Sometimes, the simplest investment strategy is the best.

The simple “Dogs of the Dow” investment strategy mechanically selects the 10 highest yielding Dow stocks at the end of each year. The selection is made without regard to fundamental analysis of dividend sustainability or financial strength. Investment dollars are equally allocated, resulting in an equal dollar investment in each of the 10 Dogs of the Dow.

The “Dogs of the Dow” investment strategy was popularized in 1991 by Michael O’Higgins in his best selling book, Beating the Dow. Due to the popularity of the book, Mr. O’Higgins was credited by the news media with “inventing” the Dogs of the Dow. The average investor found the “Dogs of the Dow” strategy compelling based on its simplicity and superior investment results. According to Mr. O’Higgins, the average annual returns over a 17 year period for the Dogs of the Dow was 17.9% compared to a return of only 11.1% for investing in the entire 30 Dow stocks.

There is an intuitive appeal for the Dogs of the Dow strategy. Dow stocks are usually large blue chip companies that have withstood the test of time. Occasionally, even the best run companies with superior management and products can encounter problems that result in a declining stock price. Assuming that the company has the financial strength to maintain its dividend, buying the highest yielding Dow stocks puts an investor into the companies most likely to experience large price gains as business conditions improve.

There is no such thing as a perfect investment strategy. The Dogs of the Dow can produce years of sub par returns. For example, during the three year period from 2007 through 2009, the Dogs of the Dow underperformed the Dow Jones by 7.8%, 8.1% and 5.9%, respectively. As previously mentioned, the Dogs of the Dow strategy does not analyze the financial strength of the various Dow stocks. Most of the under performance of the Dogs from 2007 to 2009 was due to the the collapse of financial stocks in the Dow Jones, including Citigroup (C), Bank of America (BAC) and JP Morgan Chase (JPM).

In 2010, the Dogs of the Dow had a total return including dividends of 21% versus a return of 14% for the entire Dow 30 stocks. This out performance in 2010 almost exactly matches the 6.8% superior return for the Dogs of the Dow cited in Michael O’Higgins book Beating the Dow.

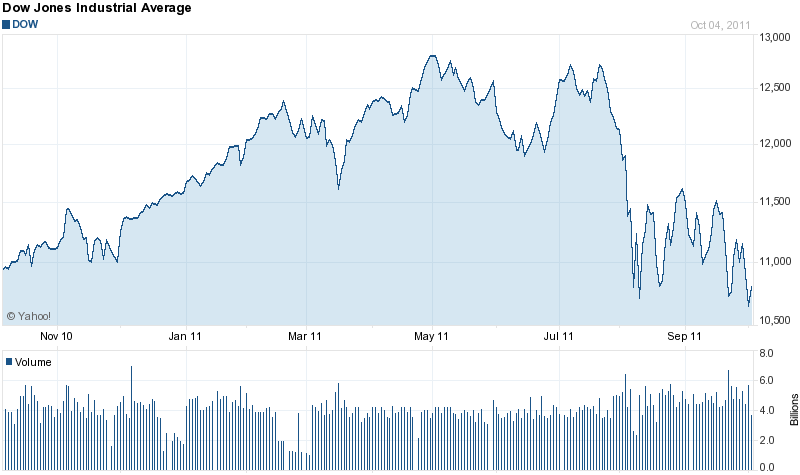

The investment performance of the Dogs of the Dow through September 30, 2011 indicates that the Dogs may again outperform the overall Dow in 2011. As of September 30, 2011, the Dow Jones was down by 5.72% or -644 points while the Dogs of the Dow were down a mere 1.4%. In addition, the nine month return from dividends on the Dogs of the Dow stocks amounted to 3.15%, resulting in an overall gain of 1.75%. During a time of zero returns on bank savings and, considering the huge overall sell off in the markets since July, the Dogs put in a respectable showing.

The chart below shows the 2011 results for the Dogs of the Dow through September 30. The largest loser was Dupont which lost 19.9% and the largest gainer was McDonalds which was up 14.4%. The current highest yielding stock is AT&T (T) at 6% and the lowest yielding stock is McDonalds (MCD) at 3.2%.

| DOW DOG STOCK | $PRICE 2010 | $PRICE | $DIVIDEND* | DIVIDEND | % YTD | |

| YEAR END | 30-Sep-11 | YIELD | CHANGE | |||

| ATT | 29.38 | 28.52 | 1.72 | 6.00% | -2.9 | |

| VERIZON | 35.78 | 36.80 | 2.00 | 5.40% | 2.8 | |

| MERCK | 36.04 | 32.70 | 1.52 | 4.64% | -9.3 | |

| PFIZER | 17.51 | 17.68 | 0.80 | 4.50% | 0.9 | |

| DUPONT | 49.88 | 39.97 | 1.64 | 4.10% | -19.9 | |

| INTEL | 21.03 | 21.34 | 0.84 | 3.90% | 1.5 | |

| JOHNSON & JOHNSON | 61.85 | 63.69 | 2.28 | 3.60% | 3.0 | |

| KRAFT FOODS | 31.51 | 33.58 | 1.16 | 3.50% | 6.6 | |

| CHEVRON | 91.25 | 92.59 | 3.12 | 3.40% | 1.5 | |

| MCDONALDS | 76.76 | 87.82 | 2.80 | 3.20% | 14.4 | |

| * FORWARD ANNUAL DIVIDEND | Data Source: Yahoo finance | |||||

Over the long term, the Dogs of the Dow have delivered documented superior returns.

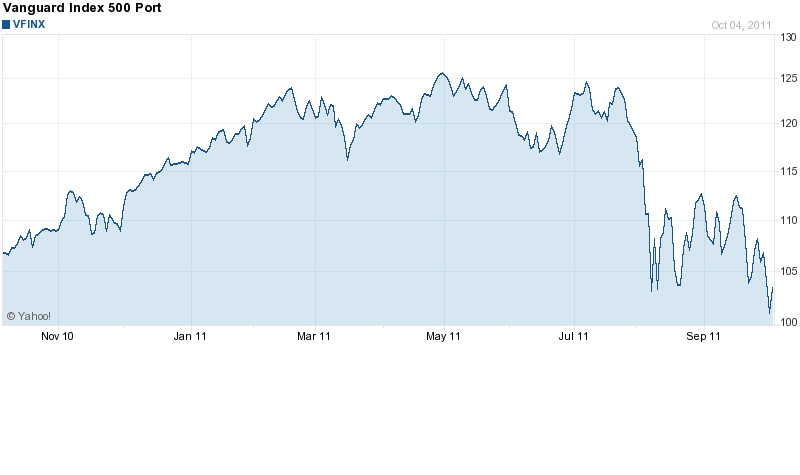

One argument against the Dogs of the Dow strategy is that the portfolio lacks diversification and is therefore riskier. For example, many analysts recommend investing in a broadly diversified mutual fund such as the Vanguard 500 Index Fund which invests equally in the 500 different stocks in the Standard and Poors 500 index. How did that work out this year?

Dogs of the Dow followers, with their small 10 stock portfolio, are laughing all the way to the bank. The Vanguard S&P 500 Index fund (VFINX) is down a whopping 8.8% (including dividends) through September 30, 2011.