FHA Tightens Rules Again

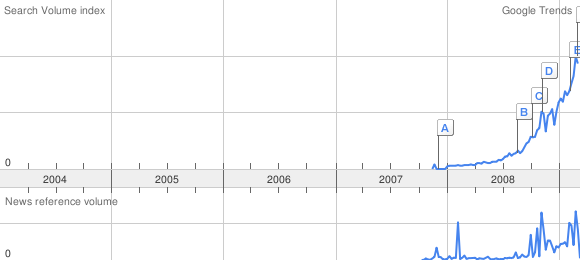

First there was an increase in the required credit scores to be eligible for FHA financing. (See FHA Increases Minimum Credit Score Requirement). Now comes a major tightening of the rules on FHA cash out refinances. HUD Mortgagee Letter 2009-08 announced that the maximum loan to value for any cash out FHA loan has been reduced from 95% to 85%, effective April 1, 2009.

HUD is taking this step due to the continued deterioration in the housing market and to limit their exposure to “undue risk”.

Effective for case number assignments on or after April 1, 2009, the loan-to-value (LTV) of any cash-out refinance to be insured by FHA may not exceed 85 percent of the appraiser’s estimate of value.

Given the continued deterioration in the housing market, and FHA’s need to limit its exposure to undue risk, this reduction to the maximum LTV for cash-out refinances is being instituted on a temporary basis while FHA further analyzes the housing and mortgage industry as well as its own portfolio to determine whether permanent measures should be taken.

Considering that the default rate on FHA loans exceeds 12%, this announcement is not surprising and long overdue. It is interesting, however, to examine the conflicting signals from the government in regards to mortgage lending, as follows:

1. There is constant talk about the need to increase the flow of credit and politicians from both sides of the aisle are encouraging the banks to lend money. At the same time the “we need more lending talk” is going on, the government controlled agency lenders have dramatically increased restrictions on lending – see Few May Benefit From Lower Mortgage Rates and Banks Restrict Mortgage Lending To A+ Customers Only.

2. Fannie Mae and Freddie Mac have imposed huge “delivery fees” on their mortgages, which has greatly increased the cost and reduced the benefits for many borrowers – see Fannie and Freddie – The New Subprime Lenders.

3. The Federal Reserve has already purchased mortgage backed securities. Chairman Bernanke has stated his intention to dramatically increase such purchases in the future in an attempt to lower mortgage rates. Since so few people are eligible for mortgages, he might as well save himself the trouble of printing the money that would be necessary to purchase mortgage backed securities.

Sound Mortgage Underwriting Essential

The banking system should have strict underwriting guidelines for approving a mortgage loan. If proper underwriting guidelines had been adhered to in the past, we would not now have a major banking and housing crisis. The question is, has the pendulum swung too far in the other direction?

The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins.

The United States Mint has officially announced the suspension of another slate of gold and silver products. The affected products are 2009 dated American Gold and Silver Eagle coins produced for collectors. These coins are considered collectible versions of the bullion coins.