Multiple Reasons For High FHA Default Rates

Massive default rates in the FHA loan program are starting to raise a few eyebrows. Without major reform of fundamentally poor lending policies, the FHA could soon join the failed ranks of her sister agencies Fannie Mae and Freddie Mac.

A spokesman for the FHA said 7.5% of FHA loans were “seriously delinquent” at the end of February, up from 6.2% a year earlier. Seriously delinquent includes loans that are 90 days or more overdue, in the foreclosure process or in bankruptcy.

The FHA’s share of the U.S. mortgage market soared to nearly a third of loans originated in last year’s fourth quarter from about 2% in 2006 as a whole, according to Inside Mortgage Finance, a trade publication. That is increasing the risk to taxpayers if the FHA’s reserves prove inadequate to cover default losses.

FHA Cash Cushion Has Fallen by 39% – The latest annual audit of the Federal Housing Administration shows a steep drop in the capital cushion the U.S. agency holds against losses from mortgage defaults.

As lenders shy away from risk, the number of loans insured by the agency has soared in recent months, fueling concerns it may be taking on too much risk.

If the FHA runs short of money to pay claims, Congress would have to provide taxpayer funds to make up the difference.

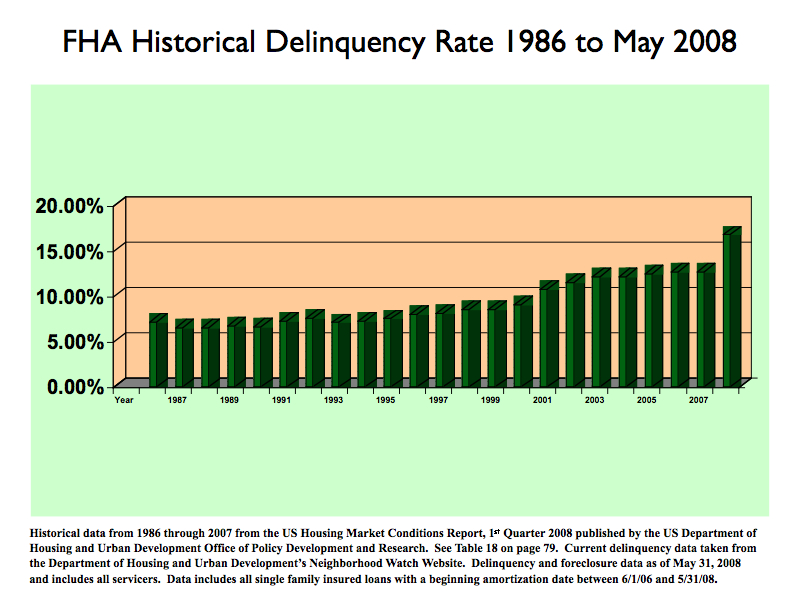

The Mortgage Bankers Association report on delinquency rates (loans that are at least one payment past due) shows the real potential for how many defaults the FHA could be facing.

Change from last quarter (second quarter of 2008)

The seasonally adjusted delinquency rate increased 41 basis points to 4.34 percent for prime loans, increased 136 basis points to 20.03 percent for subprime loans, increased 29 basis points to 12.92 percent for FHA loans.

FHA loans saw an eight basis point increase in the foreclosure inventory rate to 2.32 percent.

The delinquency rate includes loans that are at least one payment past due but does not include loans somewhere in the process of foreclosure.

Add the percentage of FHA loans in the foreclosure process to the total loans that are delinquent at least one month and we have a total default/delinquency rate of 15.24%. Something is clearly wrong with the FHA loan program and another major bailout of a federal lending agency seems inevitable. Let’s examine some data from an excellent article by Whistleblower to understand why the FHA default rate is so high.

FHA Delinquency Crisis: 1 in 6 Borrowers in Default

At a time when borrowers, lenders, regulators, and lawmakers are scurrying for cover from the subprime lending crisis, a new crisis appears to be emerging with FHA.

Just take a look at FHA delinquency rates:

