It Already Is A Depression For Many

The latest report from the Census Bureau on income, poverty and health insurance coverage portrays a darkening economic picture for millions of Americans. Incomes and living standards fell without regard to geography, race or work profession. For many, the Census report only confirms the destruction of the “American Dream” of economic advancement.

- For 2008 real median household income declined 3.6% to $50,303.

- The official poverty rate in 2008 increased to 13.2% from 12.5% the previous year and is the highest since 1997. There are now 39.8 million people in poverty. The government definition of poverty for a family of four is an income below $22,025.

- The number of people without health insurance increased from 45.7 million to 46.3 million. The number of people with private health insurance decreased slightly to 201 million.

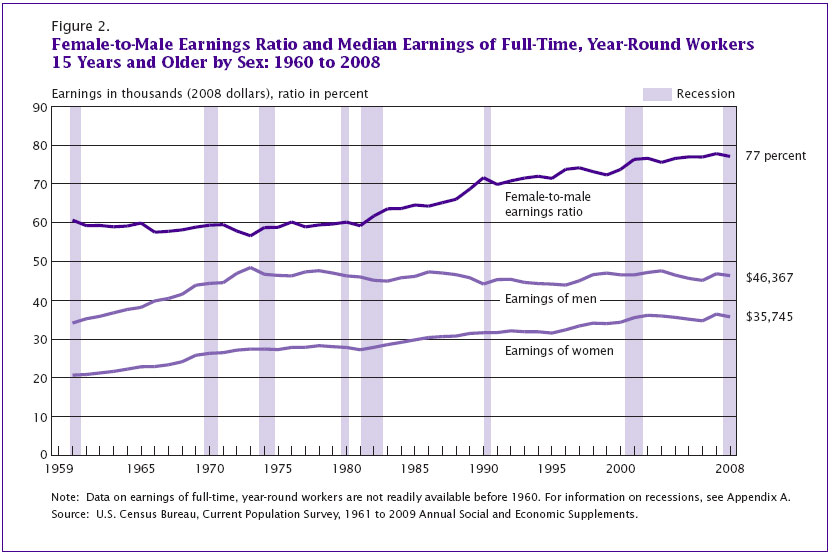

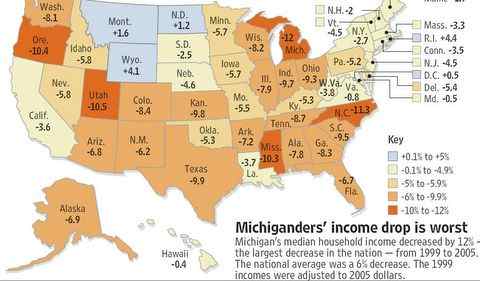

- Incomes declined across all racial groups.

- Incomes declined in every geographic region except the Northeast where incomes remained unchanged.

- Income inequality was unchanged in 2008 from the prior year, indicating that no income class was spared from a decline in income.

While the government is rolling out the press releases congratulating itself on an economic recovery, many Americans remain in an economic nightmare of unemployment, poverty and hopelessness. The latest stats from the Census Bureau provide little reason for optimism since without income growth there will be no economic recovery. The latest report on the number of homeowners in foreclosure signals no recovery to date in incomes or jobs.

U.S. Foreclosure Filings Top 300,000 for Sixth Straight Month

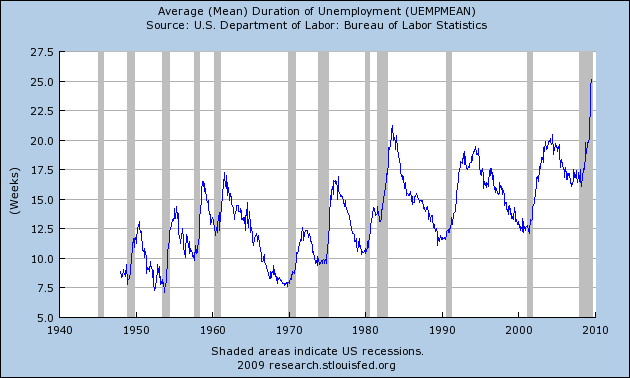

Sept. 10 (Bloomberg) — Foreclosure filings in the U.S. exceeded 300,000 for the sixth straight month as job losses that boosted the unemployment rate to a 26-year high left many homeowners unable to keep up with their mortgage payments.

A total of 358,471 properties received a default or auction notice or were seized last month, according to data provider RealtyTrac Inc. That’s up 18 percent from a year earlier…. One in 357 households received a filing.

Foreclosures rose from a year earlier as companies cut payrolls by 216,000 workers last month…

“The foreclosure numbers are largely unemployment related,” Davis, a former Federal Reserve Board economist, said in an interview. “As long as 15 million Americans are unemployed, record foreclosures will continue.”

With the real world unemployment rate approaching 20%, the government’s loan modification schemes merely delay inevitable foreclosure for many homeowners – without income any monthly payment is too high. Nor is unemployment the only cause of foreclosures. For those who still have jobs but are barely getting by, a decrease in income can easily lead to mortgage default.

We Need Income – Not More Debt

While the divorced from reality politicians in Washington decide on what new deficit financed spending program they should enact next, they are missing the big picture. Our future long term national prosperity will be based on promoting free enterprise job creation – something that does not appear to be on the agenda in Washington.

One of the consequences of a recession is a decline in demand for newly minted coins. Economic activity declines and there is less demand for coins in commerce. Individuals also put long hoarded change back into circulation. Coins come out of hiding from couch cushions, penny jars, and abandoned State Quarter collections. The net result is a drop in the number of new coins produced.

One of the consequences of a recession is a decline in demand for newly minted coins. Economic activity declines and there is less demand for coins in commerce. Individuals also put long hoarded change back into circulation. Coins come out of hiding from couch cushions, penny jars, and abandoned State Quarter collections. The net result is a drop in the number of new coins produced.