Fannie and Freddie Impose Huge Fees On Borrowers

Freddie Mac last week announced additional fees for condo owners who refinance, effective April 1, 2009. The fee mirrors a similar charge imposed by Fannie Mae last year. Both Fannie and Freddie now assess a wide variety of fees to borrowers based on loan to value, credit and type of loan. The fees are euphemistically referred to as “Postsettlement Delivery Fees for Mortgages with Special Attributes”. Translation – we need the money and are now charging huge fees to reflect lending risks that we never recognized prior to the housing crash.

Many borrowers are finding out that the Fannie and Freddie fees are resulting in mortgage rates far higher than the rates they see advertised. See All Time Low Rates For A++ Borrowers Only. The fees imposed are too large to be absorbed by the lending institutions that sell their loans to Fannie and Freddie. Therefore the fees must be passed on to the customer in the form of closing costs and/or a much higher interest rate. The total fees imposed by the agency lenders are cumulative for each special attribute. The end result is that the fees and rates are so high that most borrowers are unable to refinance.

Here is an example of the fees that Fannie and Freddie would charge on a routine mortgage refinance with the following “special attributes”. The borrower is attempting to refinance at 80% loan to value, has a 675 FICO score and needs to take cash out. This is a routine type of refinance and the credit score of 675 is considered good. The borrower is applying for the prevailing rate of 5.5%. Three years ago, this borrower would easily have qualified under a conforming Fannie or Freddie loan with a minimum of agency fees. The same borrower today, if approved, would be facing very steep fees as follows in a $250,000 loan example.

Delivery Fees Effective April 1, 2009 Based on 80% Loan to Value

1. 675 FICO score fee 2.50%

2. Cash out fee 1.50%

3. If the property is a Condo add additional fee .75%

The total fees imposed by Fannie or Freddie on this example loan would total 4.75% of the $250,000 loan or $11,875. In addition, there are various lender and legal fees involved in a refinance that could easily total another $2,000. These Fannie and Freddie fees make the defunct sub prime lenders look like good guys.

Rates Are Low – Don’t Bother Applying

In real life, here’s what would happen. The borrower refuses to pay $11,875 in fees to get 5.5%. The lender could not provide that rate in any event since the total of fees involved are so high that they would violate predatory lending rules. The rate cannot be raised enough to absorb all of these fees based on current pricing structures. The best this customer could get would be a rate of around 7.25 and agency fees of $7,000, plus regular closing costs. Several years ago, this customer could have gotten a lower fixed rate with much lower fees from a sub prime lender.

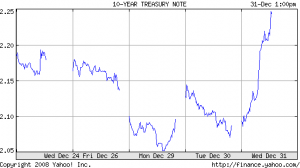

For a borrower to get the “low rates available” today, you usually need to show up with a credit score of 740 and a loan to value of 70% or less. Most borrowers who need to refinance today do not possess this loan profile. While the Fed strives to lower mortgage rates, Fannie and Freddie are effectively telling all but the highest quality borrower to get lost by pricing them out of the market. Compounding this ridiculous situation is that the Federal Housing Administration (FHA) does not charge many of these fees, even at higher loan to values and lower credit scores.

By the way, did I mention that the Government has effectively nationalized the mortgage industry?