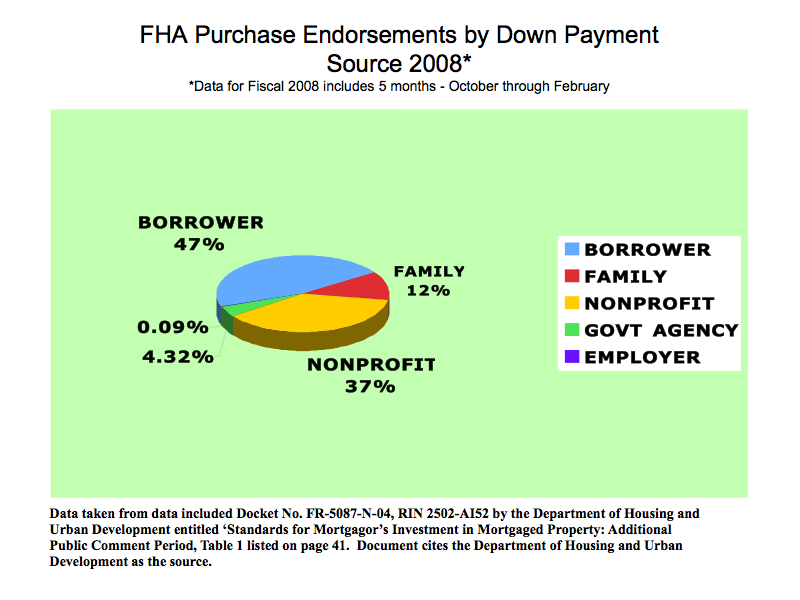

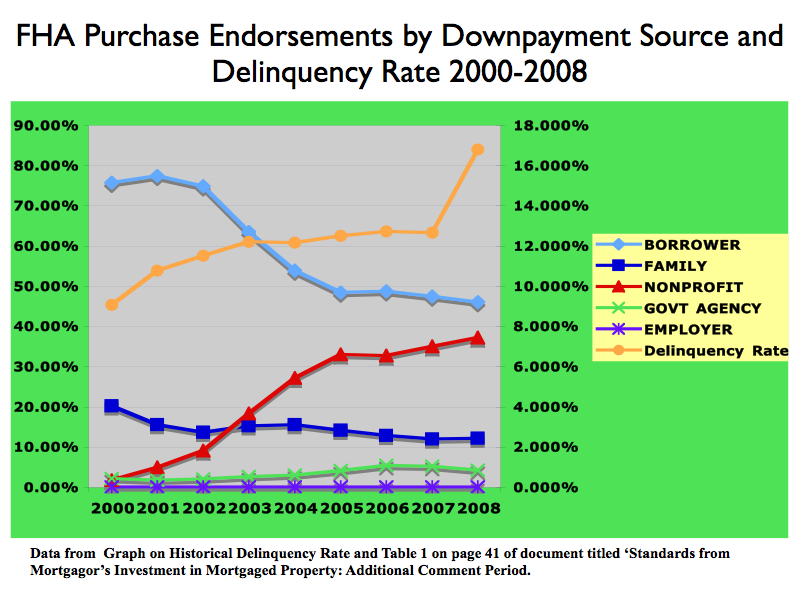

Could FHA’s rising delinquency rate be due to FHA incorporating risky practices that have become standard in the mortgage industry? Since industry experts often cite 100% financing as being a major factor in the mortgage meltdown, let’s take a look at borrower down payment sources:

In 2008, borrower funded down payments declined 38% to total only 47% of endorsements while non-profit provided down payment assistance increased a whopping 1750% to 37% of purchase endorsements. These are staggering statistics, but could they possibly correlate with FHA’s delinquency rate? Let’s take a look.

The delinquency rate clearly rises in tandem with the increase in non-profit funded down payments. But why would down payment assistance from non-profit agencies possibly impact the delinquency rate so materially?

While legitimate non-profit agencies provide much needed assistance to deserving buyers in a manner that promotes successful homeownership, certain so-called “non-profit” agencies merely advance the borrower the down payment from the seller for a fee. Companies such as Nehemiah Corporation of America, H.A.R.T. and Ameridream are prime examples of companies that provide down payments that are dependent upon seller reimbursement. Since the down payment is seller funded, whether directly or indirectly, a Quid Pro Quo clearly exists. Furthermore, because sales prices are increased to absorb the down payment grant, down payment assistance is said to skew prices for everyone.

In 2005, HUD commissioned a study entitled “An Examination of Downpayment Gift Programs Administered By Non-Profit Organizations”. Later that year, another report titled “Mortgage Financing: Additional Action Needed to Manage Risks of FHA-Insured Loans with Down Payment Assistance” was completed by the U.S. Government Accountability Office. Both studies concluded that seller funded down payment assistance increased the cost of homeownership and real estate prices in addition to maintaining a substantially higher delinquency and default rate.

Note: The down payment assistance program was ended last year but special interest groups are lobbying for its reinstatement – see Campaign to Stop FHA Subprime.

FHA Approval Process Outsourced To FHA “Direct Endorsed Lenders”

Besides the factors mentioned above that contribute to the large amount of FHA defaults there is also the issue of the unique manner in which the FHA “outsources” the loan approval process. The FHA does not directly approve loans but instead allows this to be done by HUD “direct endorsed FHA lenders”. The direct FHA lenders are in turn supposed to follow lending standards set by the FHA. Problems arise with this arrangement since loans can be underwritten and approved by the direct FHA lender’s own staff, an obvious conflict of interest. The lender only makes money on loans that are approved. This process is equivalent to leaving the bank vault unlocked and unguarded.

