If everyone from the Fed Chairman on down to the average man in the street seems confused about how the economy is doing, well, it’s because they are. The economy is still in a recession, a depression or an emerging boom depending on who you listen to. Two recent news articles published days apart highlight the divergence of opinion on the state of economic affairs.

Consumer Confidence Revisits High Set in 2007

Americans are more confident about the economy than at any time since July 2007, a survey found, suggesting consumers will spend more and accelerate growth in the months ahead.

The University of Michigan said on Friday that its final reading of consumer sentiment in July was 85.1. That’s up one point from June and nearly 13 points higher than a year ago.

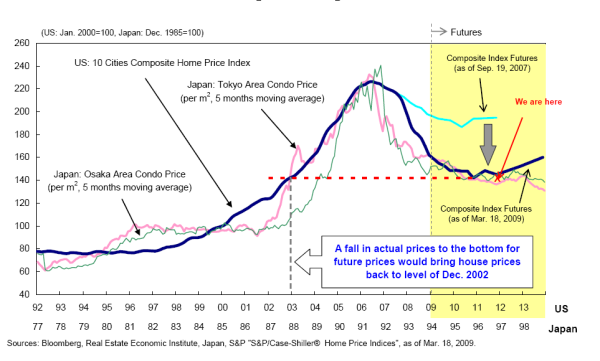

Rising home prices and steady job gains are bolstering household wealth and income. The proportion of Americans who expect their inflation-adjusted incomes to rise in the coming year is greater than at any time since late 2007, the survey found. And the percentage of Americans who say their home values have risen is also at a six-year high.

Majority of Americans Say U.S Still in Recession

The economy may be sputtering along. But it hasn’t been in recession for more than four years. More than half of Americans think it still is.

A majority of people — 54% — in a new McClatchy-Marist poll think the country is in an economic downturn, according to the survey conducted last week and released Tuesday.

The McClatchy-Marist poll found that Americans who earn less are more likely to think the economy is in a recession. Of those earning less than $50,000 a year, nearly two-thirds say the downturn is still underway. For those earning more than that, only 47% think so.

Is it any wonder that Bernanke swings from tapering to easing in the same week? The Federal Reserve, packed with PhD economists, seems as equally confused about the state of the economy as the average consumer.

After considering the divergent opinions, two general conclusions regarding the economy are possible here.

-Predicting the future is a fool’s game, and

-Consumers who have well-paying jobs, money in the bank and rising incomes are far more likely to be optimistic about the future than someone with no job and no money.