Are The Banks Paying Back TARP Money Too Soon?

Since the beginning of the year, major banks have raised over $200 billion in capital, far in excess of the $75 billion of new capital that the government stress tests had called for. The market prices of major bank stocks have recovered dramatically since March, indicating that Wall Street investors see a recovery in the banking industry.

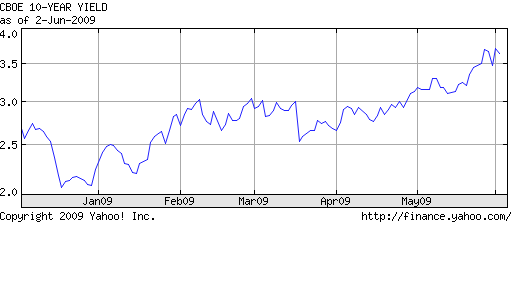

In addition, the banking industry is enjoying one of the largest net interest margins in history due to a very low cost of funds. Wells Fargo, for example, in the fourth quarter saw its average cost of funds decline to 1.5% while its net interest margin exceeded 4%. With banks able to access cheap funding thanks to the super low rate money policy of the Federal Reserve, banks almost have a license to print money.

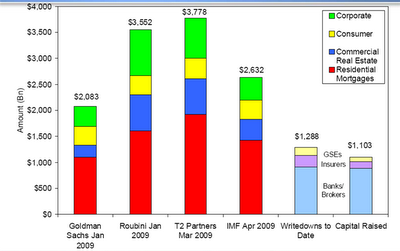

The big question is will the banks be able to earn enough to offset the huge amount of future write downs that will be needed on their troubled loans? Earlier this year, Bloomberg reported that the International Monetary Fund (IMF) estimated U.S. banking losses through 2010 at $1.06 trillion. To date the banking industry has taken write downs of only half that amount, indicating further write downs of an additional $500 billion will be necessary.

In addition, delinquency rates on $1 trillion of commercial real estate loans held by banks have been increasing at a higher rate than anticipated. Credit card losses for the banks have also been rapidly mounting from previous estimates.

Mortgage Default Surge Could Wipe Out Banking Capital

Total Estimated Losses

Courtesy: T2 Partners LLC

The banking industry’s mortgage portfolio is the real wild card and may result in the need for huge additional write downs to cover the cost of mounting defaults. The banking industry is facing a potential nightmare surge in mortgage loan defaults, even if real estate prices stabilize at current levels due to the large negative equity positions of many homeowners. (The above chart shows the total estimated banking losses of which only a fraction has been realized to date.)

There is no historical model to predict the correlation of mortgage defaults to equity position, but one would expect that being deeply underwater on the mortgage will result in a strong economic motive to stop paying or simply walk away. How many homeowners, for example, will continue to make a mortgage payment on a $200,000 mortgage when the home is valued at $100,000? The greater the negative equity, the greater the odds of a mortgage default, especially if the homeowner is under financial stress.

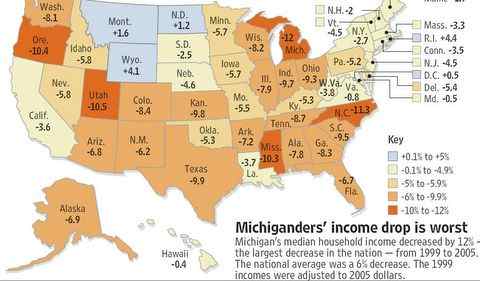

Unfortunately, the problem of negative equity is not theoretical. In the latest overview of housing and the credit crisis, T2 Partners LLC, has assembled an in depth excellently documented case on why the pain in housing is not about to end quickly. One eye opener in the report is the estimate, by type of mortgage borrower, of negative equity. T2 shows the following stats: 73% of OptionARMs, 50% of subprime , 45% of Alt A and 25% of prime mortgage loans are underwater. Combine this with a weak economy, job losses and negative income growth and the potential for additional huge write downs on residential mortgages seems inevitable.

The impact of a poor economy and huge negative equity is already being reflected in default rates never experienced in modern economic history. Almost 10% of all mortgages are in some stage of delinquency or default. The delinquency rate on prime mortgages, never expected to exceed historical delinquency rates of approximately 1%, are now over 4.5%. Note that prime mortgage loans are the loans that were never expected to have more than a minimal default rate based on the borrower’s credit and income characteristics.

The banking industry is likely to need every dollar of newly raised capital and then some to cover future loan losses. If future banking industry profits are overwhelmed by additional loan losses, it will be years before banks can be solidly classified as well capitalized. A capital constrained banking industry will survive in some form, but it may not be able to provide the new lending necessary to foster future economic growth

One of the consequences of a recession is a decline in demand for newly minted coins. Economic activity declines and there is less demand for coins in commerce. Individuals also put long hoarded change back into circulation. Coins come out of hiding from couch cushions, penny jars, and abandoned State Quarter collections. The net result is a drop in the number of new coins produced.

One of the consequences of a recession is a decline in demand for newly minted coins. Economic activity declines and there is less demand for coins in commerce. Individuals also put long hoarded change back into circulation. Coins come out of hiding from couch cushions, penny jars, and abandoned State Quarter collections. The net result is a drop in the number of new coins produced.