Theoretically, the FHA has the responsibility for policing the lenders who can approve FHA loans. In practice, FHA oversight is almost nonexistent. In the past two years, as the number of FHA lenders has doubled to almost 2,500 lenders, the FHA supervisory office has had no staffing increase. If the FHA was fulfilling their supervisory responsibilities properly, the default rate would not be at a staggering 16% and outrageous examples of fraud and abuse in the FHA lending system would not be occurring. Consider the curious case of the large number of FHA loans experiencing first payment defaults (the borrower never makes a single payment).

In the past year alone, the number of borrowers who failed to make more than a single payment before defaulting on FHA-backed mortgages has nearly tripled, far outpacing the agency’s overall growth in new loans, according to a Washington Post analysis of federal data.

Many industry experts attribute the jump in these instant defaults to factors that include the weak economy, lax scrutiny of prospective borrowers and most notably, foul play among unscrupulous lenders looking to make a quick buck.

If a loan “is going into default immediately, it clearly suggests impropriety and fraudulent activity,” said Kenneth Donohue, the inspector general of the Department of Housing and Urban Development, which includes the FHA.

Once again, thousands of borrowers are getting loans they do not stand a chance of repaying. Only now, unlike in the subprime meltdown, Congress would have to bail out the lenders if the FHA cannot make good on guarantees from its existing reserves.

More than 9,200 of the loans insured by the FHA in the past two years have gone into default after no or only one payment, according to the Post analysis. The pace of these instant defaults has tripled in one year.

The overall default rate on FHA loans is accelerating rapidly as well but not as dramatically as that of instant defaults.

Under the FHA’s own rules, there’s a presumption of fraud or material misrepresentation if loans default after borrowers make no more than one payment. In those cases, the lenders are required by the FHA to investigate what went awry and notify the agency of any suspected fraud. But the agency’s efforts at pursuing abusive lenders have been hamstrung. Once, about 130 HUD investigators teamed with FBI agents in an FHA fraud unit, but this office was dismantled in 2003 after the FHA’s business dwindled in the housing boom.

William Apgar, senior adviser to new HUD Secretary Shaun Donovan, agreed that early defaults are a worrisome sign that a lender is abusing FHA-backed loans.

The Palm Hill Condominiums project near West Palm Beach, Fla., exemplifies the problem. The two-story stucco apartments built 28 years ago on former Everglades swampland were converted to condominiums three years ago. The complex had the same owner as an FHA-approved mortgage company Great Country Mortgage of Coral Gables, whose brokers pushed no-money-down, no-closing-cost loans to prospective buyers of the condos, according to Michael Tanner, who is identified on a company Web site as a senior loan officer.

Eighty percent of the Great Country loans at the project have defaulted, a dozen after no payment or one. With 64 percent of all its loans gone bad, Great Country has the highest default rate of any FHA lender, according to the agency’s database. It also has the highest instant default rate.

Some of the country’s largest and most established lenders are so concerned about this new threat to the credit market that they are not waiting for the FHA to tighten its requirements. Instead, they are imposing new rules on the brokers they work with. Wells Fargo and Bank of America, for instance, now require higher credit scores on certain FHA loan transactions and better on-time payment history.

Some experts who track FHA lending say the agency should not wait for lenders to take the lead on toughening the rules, especially given the mortgage industry’s poor track record for policing subprime and other risky home loans.

“Even if the market eventually gets these guys, they shouldn’t have to wait for the market to do it,” said Brian Chappelle, a former FHA official who is now a banking industry consultant. “The most frequent question I get asked by the groups I talk to is: ‘Is FHA going to implode?’ . . . They haven’t seen HUD do anything significant in the past two years to tighten up its lending.”

FHA Losses Mount As Regulators Snooze

The FHA escaped the financial collapse that occurred at Fannie and Freddie by an accident of circumstance. During the lending boom, the FHA attracted few borrowers since putting a borrower into a sub prime loan was faster and more profitable. Since the collapse of the sub prime lenders, the FHA’s share of the mortgage market has increased to around 33% today from 2% three years ago. The reason for the big increase in loan volume is due to one factor – the FHA now has the lowest lending standards and its loan delinquencies prove it.

Will The FHA Be The Next Government Bailout?

Without immediate reform of the FHA loan program, the FHA will be the next lending disaster and government bailout. The flawed lending policies that will eventually cause the collapse of the FHA include:

1. Minimal or no down payment purchases. Study after study has shown the correlation between low down payments and increased mortgage defaults.

2. Lax lending standards. FHA loans are routinely approved with low credit scores and insufficient income, resulting in high default rates.

3. Allowing the use of “direct endorsed lenders” who approve FHA loans without adequate oversight by the FHA is an invitation to fraud and abuse. The direct FHA lenders have a vested financial interest in approving unqualified loan applicants – the results can be seen in the number of first payment defaults and loan delinquencies.

Putting borrowers into homes that they cannot afford is an injustice to the homeowner and perpetuates the foreclosure cycle. The cost of the FHA losses to the taxpayer is a an expense we cannot afford. It is time to rein in the FHA’s irresponsible lending practices.