stories of American enterprise, seems to have lost its magic. Superb management and great products resulted in HPQ’s stock rising relentlessly from the mid 1960’s through early 2000 when the stock traded in the $70 range. After 12 long years, HPQ’s stock trades for a third of its value, closing today at $23.46.

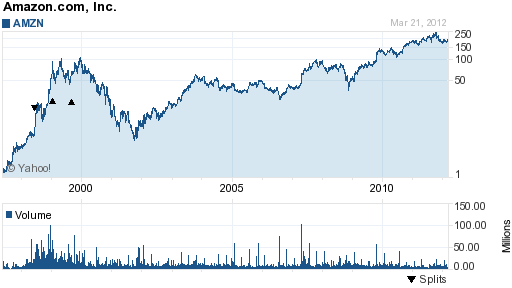

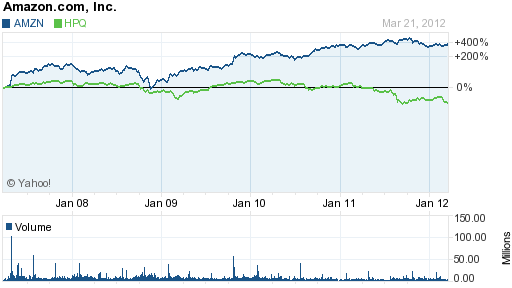

Meanwhile, Amazon (AMZN), under the brilliant leadership of Jeffrey Bezos, has seen its stock price almost double since 2000. Over the past five years, Amazon’s stock price has risen by 380% while Hewlett-Packard’s has declined by 42%.

The rise of Amazon and the fall of Hewlett-Packard involve many complex factors, but one critical area where Amazon absolutely scorches Hewlett-Packard is in customer fulfillment, an essential aspect of e-commerce.

Two years ago I purchased a Hewlett-Packard laptop on which the battery suddenly went dead. How hard can it be to order a replacement battery for a HP computer from the HP website? Harder than you can imagine. Here are the results after typing in the information on my computer into the HP search box.

Search HP

Numerous other queries brought up useless information and links to unrelated topics. Should it be that difficult and annoying to purchase a replacement battery for an HP computer from the HP website?

On the Amazon website, the query “replacement battery for model dv4-2145dx” instantly brought up 2 pages of results for the exact item I needed. Ordering the product took less than 60 seconds and a scheduled delivery time of two days.