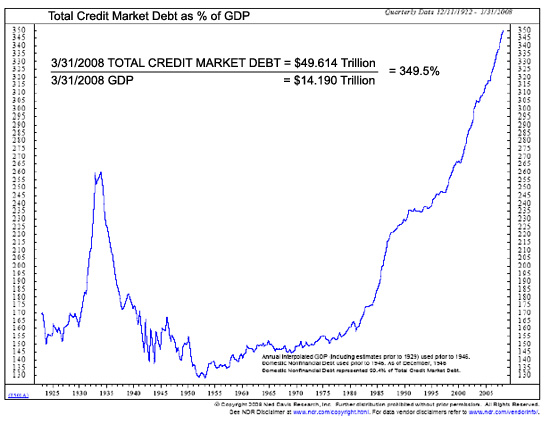

Fear and loss of confidence in our economic future due to over leverage can be seen in many areas. There have been many stories lately about individuals attempting to secure their future by burying cash in their backyards. Those of presumably greater means with the same idea have propelled safe manufacturers into one of the few industries showing sales growth today.

Burying cash is an old idea born of the depression years prior to the FDIC when if a bank went under you lost your money. Under the current Federal guarantee of bank deposits, the failure of a depositor to be made whole would be equivalent to a default by the Federal Treasury.

Those inclined to burying cash should ponder the baseball card craze of years past. Baseball card “investors” would fill their garages and basements with boxes of unopened cards and dream of the day when their value would skyrocket. The card sellers made money but the buyers failed to realize that the cards they were buying as collectibles were being produced in massive quantities, almost guaranteeing little scarcity value in the future. Paper cards could also be flawlessly produced in quantity by counterfeit card operators. While individually graded cards merited an investment consideration, holding boxful’s of ordinary cards did not seem wise.

The cash dollars of today are the baseball cards of yesterday. Dollars can be produced cheaply and in infinite quantities as deemed necessary by the Federal Reserve. There is a risk of buried cash being lost or stolen. There is no risk betting that the Government will print as many dollars as necessary should the downward economic spiral continue. As the Government assumes the massive losses of every more entities via bailouts, those still holding the cards may become the winners (from a value standpoint) over those holding dollars.

My viewpoint is that one asset class deemed worthy of investing in to preserve wealth is gold, as discussed in Gold, Cheap at $5,000?

Gold investors have been laughed at for years and there have been long periods of declines and/or under performance in price versus other asset classes. Gold, however, is the only monetary asset where the ultimate value of your investment is not subject to someone’s else’s promise or ability to pay. I view gold as the ultimate insurance hedge against a government’s propensity to spend itself into insolvency and, accordingly, I believe that gold should constitute 10 to 20% of one’s core investment assets. Historically, governments have regularly and repeatedly defaulted on their sovereign debts. In every such case of default, the citizens of those nations would have been far better off holding gold rather than government paper.