US Insists China Fears Over Debt Unfounded

The Obama administration rejected China’s concerns that its vast holdings of U.S. assets might be unsafe, in an unusual diplomatic exchange that underscored the global importance and the potential fragility of the Sino-U.S. economic relationship.

In a coordinated response to blunt comments from Chinese Premier Wen Jiabao, White House officials said Friday that Mr. Obama intends to return the country to fiscal prudence once the crisis passes.

“There’s no safer investment in the world than in the United States,” said presidential spokesman Robert Gibbs.

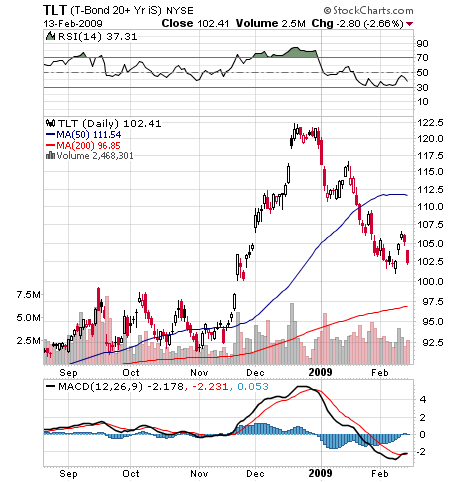

The premier’s comments were unusually pointed and raised the possibility that Beijing’s appetite for U.S. debt could wane. In the worst-case scenario, a significant new aversion to U.S. investments could drive down the dollar and drive up interest rates, worsening the U.S. recession.

But in the last year, Beijing has become increasingly vocal about what it sees as U.S. economic mismanagement making U.S. investments riskier.

Obama Says Investors Can Be Fully Confident In US

March 14 (Bloomberg) — President Barack Obama said investors can have “absolute confidence” in Treasury bills as he sought to assuage China’s concern about the safety of its holdings of U.S. debt.

Chinese Premier Wen Jiabao, whose country is the single largest overseas owner of U.S. government debt, said two days ago that he was “worried” about holdings of Treasuries and wanted assurances that the investment is safe. The U.S. is counting on overseas purchases of its debt to finance Obama’s $787 billion package intended to help pull the world’s biggest economy out of a recession.

Obama’s Catastrophe

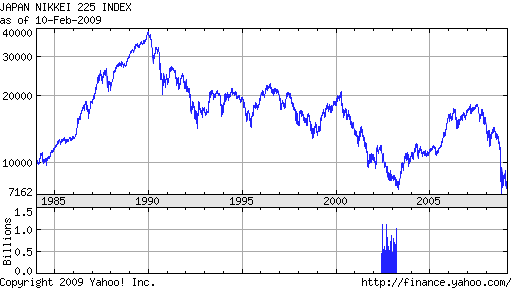

US creditors are getting nervous about the ability of the United States to repay its huge and fast growing debt load. The fact that the US has to explicitly tell its creditors not to worry makes them worry more. Obviously, if there was no need to worry, China would not have raised the issue of US solvency and the US would not have had to assert it’s credit worthiness. We need to go very far back in history to revisit the last time that the credit worthiness of the United States was questioned.

China is not likely to be swayed by the latest spin out of Washington. Actions speak louder than words and the Chinese view the US debt rampage as economic mismanagement. Perhaps the Chinese concerns arose after Mr Obama stated that the US was facing an economic “catastrophe” if we did not borrow and spend more money. When China couldn’t see the logic of our strategy of curing a debt crisis with more debt, they started to reassess the US credit rating.

China Should Act Like A Real Lender

Hopefully, this entire situation will have a happy ending. If China implements sound lending practices, they will not continue to lend more money to an already over leveraged borrower, or at a minimum, demand a higher interest rate for the higher risk. If China can help the United States find the fiscal discipline it lacks by imposing harsher terms as a condition for additional loans, both parties will benefit.