It wasn’t supposed to be like this.

It wasn’t supposed to be like this.

Housing prices were never supposed to decline year over year.

Economic depressions were supposed to be a relic of the past.

If the economy weakened, the Fed would fix everything with lower interest rates and Congress would pass some new laws to create new jobs.

If things got really tough, the government would temporarily increase the debt and the magic of Keynesian economics was supposed to quickly “re-stimulate” the economy.

Our children were expected to lead more prosperous lives. They were not supposed to move back in with Mom and Dad after four expensive years of college – arriving on the doorstep with a diploma in one hand, student loan notes in the other, telling us that they couldn’t find a job.

Day by day, we are discovering that a lot of things that were never supposed to happen are happening and no one seems able to turn things around.

The Federal Reserve and the White House promised to re-inflate the collapsed humpty dumpty real estate bubble with printed money and bailout programs for banks and defaulted homeowners.

An ex Princeton professor, now Chairman of the Federal Reserve, spent his life studying the Great Depression of the 1930’s. He was supposed to know how to prevent another one, or so he assured us.

Fast forward to 2022 – housing prices that were supposed to have recovered a decade ago are still at levels seen more than 20 years ago.

Not possible you say? Optimists and shills for the housing industry might want to consider some inconvenient truths.

Will the U.S. have 20 years of stagnant home prices?

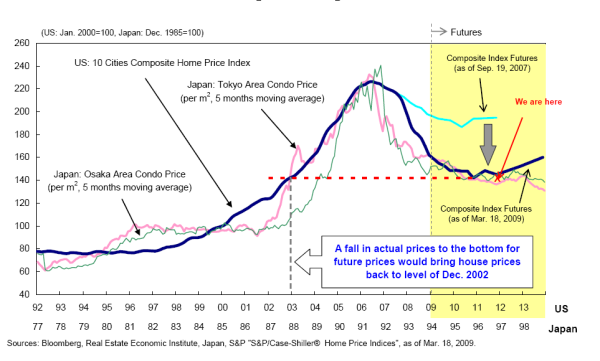

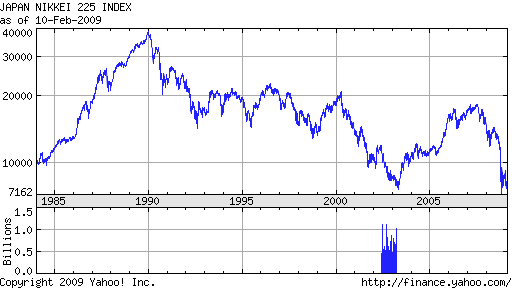

What if real estate prices remain the same for another decade? As I look at economic trends in our nation including the jobs we are adding, it is becoming more apparent that we may be entering a time when low wage jobs dominate and home prices remain sluggish for a decade moving forward. Why would this occur? No one has a crystal ball but looking at the Federal Reserve’s quantitative easing program, growth of lower paying jobs, baby boomers retiring, and the massive amount of excess housing inventory we start to see why Japan’s post-bubble real estate market is very likely to occur in the United States. It is probably useful to mention that the Case-Shiller 20 City Index has already hit the rewind button to 2003 and many metro areas have already surpassed the lost decade mark in prices. This is the aftermath of a bubble. Prices cannot go back to previous peaks because those summits never reflected an economic reality that was sustainable.

The days of “no doc” loans are long gone and not likely to return anytime soon. Lenders have reactivated a quaint old mainstay of mortgage underwriting and now require borrowers to verify the capacity to service debt payments. Higher home prices require rising incomes but real incomes for many Americans have been declining for decades.

The income of the typical American family—long the envy of much of the world—has dropped for the third year in a row and is now roughly where it was in 1996 when adjusted for inflation.

The income of a household considered to be at the statistical middle fell 2.3% to an inflation-adjusted $49,445 in 2010, which is 7.1% below its 1999 peak, the Census Bureau said.

The Census Bureau’s annual snapshot of living standards offered a new set of statistics to show how devastating the recession was and how disappointing the recovery has been. For a huge swath of American families, the gains of the boom of the 2000s have been wiped out.

Earnings of the typical man who works full-time year round fell, and are lower—adjusted for inflation—than in 1978.

Gary Shilling, who correctly called the housing bubble collapse, tells the Wall Street Journal that housing prices could decline another 20% or more.

It will take a 22% drop to return median single-family house prices to the trend identified by Robert Shiller of Yale University that stretches back to the 1890s and prevailed until the housing bubble began. (It adjusts for inflation and the tendency of houses to get bigger over time.) And corrections usually overshoot on the downside just as bubbles do on the upside.

The problem is excess inventories. They are the mortal enemy of prices, and we’ve calculated an excess of two million housing units, over and above normal working levels of inventories of new and existing homes. That is huge, considering that before the housing market collapsed, about 1.5 million new homes were being built annually, a figure that shrank to 568,000 in February. At current rates of housing starts and household formation, it will take four years to work off the excess inventory, plenty of time for those surplus houses to drag down prices.

Additionally, our inventory estimate doesn’t even include future foreclosures, some five million of which are waiting in the wings. The 49% drop in new foreclosures since the second quarter of 2009 is a mirage, and was partly due to the Obama administration pressuring mortgage lenders to try to modify troubled mortgages to keep people in their homes. (They were largely unsuccessful.)

We can say that “We are not Japan” but every passing day proves otherwise. And for those misguided souls who still believe that the government and Fed can put humpty dumpty back together again, don’t you think that if they could have they would have?