With Europe Facing Meltdown Geithner Offers Advice

After recently “saving” the US from economic Armageddon, Treasury Secretary Geithner must feel uniquely qualified to advise European governments on their looming sovereign debt crisis. Geithner’s solution to Europe’s out of control deficits is additional stimulus (via increased deficit spending), bailouts and stress tests on Europe’s tottering banks to rebuild public confidence in the banking system.

Wall Street Journal – LONDON—U.S. Treasury Secretary Timothy Geithner landed in Europe and reasserted a traditional American role of dispenser of financial advice to the world, telling European governments to get their fiscal houses in order.

After two years in which an historic financial crisis seemed to deprive the U.S. of its self-confident global economic leadership, Mr. Geithner signaled a new-found willingness to reassert American authority on the future of the world economy.

Inside No. 11 Downing Street, the home of his British counterpart, Mr. Geithner pushed continental Europe to speed up the rescue of debt-laden economies, and to not stint on fiscal stimulus.

The U.S. is also advising European countries that can afford it—the U.K., Germany, France—to keep pumping stimulus into their economies.

“This crisis is multifaceted, but I believe bank stress tests can be helpful as a critical component of any comprehensive plan to restore confidence in the European financial system,” said Lee Sachs, who was, until a month ago, a top adviser to Treasury Secretary Timothy Geithner.

Mr Geithner’s advice that over indebted nations should borrow more money to solve their debt crisis was met with scorn by European officials. The recommended stress tests for banks was viewed as a mere public relations exercise.

WSJ – For Geithner critics, the new U.S. assertiveness is misplaced. Desmond Lachman, a former senior IMF European official who is now a researcher at the American Enterprise Institute, said the repeated bailouts engineered by Mr. Geithner have made the overall problem worse, and that the U.S. advice of providing even more financing for heavily indebted countries like Greece is bound to fail.

Mr. Lachman said Greece’s debt needs to be restructured and that weaker euro-zone countries should consider dropping the euro and reverting to their national currencies. “Geithner is part of the problem,” he said. “It’s obvious this can’t work.”

“You don’t need a stress test to tell you what would happen if Spain became bankrupt; it would be horrible,” one German official said. German officials argue the U.S. tests were little more than public-relations stunts, designed so that banks would pass.

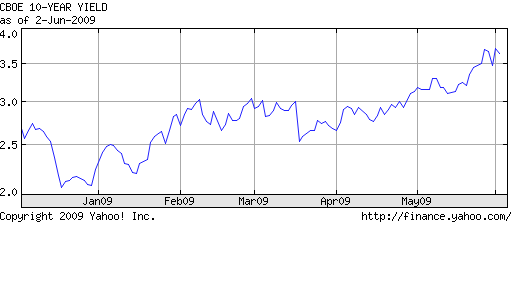

European governments realize that the American solution of borrowing trillions for bailouts and fiscal stimulus has only compounded the original problem of too much debt. US Government debt now exceeds $13 trillion and the debt to GDP ratio of the US equals or exceeds that of many European nations that are now tottering on the fiscal abyss. Based on continued unprecedented expansion of the national debt, the IMF is forecasting that total US debt will exceed GDP by 2012. Debt to GDP ratios over 100% raise serious questions about a country’s ability to service their debt, especially if interest rates rise.

Tragically, Europe has bought into the “Geithner solution”. Despite their doubts and with no other easy options, Europe will lend up to $1 trillion to bailout hopelessly over indebted sovereign borrowers. Does anyone really believe that this latest bailout is a solution?

Geithner Does It Again

Geithner Does It Again