Congress Takes Bow For Credit Card Act of 2009

The Credit Card Act of 2009 was intended to curb certain practices of the credit card industry that were deemed abusive to consumers. With a great deal of public fanfare, Congress passed legislation that provided the following benefits to credit card holders:

- Credit card bills would be mailed at least 21 days before the payment due date

- Customers would be given a 45 day advance notice of contract changes

- An increase of the interest rate could be rejected by consumers who would then be required to cancel their card and pay off any existing balance within 5 years, possibly with a much higher minimum monthly payment

- Payments would have to be applied to that portion of debt with the highest interest rate

- Interest rates could not be raised on existing balances unless the borrower was more than 60 days delinquent

- Prohibited “universal default” provisions and double cycle billing

- Better disclosure of fees, card rules and interest costs

Senator Dodd of Connecticut, Chairman of the Senate Banking Committee, stated that “The new rules of the road established by the Credit Card Act will shield credit cardholders from widespread abusive practices”. Whether or not the Senator (who faced an ethics probe relating to the special low rate mortgage he received from Countrywide) actually succeeded in providing any real benefits to credit card holders remains questionable.

Credit Card Industry Response To Credit Card “Protection” Act

The credit card industry is not based on philanthropy – they seek profits and have been exceptionally proficient in doing so historically. Faced with huge losses from defaulting customers and the prospect of legislated profit limitations, the credit card industry reacted to these threats with the following changes:

- Reduced or eliminated fixed rate credit cards; when interest rates increase, card rates will increase commensurately

- Instituted annual fees, higher balance transfer fees, international transaction fees, higher cash advance fees, reduced award programs, slashed credit limits, canceled over $500 billion dollars in credit lines, summarily closed accounts deemed risky, raised monthly minimum payments and imposed strict standards for new credit cards

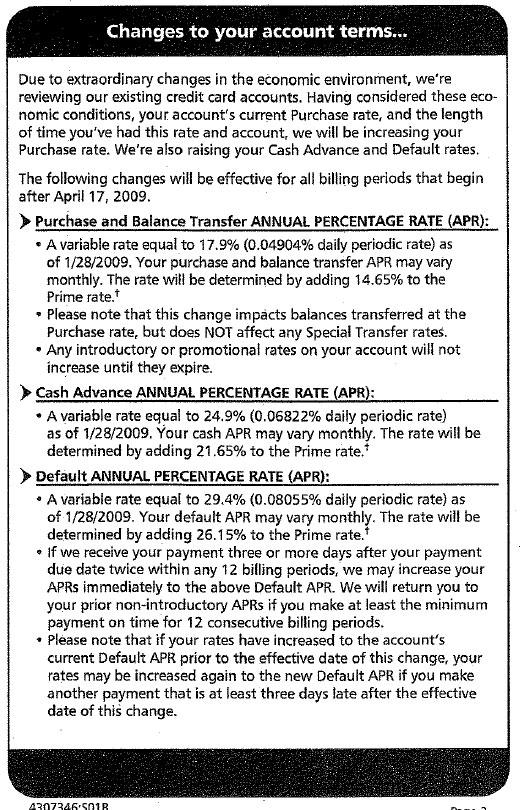

- Increased interest rates by as much as 10 percentage points or more across the board, regardless of credit or payment history. Unable to adequately assess risk or price accordingly, every credit card holder was assumed to be a potential default and charged accordingly – See Capital One Can’t Identify Their Low Risk Customers.

I have heard countless cases of people telling me that their card rates have been raised to 20% to 28% for purchases and cash advances. Personally speaking, virtually every credit card I have has had the interest rate increased substantially, with Capital One taking first prize by going from 8% to 17.9% on purchase balances.

Ironically, my General Motors credit card has actually dropped the interest rate from 14.15% in 2006 to a “low” 9.9% currently. I assume that the low rate from General Motors has something to do with the fact that GM has an unlimited credit line with the US Treasury and does not have to worry about silly things like making a profit.

Why The Credit Card Companies Are The Biggest Winners Under The Credit Card Act Of 2009

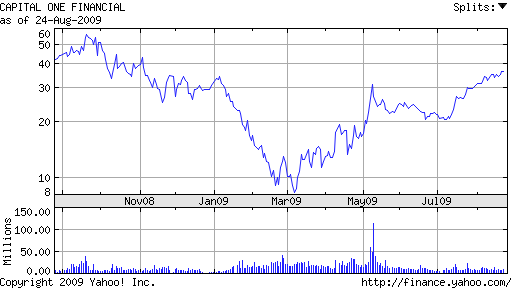

What was supposed to be a major consumer protection act has turned into a future profit bonanza for the credit card companies. Many credit card customers may go under financially but the credit card companies will do just fine, judging by the price performance of their shares and their actions taken cited above. The credit card industry has adjusted their business model to the new reality and will prosper.

While the S&P 500 has increased by 52% since March of this year, the stocks of credit card companies have performed dramatically better. Since March 2009 the stocks of companies such as American Express and Capital One have tripled in value even as write-offs of credit card debt hover in the 10% range and new restrictions on credit card companies become law.

“I Am From The Government And I Am Here To Help”

After bailing out the banking industry, our government (perhaps inadvertently) managed to provide even more help to the credit card industry. Thanks for trying to help Congress – I feel much better now that I am paying 18% instead of 8%.

COF

Disclosures: None