Pump and Dump

According to the SEC website, a pump and dump scheme is one of the most common investment frauds and works as follows:

First, there’s the glowing press release about a company, usually on its financial health or some new product or innovation. Then, newsletters that purport to offer unbiased recommendations may suddenly tout the company as the latest “hot” stock. Messages in chat rooms and bulletin board postings may urge you to buy the stock quickly or to sell before the price goes down. Or you may even hear the company mentioned by a radio or TV analyst.

Unsuspecting investors then purchase the stock in droves, pumping up the price. But when the fraudsters behind the scheme sell their shares at the peak and stop hyping the stock, the price plummets, and innocent investors lose their money.

If all of this sounds familiar it should, since we have probably just witnessed one of the biggest pump and dump schemes ever perpetrated at the expense of witless bank share investors.

Consider the scenario: The Pump

Early this year, the financial system is in a panic as banks announce ever greater losses and talk of nationalizing the banking system is rampant. Public officials fear a full blown banking collapse if worried depositors start a run on the banks. Public opposition to bank bailouts is intense.

To stop the growing banking panic, the Fed and Treasury announce that the major banks are too large to fail and will not be allowed to collapse.

An easy to pass “stress test” of the biggest banks is announced to prove to the public that the banking industry is sound.

After a cursory examination of the largest banks, they all pass and are told to raise additional capital just to be on the safe side.

Investors start to buy the bank stocks en masse causing many bank stock shares to double and triple in price.

Over $200 billion in new capital is obtained from investors eager to get in at depressed prices.

Treasury Secretary Geithner states that “this transparent, conservatively designed test should result in a more efficient, stronger banking system”.

Witless commentators at CNBC pile on with predictions that the banks will soon be earning billions in profits.

No less a luminary than Warren Buffet adds to the buying panic by stating that he would put his entire net worth into Wells Fargo.

Potentially catastrophic losses on derivatives, commercial real estate, mortgages, off balance sheet assets and credit cards are swept under the rug as frenzied investors pile into a sure thing.

The Dump

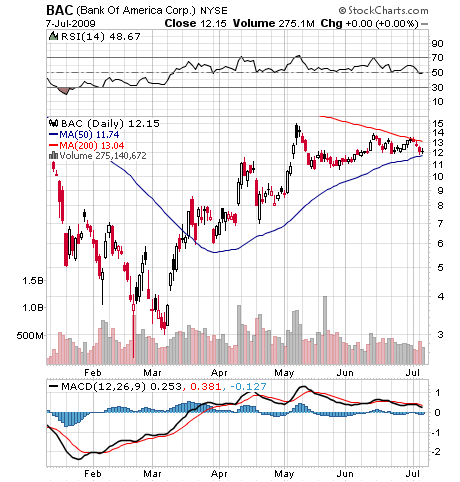

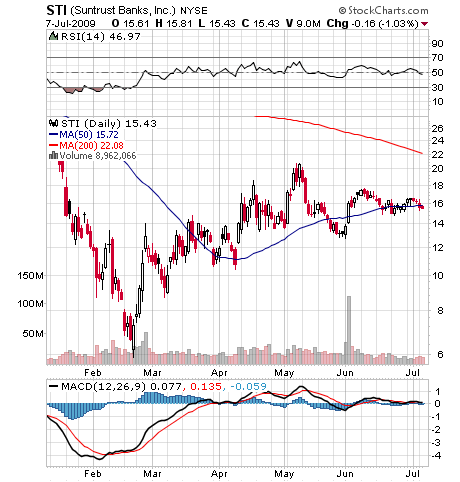

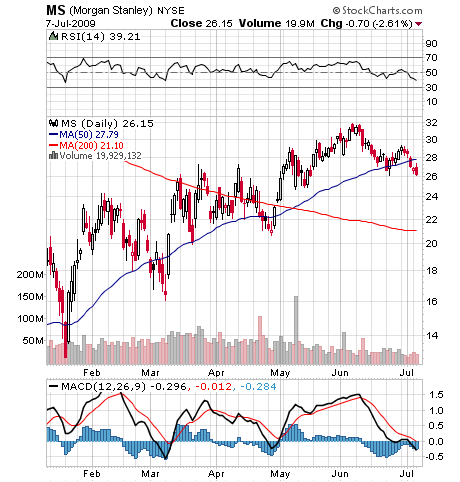

Now, however, Geithner’s brilliant scheme seems to be entering the “dump” phase where “prices plummet and innocent investors lose their money”. Consider the recent price action in major bank stocks:

Most of the bank stocks peaked during May and have already declined substantially or appear to be in a distribution phase. Nervous investors are considering the latest horrendous employment numbers and increasing defaults in virtually every major loan category. There’s no harm in jumping into a pump and dump scheme early on for some quick gains. It just might now be the time to jump back out.

Disclosures: None