Treasury’s Victory Call On Financial Bailout Premature

The Treasury Department’s latest public relations effort to highlight the success of the financial system bailout focuses on the amount of TARP repayments versus total debt outstanding. In addition, the Treasury, which had previously estimated the cost of the TARP program at $341 billion, has now lowered that estimate to only $105 billion.

Wall Street Journal – The U.S. Treasury Department said Friday the total amount repaid to taxpayers for government funds used to bail out U.S. companies has surpassed, for the first time, the amount of outstanding debt.

The Treasury, in its May report to Congress on the Troubled Asset Relief Program, reported TARP repayments reached $194 billion, which has exceeded by $4 billion the total amount of outstanding debt—$190 billion.

Treasury’s assistant secretary for financial stability, Herb Allison, in a statement described the totals as a “milestone” and said this is “further evidence that TARP is achieving its intended objectives: stabilizing our financial system and laying the groundwork for economic recovery.”

Does the general public accept the Treasury’s view that the bailout was a resounding success at a relatively modest cost? Recent Pew Research data, which reveals overwhelming negative public opinion for both the government and the banks, suggests that the Treasury’s spin on the bailout will be given little credence by the public.

Large majorities of Americans say that Congress (65%) and the federal government (65%) are having a negative effect on the way things are going in this country; somewhat fewer, but still a majority (54%), say the same about the agencies and departments of the federal government.

But opinions about the impact of large corporations and banks and other financial institutions are as negative as are views of government. Fully 69% say that banks and financial institutions have a negative effect on the country while 64% see large corporations as having a negative impact.

In March, during the final debate over health care reform, just 26% of Americans offered a favorable assessment of Congress – by far the lowest in a quarter-century of Pew Research Center polling.

Large majorities across partisan lines see elected officials as not careful with the government’s money, influenced by special interest money, overly concerned about their own careers, unwilling to compromise and out of touch with regular Americans.

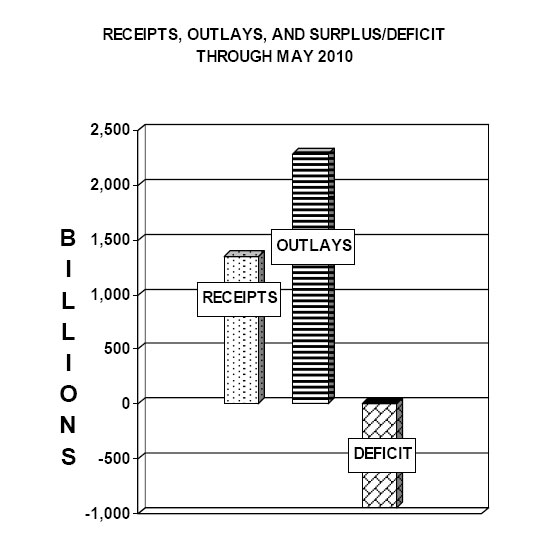

The skepticism regarding the ability of government to operate honestly in the public’s best interest is well founded and the latest Treasury report on progress of the TARP program bears this out. While the Treasury reports on the “success” of repayments under the $700 billion Troubled Asset Relief Program, other government bailouts and guarantees that are far exceed the cost of the TARP program are conveniently ignored. If the Treasury really wants to provide a comprehensive accounting of what the financial system bailout will cost the American taxpayers, here’s my short list of additional items to address in their next report.

1. The amount currently owed under the TARP program does not include amounts committed by the US Treasury but not paid out. According to the WSJ, “the outstanding debt amount does not include $106.36 billion that has been committed to institutions but has yet to be paid out by the Treasury. Factoring in that amount, the outstanding debt would be roughly $296 billion.”

2. Two of the biggest ongoing bailouts in history go unmentioned. The Housing and Economic Recovery Act of 2008 provided for a $400 billion bailout of Fannie Mae and Freddie Mac. The Government subsequently granted Fannie and Freddie an unlimited line of credit with the Treasury. Fannie and Freddie have already drawn $145 billion and according to Bloomberg, the final cost to bailout out the two agencies could approach $1 trillion.

3. Future banking failures constitute another sizable risk for increasing the cost of bailing out the US financial system. The FDIC has been able to resolve banking failures to date using premiums collected from the banking industry, including a special assessment of $46 billion at the end of 2009. While the FDIC has not yet had to tap its $500 billion line of credit with the US Treasury, future banking failures may require it to do so.

In its latest quarterly report, the FDIC reported an increase in the number of problem banks to 775, out of a total of 7,932 FDIC insured banks. Assets at the problem banks total $431 billion. Total deposits insured by the FDIC now total $5.5 trillion. The amount of reserves in the FDIC Deposit Insurance Fund total negative $20.7 billion. Liquid reserves of the FDIC total a mere $63 billion. If the US economy weakens and more banks fail, the FDIC’s only option will be a costly bailout by the US Treasury.

The government seems to believe they can fool all of the people all of the time. Whatever happened to “change you can believe in”?