Reverse Mortgages – More Easy Lending

As originally conceived, reverse mortgages were designed to fulfill a legitimate borrowing need. Reverse mortgages were developed for elderly Americans who had a mortgage free home with substantial equity and wanted to cash out their home equity to supplement their retirement income without having to sell the house or face large mortgage payments.

Almost all reverse mortgages are purchased by HUD and insured by the Federal Housing Administration (FHA). FHA insured reverse mortgages are known as “home equity conversion mortgages” (HECM) and they provide the following advantages to elderly homeowners:

- Provides supplemental cash income to elderly homeowners.

- Does not require a monthly payment.

- Allows the homeowner to remain in his residence until death or sale of the property.

- Should the borrower decide to sell and move, the amount of the loan repayment cannot exceed the value of the house.

- HECM allows the borrower either a monthly lifetime payment (based on value of the home and age at time of mortgage closing) , a lump sum payment, a line of credit or a combination of the above choices.

In theory, the HECM made sense by allowing homeowners to remain in their homes and monetize their equity. The lifetime HECM payment, along with other retirement income and savings would allow for a more comfortable lifestyle. The only theoretical loser on the HECM program would be the FHA if property values dropped.

HECM Program – Theory VS Reality

The disadvantages for a borrower of a reverse mortgage are as follows:

HECM rules require a borrower to make a full draw at closing to obtain a fixed rate mortgage. Most borrowers take the adjustable rate option and a line of credit. The adjustable rate HECM presently has a low borrower rate of around 3.1% based on a lending margin of 2.75% and a LIBOR index of only .32%. At some point rates will rise again and rates on the HECM could rise dramatically – the lifetime cap on the loan is over 13%. Borrowers could see their credit lines reduced and their equity vanish quickly with higher interest rates.

Borrowing money without having to make a loan payment equates to compounding interest working against the borrower since the loan balance increases each month along with interest charges. Borrowers who later decide to pay off the HECM and sell their homes may find that most of their equity has been lost due to accrued interest.

The HECM is a very complex product. Despite the fact that HUD requires a potential borrower to receive financial counseling, it is unlikely that most borrowers fully understand the type of mortgage they are taking out.

The HECM is available to all those 62 or older who have sufficient equity in their homes. HECM program lends without regard to credit or income and is strictly asset based lending. Do these lending criteria remind anyone of past disastrous mortgage programs, such as sub prime, ALT A or Pay Option ARMs??

The fees on a HECM are very high and include an upfront and monthly mortgage insurance payment to the FHA, loan origination fees and other closing fees. Total fees over the life of the loan can reach 12%.

A HECM does not require that the homeowner escrow for taxes or homeowners insurance. A known risk factor for default is a non escrowed loan. The homeowner can face foreclosure for not properly maintaining the property or for non payment of taxes or insurance.

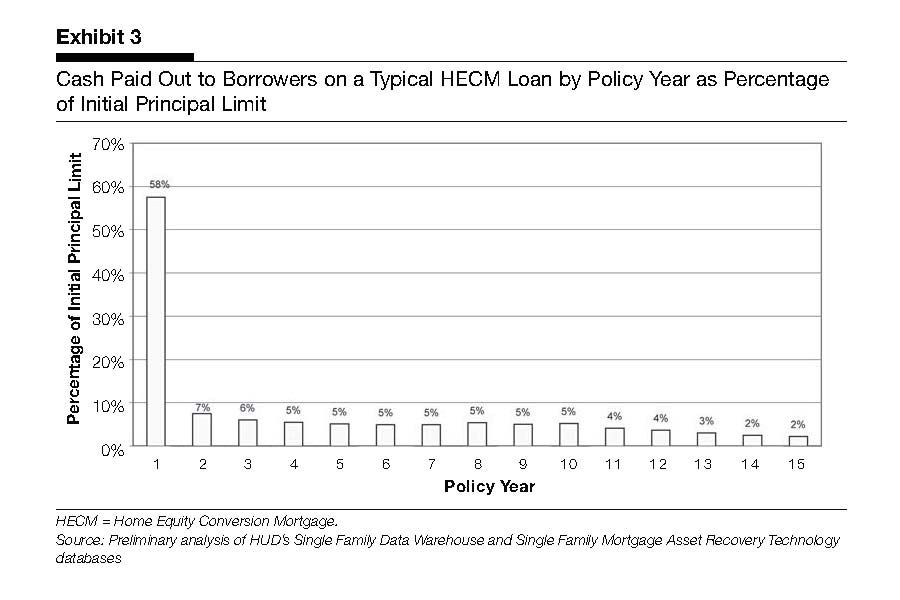

The most striking feature regarding the use of reverse mortgages by elderly Americans is the large amount of equity that is being extracted upfront, leaving them with only a small future monthly cash payment as can be seen in Exhibit 3 below.

HECM CASH PAY BY YEAR

Courtesy: HUD.GOV

The reason why borrowers are taking most of their available cash out upfront is because they are using the proceeds to pay off mortgages, consumer debt, medical bills, credit cards, etc. Borrowers run up large amounts of debt when spending exceeds income, a situation likely to continue after the borrower taps the last dime of equity from his home. Since the HECM was the last option available, what happens in a couple of years when the borrower is again overwhelmed by debt?

HECM – Loan Of Last Resort

The number of reverse mortgages has increased tremendously as other borrowing sources have disappeared. Many of the reverse mortgage borrowers are retirees with limited income who would not qualify for a traditional mortgage loan under current underwriting guidelines. In the past, many of these borrowers would have taken out a stated or no income verification mortgage. The large increase of HECMs starting in 2005 correlates to the time period during which no income verification loans were being discontinued.

Reverse Mortgage Volume

Here’s an actual example of a HUD approved HECM. Borrower has a home worth $525,000 and owes $290,000 in mortgages and other debt which will be paid off with a $350,000 HECM. Homeowner is left with about $60,000 at closing. Borrower has an abysmal credit score of 510 and is 90 days past due on his current mortgage. Income is unknown since HUD doesn’t care about the borrowers income.

Based on the credit profile and debt levels incurred prior to his approval of a HECM, what are the odds that the borrower’s finances turn around after his refinance? My guess is that within a few short years, borrower is in heavy debt again, unable to pay the property taxes or maintenance on the property and thus facing a potential foreclosure. Since HUD will not be throwing senior citizens out of their homes, expect a mortgage modification program for reverse mortgages and further losses to the taxpayer on another mortgage program gone bad.

Smarter planning would probably eliminate the need to borrow when retiring. Bob Adams writes an informative and thoughtful blog on the challenges of successful retirement – a site worth bookmarking.

FHA Bailout Appears Likely

FHA Bailout Appears Likely