FHA Only Option For Some

The FHA loan program is the only viable option for many mortgage applicants who no longer qualify under Fannie Mae or Freddie Mac guidelines. Most of the larger lending institutions have implemented a minimum FICO score requirement of 620 for FHA loans. Here are some lenders that are still doing sub 620 FICO score mortgages.

US Bank is a premier major direct lender that operates nationwide. I have dealt directly with US Bank and they are a well run and reputable bank offering a wide range of mortgage products. According to Scott Lambert, a seasoned US Bank Mortgage Loan Officer, US Bank “offers a no minimum credit score requirement on our FHA and VA programs”. Scott’s background and service pledge follows:

I have over 10 years of mortgage banking experience. Selecting an experienced Mortgage Loan Officer is just as important as what company qualifies to be your financial partner. We’re proud of our reputation as a strong bank and millions of people have selected us as their financial partner.

My promise to you is that I will put my years of experience to work for you! I will help you analyze what mortgage programs may be the best solution for you. I promise to provide honest and dependable service. Our reputation depends on it!

Scott Lambert can be reached at:

Scott Lambert

Home Mortgage Division

1401 Wilshire Boulevard

Santa Monica, CA 90403

Direct: 310-394-8745

Below are other loan programs that I can offer the consumer.

* FHA Program

– No Minimum Credit Score Requirement

– 3.5% Down Payment. Can be Gifted.

– Seller Paid Closing Cost to 6% of Purchase Price

* Rural Development (USDA)

– 100% Financing

– No Minimum Credit Score Requirement

– No Mortgage Insurance

* Community Program

– No Minimum Credit Score Requirement

– No Mortgage Insurance

– 97% Financing. CA, AZ, MI to 95%

– 12 Month Credit Depth

Scott.lambert1@usbank.com

Do Your Homework

Keep in mind that lenders sometimes promise more than they can deliver. Sub 620 FHA loans are difficult to get approved so do your homework. Check out the lender with your state banking department and talk to several different lenders before deciding where to apply.

FHA Introduces New Minimum 580 Credit Score Requirement

New FHA Minimum FICO Score Requirements Meaningless To Many Borrowers

What Are My Odds Of FHA Loan Approval With A FICO Score Below 620?

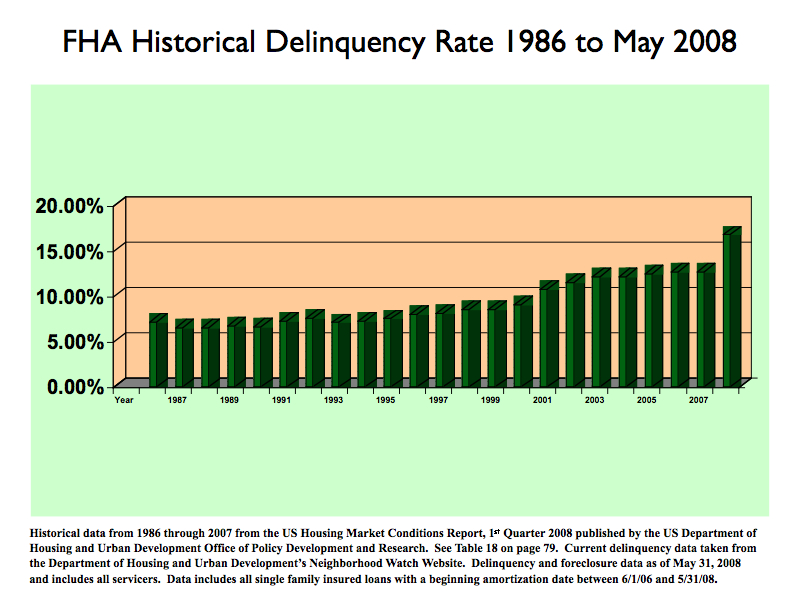

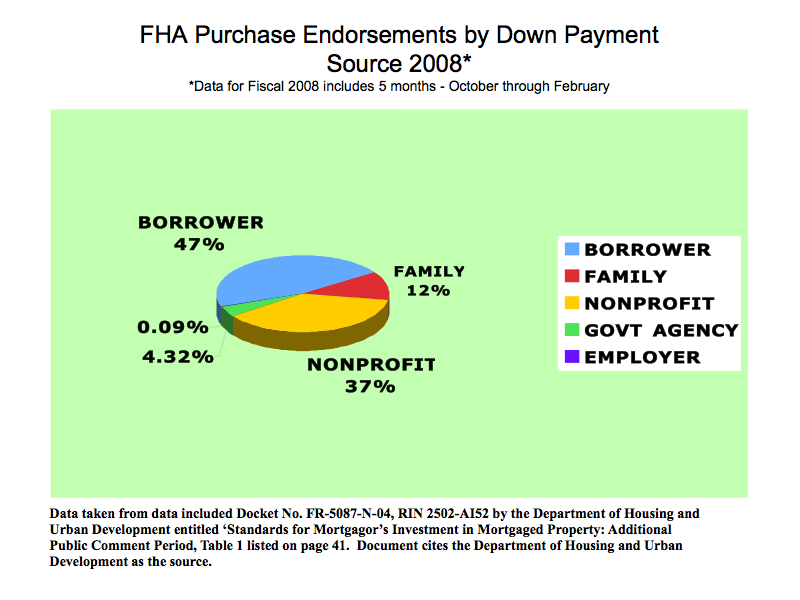

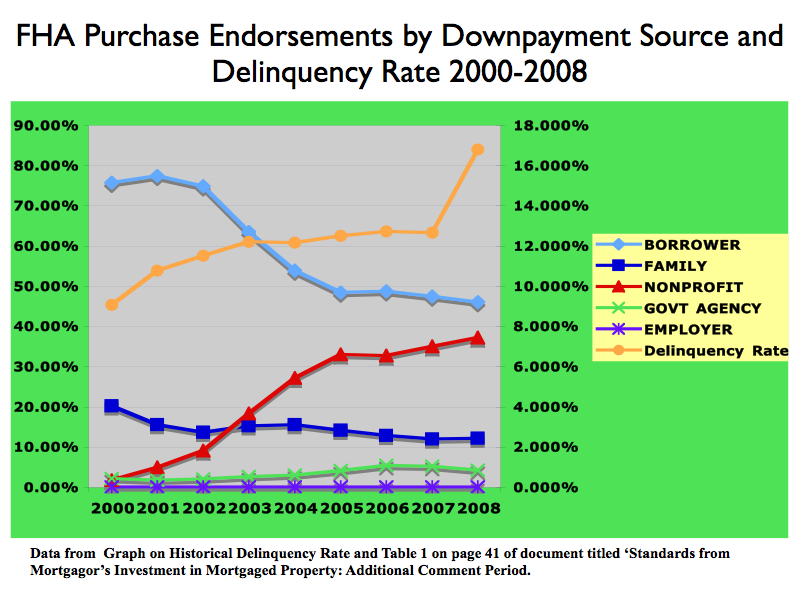

FHA Bailout Appears Likely

FHA Bailout Appears Likely