About a decade ago, Jones Soda (JSDA) was briefly an incredible success story about a regionally popular brand which had used grassroots marketing to achieve rapid growth on a national scale. Unfortunately, the soda story fizzled when they tried to expand into national chains like Target (TGT) and Walmart (WMT) using aluminum cans rather than their iconic glass bottles. In addition, Jones Soda began their expansion efforts precisely at a time when the popularity of carbonated beverages began to decline.

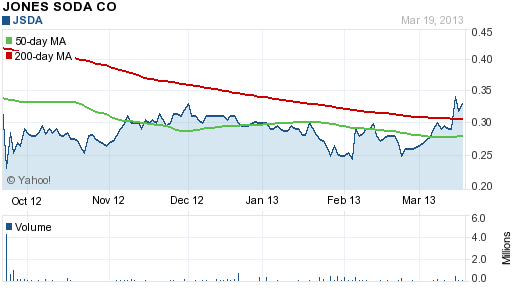

A combination of missteps and bad timing brought the company to the brink of bankruptcy, driving its once promising stock from a peak of more than $28 to less than $1. The price fell further to about 25 cents after the shares were delisted from the NASDAQ exchange. Since early March Jones Soda has been moving steadily higher and recently had a higher volume spike that propelled the stock price above both the 6 month price range and the 50 and 200 day moving average.

courtesy: yahoo finance

Things may finally be looking brighter for Jones Soda with new CEO Jennifer Cue at the helm. Since her appointment on June 30, 2012, she has implemented a back to basics turnaround strategy which has allowed the company to stabilize before pursuing a path of responsible and hopefully profitable growth.

The strategy involved rapidly trimming expenses and slightly retrenching to the company’s core markets and independent distributors. In the latest quarter, operating expenses were cut to $1.1 million compared to $2.7 million last year. Some of the cuts did have an impact on revenue which fell to $3.1 million from $3.4 million in the prior year. Despite the drop in revenue, gross profit was up slightly, showing the positive impact of the realignment of costs.

The loss from operations for the most recent quarter was $448,000, a vast improvement from the loss of $2.0 million last year. Most significantly, the company was cash flow positive for the quarter with $247,000 generated from operations. In the previous three quarters, Jones Soda had negative cash flow from operations of $6.5 million, and they were at risk of running out of capital. Now the company believes they have sufficient working capital to carry out their operating plan for 2013. In addition to $4.1 million of working capital, Jones Soda has a $2 million credit facility.

Corporate insiders have confirmed their conviction of a brighter future for Jones Soda through a series of stock purchases. CEO Jennifer Cue bought 50,000 shares at $0.30 from December 7 to 10, 2012. Carrie Traner, VP of Finance bought 10,000 shares at $0.29 to $0.34 on March 14 – 15, 2013 and Director Mills A Brown bought (indirectly) 81,350 shares at $0.2975 to $.033 on March 15, 2013.

Now that the company has brought expenses under control, they are investing in distribution and product lines that will drive long term profitable growth. After laying off nearly half of their staff in the second half of 2012, they recently hired four new employees for their sales staff. The sales staff is now paid on a variable compensation structure, which should help to keep costs aligned with revenue.

Now that the company has brought expenses under control, they are investing in distribution and product lines that will drive long term profitable growth. After laying off nearly half of their staff in the second half of 2012, they recently hired four new employees for their sales staff. The sales staff is now paid on a variable compensation structure, which should help to keep costs aligned with revenue.

The company has just introduced Jones Natural, which will soon launch in California. The new beverage has 30 calories and will come in four different flavors. It will be offered in 50 Albertson’s grocery stores in the natural foods section. The new beverage will also be offered in 25 Whole Foods Market (WFM) stores in Northern California. Significantly, this is the first time that a Jones Soda product has been carried by Whole Foods.

The groundwork has now been laid for a possible return to growth and profitability for a company once left for dead. The current market cap of merely $13 million hardly reflects the progress that has been made in the last two quarters. While the stock remains extremely speculative, it is certainly one worth watching in the coming months.

Disclosure: Long JSDA